Credit Crisis Mega Opportunities as Everything is Repriced to True Values

Stock-Markets / Credit Crisis 2008 Mar 06, 2008 - 01:31 AM GMTBy: Ty_Andros

I can't tell you how wonderful it is to be alive in today's markets. This past week was one of great importance as the markets really signaled enormous new realities which now have to be priced in over the coming years. Volatility is opportunity and it is abundant . What makes it even juicier for the prepared investor is that it is now apparent on WEEKLY and MONTHLY charts, signaling the enormous timeframes in which we are anticipating BIG MOVES! We're only in the second inning in a 9-inning ballgame. Re-pricing of everything to its TRUE VALUE is underway and creating mega opportunities for prepared investors.

I can't tell you how wonderful it is to be alive in today's markets. This past week was one of great importance as the markets really signaled enormous new realities which now have to be priced in over the coming years. Volatility is opportunity and it is abundant . What makes it even juicier for the prepared investor is that it is now apparent on WEEKLY and MONTHLY charts, signaling the enormous timeframes in which we are anticipating BIG MOVES! We're only in the second inning in a 9-inning ballgame. Re-pricing of everything to its TRUE VALUE is underway and creating mega opportunities for prepared investors.

Every mainstream financial media pundit is in full firefighting mode trying to deny reality and what it means to the sheep who rely on them for advice. I just finished reading a financial newsletter claiming inflation is about to wane and that you can expect crude oil to fall. I hope you all are taking notes and keeping records of what your TRUSTED advisors are saying, and if you find the GUIDANCE not so good I hope that you then vote with your feet. Some of the greatest illusions in history are being unwound as we sit here! The only way you can think commodity prices are headed lower is to believe the purchasing power of FIAT currencies is headed higher and the incremental expansion of demand of the emerging world is suddenly going to DISAPPEAR.

The crushing blows of declining income signaled by the pattern of the year (Wolf wave, see 2008 Outlook at www.TraderView.com ) coupled with being overly indebted is signaling quite a waterloo for the G7 and the financial alchemists. The de-leveraging is unfolding at a quickening pace and G7 Central Bank balance sheets are expanding at quite a rate, as they take in the trash paper and provide liquidity for impaired financial institutions. The money printing is barreling along, the unadjusted monetary base measured by M1 is FLAT, but MZM (Money with Zero Maturity) is growing at a 22% annual pace while reconstructed M3 is growing at an approximate pace of 15% plus.

Helicopter Ben Bernanke made his semi-annual trip to congress on Tuesday and in a speech he said quite a mouthful. There is now only one mandate on his plate and that is to INFLATE! He tacitly endorsed the government establishing a facility to buy troubled mortgages and mortgage reduction, and Barney Frank of the House Ways and Means Committee has legislation ready to go. Can you say MORAL hazard? What do you say to a lender when the Federal Reserve says they should FORGIVE part of the principle owed? Thirty-year fixed mortgages which normally price at about 120 basis points above 10-year treasury notes are now over 200 basis points above 10 years and widening rapidly. This is not what the Fed hoped for when they lowered rates. It illustrates what lenders do when the prospect of not getting repaid is front and center. Uncertainty anyone?

Helicopter Ben Bernanke made his semi-annual trip to congress on Tuesday and in a speech he said quite a mouthful. There is now only one mandate on his plate and that is to INFLATE! He tacitly endorsed the government establishing a facility to buy troubled mortgages and mortgage reduction, and Barney Frank of the House Ways and Means Committee has legislation ready to go. Can you say MORAL hazard? What do you say to a lender when the Federal Reserve says they should FORGIVE part of the principle owed? Thirty-year fixed mortgages which normally price at about 120 basis points above 10-year treasury notes are now over 200 basis points above 10 years and widening rapidly. This is not what the Fed hoped for when they lowered rates. It illustrates what lenders do when the prospect of not getting repaid is front and center. Uncertainty anyone?

He clearly expressed his intentions to print whatever sum of money is necessary to underpin the financial system and economic growth regardless of the inflationary implications. What about the people who did not behave irresponsibly and over borrow, they are now on the hook for those who did. He demonstrated his total incompetence in suggesting the OIL markets were signaling lower prices this summer as they are in BACKWARDIZATION; unfortunately he didn't speak to anyone in the futures industry as this signals JUST THE OPPOSITE. Crude oil finished the week and month solidly in breakout mode with projections to $115 dollars directly ahead (see Crossroads in the Ted bits archives at www.TraderView.com ).

Fannie Mae signaled its intention to create small bridge loans for troubled borrowers with the qualifications eerily similar to LIAR loans, also known as NINJA loans (No income, No Job or Assets). Of course they did, as the quality of their own insured portfolios is crumbling as we speak. So it's a policy of loaning deadbeats MORE money to pay back their previously un-payable obligations. A finger in the dike so to speak as they announced 5 billion dollars worth of losses for the 4 th quarter of 2007 on their multi-trillion dollar guarantees. Meanwhile, the US government raised the amount of mortgages they can insure to over $700,000 dollars, and simultaneously raised the ceilings of mortgages and securities they can hold. Can you say “ballooning balance sheets” as the American taxpayer takes every crappy lending decision onto the liability side of the government which they guarantee?

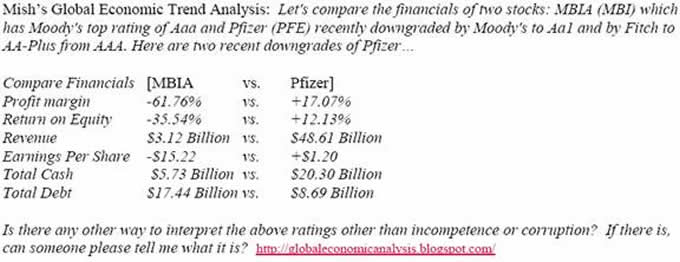

The credit markets are in disarray and the Muni bond and mortgage markets suffered withering blows as capital losses are the order of the day, reflecting both the coming debasement of the money in which they are denominated and, contrary to popular belief, the poor quality of the credit of the various municipalities and borrowers. S&P and Moody's reiterated the Monolines Ambac and MBIA's Triple AAA ratings, while grade inflation is readily apparent to anyone who wishes to peek behind the headlines. Take a look at this balance sheet comparison of MBIA versus pharmaceutical powerhouse Pfizer provided by Bill King and, by extension, Mish Shedlock's Blog:

There is no way to read this but REGULATOR forbearance, as this illusion was broadcast throughout the financial headlines without even a whimper from the Federal Reserve, US treasury and SEC. This signaled their implicit approval of these clearly illusionary declarations as to the soundness of these enterprises. An economic tsunami is headed the way of the States and municipalities as the imploding credit and real estate bubbles combine with the WOLF wave to rob them of their revenues and costs spiral higher and higher for everything in which they are engaged. The ratings agencies have now become comic book characters and purveyors of totally unreliable indications of financial soundness, you can now rely on them for NOTHING!

As business taxes collapse so are their finances, so expect increasing municipal bankruptcies to unfold in the near future. Chicago/Cook County raised the total sales tax rates to 10.5% and scheduled to create another 1,000 patronage job - spending restraint is NOT being considered. Spending restraint is a ticket to retirement and a real job in the private sector for the public servants who support it! So they don't!

Municipalities and States borrowing costs are headed to the moon to reflect the poor quality of their income streams and the enormous new spending and expense liabilities they are increasingly faced with. They have extended their budgets in reckless fashion and assumed that income and tax receipt growth will always materialize; they are about to get a lesson in reality. Anything chained to GENERAL revenues will fair especially poorly. The Monolines are done, their business models fatally flawed and the liabilities, now and in the future, are un-payable. The government will have to nationalize these financial guarantors and print the money to meet their obligations! THEY WILL DO SO!

Plans for bank bailouts are firmly underway in Washington DC as hundreds of small banks wrestle with imploding construction loans and big banks wrestle with the toxic loans they were holding when the tide of liquidity receded last July. The number being bandied about is 700 to 800 billion dollars and IT WILL HAPPEN!! The chorus for a bailout is growing by the day (Bernanke, the big banks, Mohammed El Arian of Pimco, Barney Frank House Ways and Means Chair, Hillary Clinton, Barack Obama, Chris Dodd of Senate Banking and Finance, just to name a few) and the PUBLIC servants in congress will do anything to avoid derailing their RE-ELECTION hopes!

Hi ho, hi ho, its off to the printing press we go! Look no further then Mega whale Citigroup which declined to less then BOOK VALUE yesterday for the first time since the S&L crisis in 1990-1992. Can the other money center and investment banks be far behind? NO. The next wave of write-down's for the banking industry looms dead ahead with the estimate of Citigroup's next revelation to be over $18 billion. Can you believe Citigroup paid out 38 billion dollars of bonuses and dividends last year when they are basically bankrupt? That 38 billion sure would have gone a long way at fixing their balance sheet.

In Europe and the United States huge spreads are widening between Sovereign Treasuries and anything that is not government guaranteed. Mortgage and corporate borrowing costs are skyrocketing while investors seek the safety of the taxpayer-guaranteed credits. The Euro zone is also being torn apart by the level of the Euro and the additional borrowing costs of Spain , Italy , Greece and other banana republic/socialist members. Germany gets funds for one price and the others get it for a much higher rate. Huge pressures are building between countries with the worst policies and those that are creating more wealth and which are business-friendly.

In Japan and the European Union the level of their currencies versus the dollar are front page issues signaling the coming competitive devaluations that are looming. Politicians everywhere believe they can devalue their way to prosperity in the ever-increasing GLOBAL economy. REMEMBER, CURRENCIES DON'T FLOAT THEY JUST SINK AT DIFFERENT RATES. They believe they must devalue their currencies to remain competitive exporters. They are being priced out in their minds. So its back to the competitive devaluation raceway we have been on for thirty + years, since Bretton woods II in the early 1970's which forever tore currencies from gold and precious metal underpinnings.

In conclusion: THERE IS NO SHORTAGE OF MONEY OR LIQUIDITY, IT IS ABUNDANT. Look no further than the commodities sectors, government treasuries and gold; those prices are not indicative of shortages of liquidity. Interest rates to non-government borrowers will continue to climb regardless of what Sovereign Treasuries and Central Banks do. Interest rates and funding costs will continue to rise until GREED outweighs FEAR, at which point the money will leave the sidelines and engage in lending once again. Re-pricing risk is the order of the day. Inflation is the POLICY OF THE G7 governments, make a note of it!

Mortgage lending is dead except when it is for conforming loans that Freddie, Fannie or the FHA will guarantee the funding. As long as Washington believes they can rewrite terms and forgive balances for borrowers the mortgage markets are CLOSED for business. So public servants will just extend the reach of the fiat currency and credit creation to these new markets in addition to the deficit spending they are currently underpinning. Look for federal bailouts of State and Municipal shortfalls as well. Auction rate securities and over-the-counter debt markets continue to implode as lack of a secondary marketplace or exchange with price discovery mechanisms doom holders of these products to fire sale prices. This reflects the absence of organized marketplaces with buyers and sellers performing price discovery and providing liquidity.

With everyone's attention on the housing, stock and credit bubble implosions nobody is looking at what's coming down the road politically. The something for nothing G7 social trend is setting up more nails in the future of wealth creation. Businessmen and corporations are being placed on the dinner table for the deadbeats in the populous at large. Trillions of Dollars, Euros, Pounds and Yen are about to be TAKEN from the most productive parts of these economies and fed to the weakest and least productive in exchange for support at the BALLOT box. This is not a recipe for higher growth, wages, tax receipts or wealth creation. To substitute for the lost income they will once again say; “Hi ho, hi ho it's off to the printing press we go.” Government policy is destroying what's left of CAPITALISM in the G7.

The “Crack up Boom” is moving into a higher gear (see the Tedbits archives at www.TraderView.com ). Revel in it as it represents huge opportunities for YOU! If you are holding paper, DON'T! Learn to short circuit the printing presses, then learn to invest to take advantage of it! Markets are going to move as far as the eye can see. What is about to unfold is inconceivable to most people, but opportunities for YOU.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.