China’s $3.3 Trillion FX Reserves Could Buy All World’s Gold Twice

Commodities / Gold and Silver 2013 Mar 04, 2013 - 02:23 PM GMTBy: GoldCore

Today’s AM fix was USD 1,578.00, EUR 1,214.13 and GBP 1,049.06 per ounce.

Today’s AM fix was USD 1,578.00, EUR 1,214.13 and GBP 1,049.06 per ounce.

Friday’s AM fix was USD 1,570.00, EUR 1,203.99 and GBP 1,043.74 per ounce.

Silver is trading at $28.75/oz, €22.11/oz and £19.20/oz. Platinum is trading at $1,584.25/oz, palladium at $719.00/oz and rhodium at $1,200/oz.

Gold fell $4.80 or 0.,31%% on Friday in New York and closed at $1,575.60/oz. Silver surged to a high of $28.77 in early New York trade before it also fell back off, finishing with a gain of 0.28%. Gold was off 0.31% for the week while silver was down 0.66%.

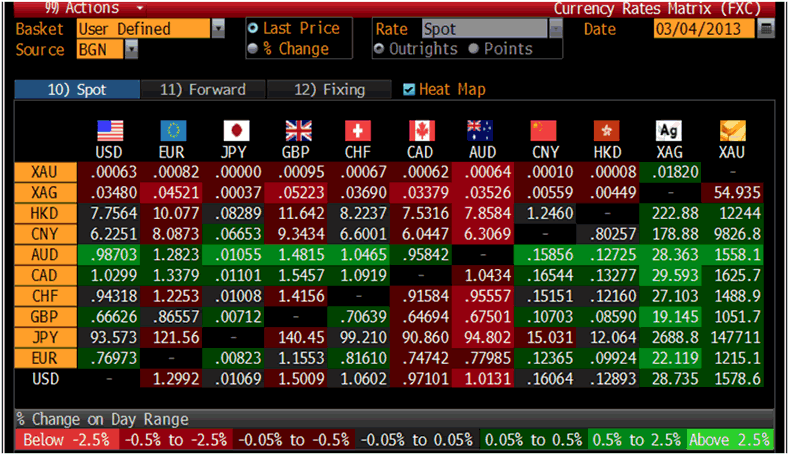

Cross Currency Table – (Bloomberg)

Gold inched higher in all currencies today supported by physical buying in Asia.

Concerns about the global economy and the outlook for riskier assets have led to renewed physical buying interest in Asia, particularly in China. The increasingly popular gold forward contract on the Shanghai Gold Exchange stood at 320 yuan a gram by 0741 GMT according to Reuters, or $1,600/oz. This is a healthy premium of about $23 to spot gold.

Investors are waiting to see the impact of the spending cuts, known as the "sequester", although the $85 billion cuts are a tiny fraction of the U.S. government's total spending of $3.7 trillion and show the U.S. looks incapable of tacking its very precarious financial position.

Hedge funds and money managers increased their net long positions in gold in the week to February 26 from a more than four-year low hit a week earlier. Those lows are very bullish from a contrarian perspective and a gradual increase in speculative longs in the coming weeks seems very likely.

In contrast to a sharp decline in speculative interest in futures and options over the past month, sales of American Eagle gold coins rose sharply in February on the year, and silver coin sales in the form of one ounce Silver Eagles posted their strongest performance for the month since 1986.

Gold in Dollars (01/01/10 to Today) – (Bloomberg)

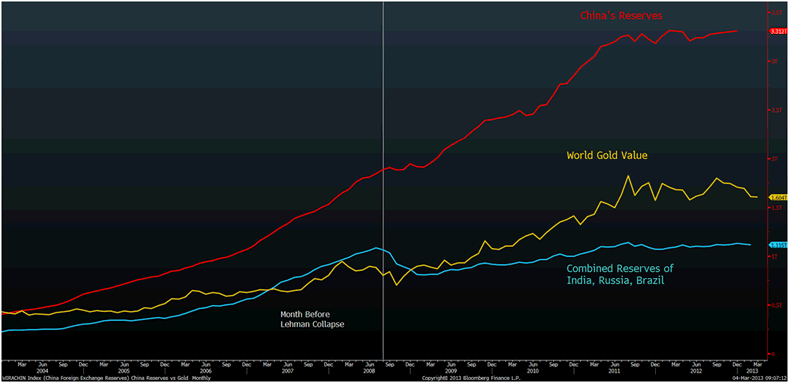

China’s foreign currency reserves have surged more than 700% since 2004 and are now enough to buy every central bank’s official gold supply -- twice.

The Bloomberg CHART OF THE DAY shows how China’s foreign reserves surpassed the value of all official bullion holdings in January 2004 and rose to $3.3 trillion at the end of 2012.

The price of gold has failed to keep pace with the surge in the value of Chinese and global foreign exchange holdings. Gold has increased just 263% from 2004 through to February 28, with the registered volume little changed, according to data based on International Monetary Fund and World Gold Council figures.

By comparison, China’s reserves rose 721% through 2012, while the combined total among Brazil, Russia and India rose about 400% to $1.1 trillion.

Continuing diversification into gold from the huge foreign exchange reserves by the People’s Bank of China and other central banks is a primary pillar which will support gold and should contribute to higher prices in the coming years.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.