An Orwellian America, Unsound Money Leads To Statism

Politics / US Politics Mar 12, 2013 - 03:18 PM GMTBy: Gordon_T_Long

Macro Insights - March 2013

Macro Insights - March 2013

As a young man, I voraciously read George Orwell's "1984", Aldous Huxley's "Brave New World" and Alvin Toffler's trilogy which included "Future Shock", "The Third Wave" and "Power Shift". During the era of the Vietnam War, I wondered seriously about the future and how it was destined to unfold. Now being considerably older, I have the vantage point to reflect back on my early ruminations and expectations. Unfortunately, I am too old to alter the lessons that are now so painfully obvious. Instead, I pass the gauntlet to those who can understand and take action on what I have unavoidably come to expect for America.

A Framework of Understanding

The 'Huxley-Orwell' Transition

I recently read a perceptive paper by Chris Hedges that would have made any English Professor envious, powerfully philosophical but not something an Economics department would pay much attention to. I found it both intriguing and enlightening.

I have borrowed so heavily from it, that I am unsure where the lines diverge. Therefore, below I give full credit to Chris Hedges and take full credit for all the bad ideas.

Chris Hedges of TruthDig.com wrote 2011: A Brave New Dystopia, from which the following evolved.

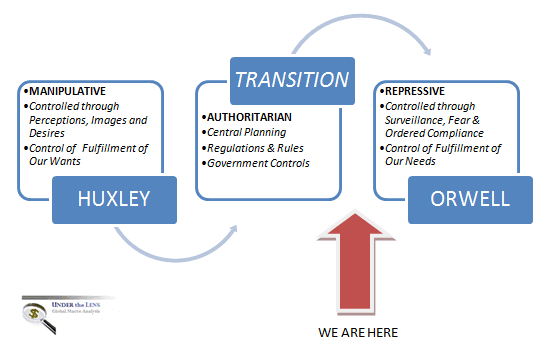

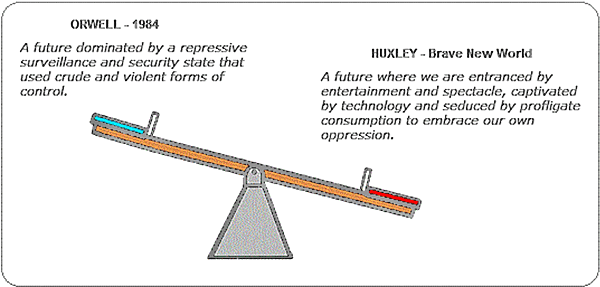

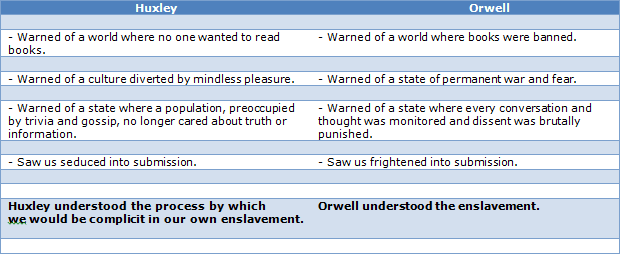

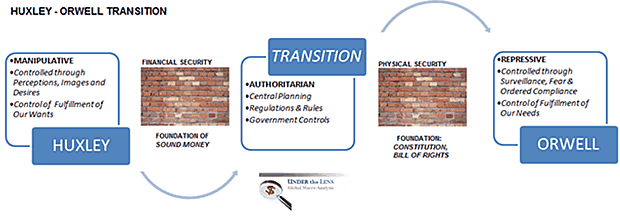

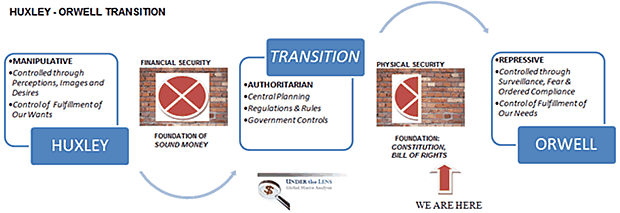

The two greatest visions of a future dystopia were George Orwell's "1984" and Aldous Huxley's "Brave New World." The debate, between those who watched our descent towards corporate totalitarianism, was who was right. Would we be, as Orwell wrote, dominated by a repressive surveillance and security state that used crude and violent forms of control? Or would we be, as Huxley envisioned, entranced by entertainment and spectacle, captivated by technology and seduced by profligate consumption to embrace our own oppression? It turns out Orwell and Huxley were both right. Huxley saw the first stage of our enslavement. Orwell saw the second.

We have been gradually disempowered by a corporate state that, as Huxley foresaw, seduced and manipulated us through:

- Sensual gratification,

- Cheap mass-produced goods,

- Boundless credit,

- Political theater and

- Amusement.

While we were entertained,

- The regulations that once kept predatory corporate power in check were dismantled,

- The laws that once protected us were rewritten and

- We were impoverished.

Now that:

- Credit is drying up,

- Good jobs for the working class are gone forever and

- Mass-produced goods are unaffordable,

.... we find ourselves transported from "Brave New World" to "1984."

The state, crippled by massive deficits, endless war and corporate malfeasance, is clearly sliding toward unavoidable bankruptcy.

It is time for Big Brother to take over from Huxley's feelies, the orgy-porgy and the centrifugal bumble-puppy.

We are transitioning from a society where we are skillfully manipulated by lies and illusions to one where we are overtly controlled.

Huxley, we are discovering, was merely the prelude to Orwell.

Now that the corporate coup is over, we stand naked and defenseless. We are beginning to understand, as Karl Marx knew:

Unfettered and unregulated capitalism is a brutal and revolutionary force that exploits human beings and the natural world until exhaustion or collapse.

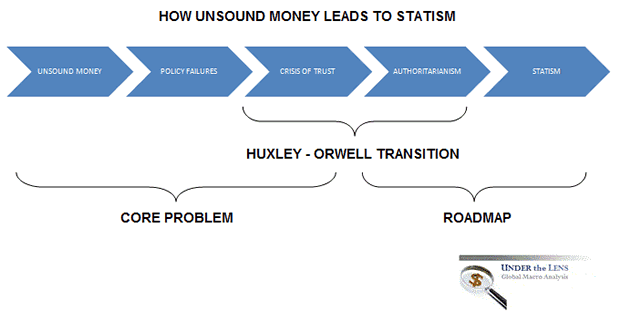

Unsound Money Leads To Statism

With this as a backdrop let's explore how Unsound Money in concert with the Huxley-Orwell Transition leads to Statism, the path which I believe we are presently on.

The Catalysts Behind The "Transition"

1- UNSOUND MONEY

- Removal from Gold Standard and adoption of Fiat Currency regime (in August 1971 during the winding down of the Vietnam War; the first War ever fought without tax increases to pay for it; the beginning of endless 'conflicts' and the War on "Terror").

- Creation and Fostering of a $67 Trillion Shadow Banking Credit Growth,

- Massive Securitization & Off Balance Sheet Contingent Liability Debt Growth.

2- POLICY FAILURES

- Failed Monetary Policy & Monetary Malpractice,

- Moral Malady,

- Failed Fiscal Policy,

- Failed Public Policy,

- Growth of Political Polarization,

- Entrenched 'Left-Right' Factions,

- An Un-Governable Democracy.

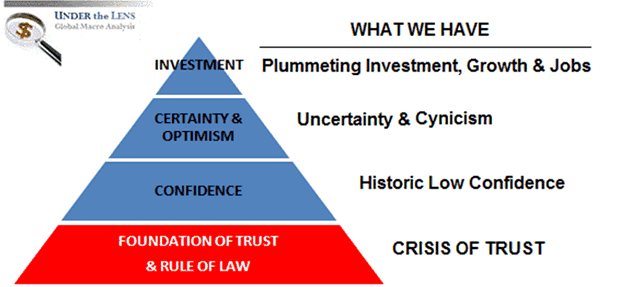

3- CRISIS OF TRUST

- Lost Respect & Confidence

- A Doomed Middle Class

- A Broken Social Contract

4- AUTHORITARIAN ACCEPTANCE

- Central Planning

- Growth in Regulations & Control

- Crony Capitalism & Corporatocracy

- Big Government

- The Huxley - Orwell Transition

Crumbling Barriers

- The Great Huxley-Orwell Transition

- From Manipulative to Repressive

ROADBLOCKS

- Financial Security through Sound Money REMOVED

- Reduced Personal Freedoms through a Crisis PENDING

- Reduced Personal Security through a Constitutional Crisis FUTURE

DRIVERS

- Globalization & Complexity

- Fragile versus Robust Systems

- Interconnectivity and Counter Party Dependency

- The Productivity Paradox

- Creative Destruction & Job Creation

Let's shift gears and consider what "greases the skids" in enabling this transition in our society to occur.

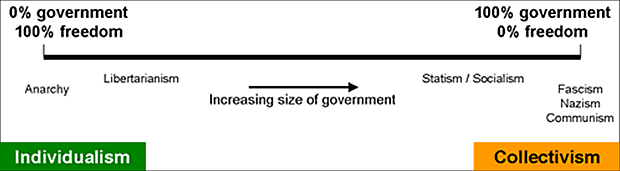

Collectivism

In The Road to Serfdom, F.A. Hayek showed how governments, supported by a collectivist mindset, always tend towards totalitarianism. Even the most libertarian government thus far created, the government of the United States, has slipped incrementally towards totalitarianism over the past two centuries. This is because it is an inherent trait of a government.

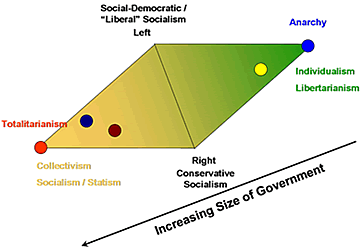

The degree of socialism in the United States increased substantially after the establishment of the Federal Reserve System (1913) and the measures taken during the Great Depression (1929-46) which it created. Ever since the early 1900's the United States has had a two-party system dominated by 'socialists'. The Republican Party has always advocated conservative socialism. The Democratic Party, which in the 19th century favored libertarianism, advocates social-democratic socialism. So long as people are divided by Left and Right, Democratic and Republican, the US is prone to being influenced by factions who transcend party politics and from behind the scenes could possible exert strong control over the United States. They could do this by maintaining power over public opinion and hence over the course of government. Steadily, the United States has been travelling down the road to totalitarianism, and many people have not noticed, possibly because they are only looking at the position on the Left-Right paradigm.

Upon further analysis, it is clear that Left, Right and Centre, are all forms of socialism. In particular, we may call them "social-democratic socialism" (the Left) and "conservative socialism" (the Right). They are both socialism because they both share the principle that the government should "run" and "mold" society, by using legal force and intervention to transfer property and personal wealth as part of the political scientists' process of 'redistribution of wealth'.

The differences are only in the particular ways the government should run society - the methods it should use, and who, exactly, should be the recipients of government wealth transfers and who should pay. In particular:

- Social democrats tend to prefer heavy taxation, large wealth transfers to the poor, and nationalized industries, and oppose price controls, regulations and behavioral controls.

- Conservatives tend to prefer lower taxation, a smaller welfare state, regulated (cartelized) industries, price controls, product and behavioral controls.

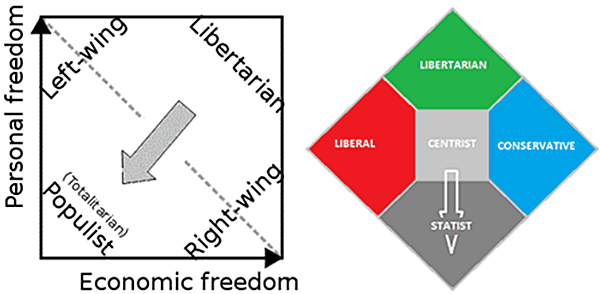

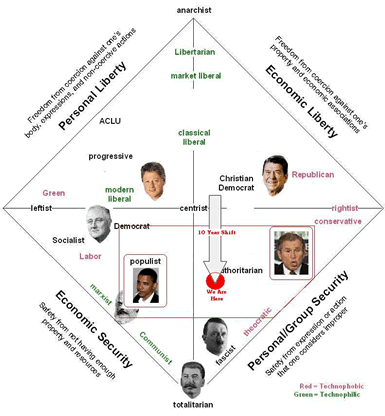

Nolan Charts: Personal Freedom versus Economic Freedom

The modern Republican Party is Center-Right on the Left-Right paradigm. As with the Democratic Party, this obscures the huge range of views Republicans hold on how powerful and how much control the State should be allowed. Their 2008 presidential nominee John McCain, like Barack Obama, strongly favored socialism, though with a Right-wing flavor. Barack Obama (blue circle) and John McCain (red circle) are positioned in the accompanying graphic. Thus, the two main candidates at the 2008 Presidential election represented a false choice - really no choice at all. One candidate, Ron Paul (yellow circle), stood in stark contrast to the candidates, favored by the mainstream media and political establishment. As would be expected, he was neutralized by the mainstream media outlets as a zealot with an unsound political view of America.

The Political Continuum

The Emergimg Roadmap To Statism

Let me now develop and explore the roadmap that outlines the path leading from Policy Failures and Monetary Malpractice, stemming from Unsound Money, to STATISM.

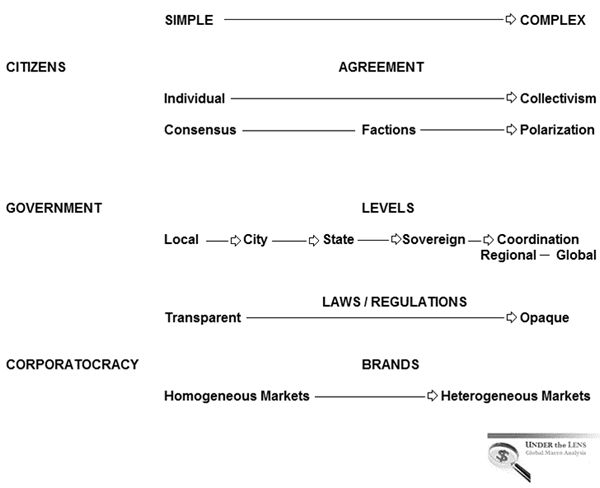

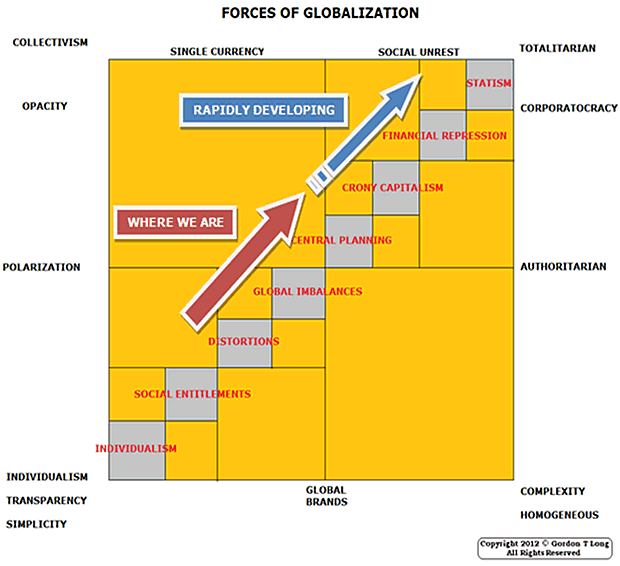

First we will build the outline for the basis of a roadmap on a number of observable continuums.

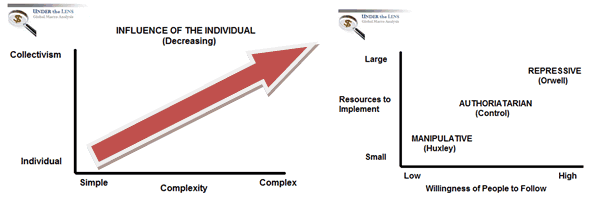

The more complex that issues become, the more collectivism will dominate and individual needs will be repressed. In turn governments will be forced to be more repressive to maintain control over increasing polarization and diverse views and opinions.

Evolving Stages

When we arrange our various continuums we arrive at the representative grid model shown below.

We will quickly acknowledge it is not ideal, but it allows many concepts currently at play to be shown in relationship to others.

This grid is best described as the social forces at play within Globalization - Financial, Economic and Political.

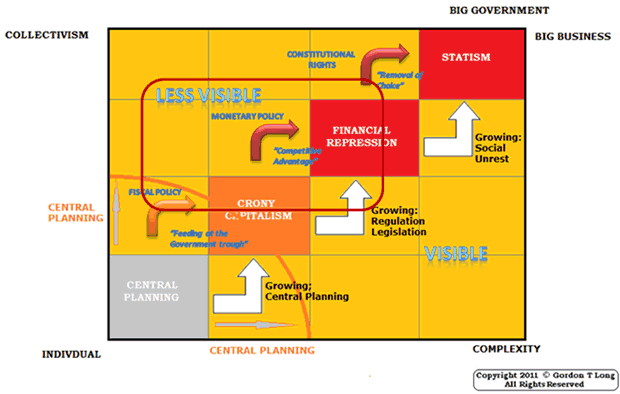

Driver$ - Visible & Invisible

There are both visible and less visible forces at play that are forcing 'greasing' the skids in the movement towards Statism.

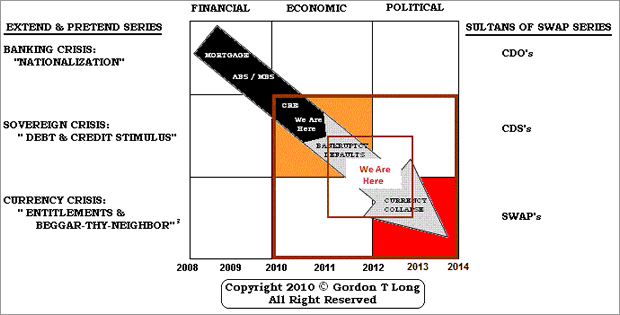

The roadmap integrates well into our roadmap from our THESIS 2011: Beggar-Thy-Neighbor / Currency Wars and 2012 Thesis: Financial Repression papers.

The Unfolding Outlook

Orwell's 1984 Is Happening

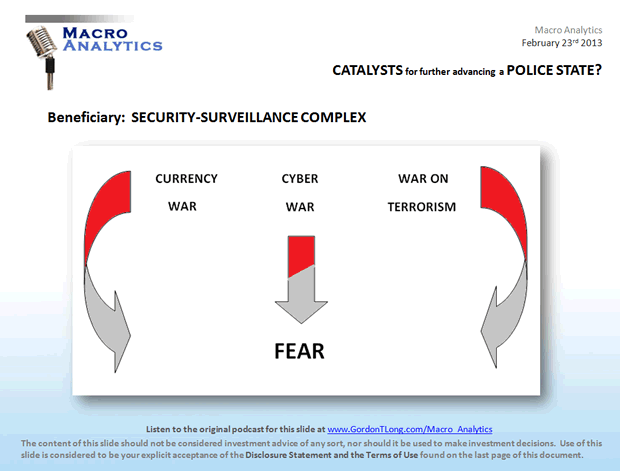

We are one crisis away from a police state. All the powers are in place. Someone will flip the switch. Whether a Cyber Attack, escalating Currency War tensions or a 'terrorist' attack by indebted college youth, it is only a matter of time and circumstance.

Listen to our YouTube Videos on this whole subject. FREE LIBRARY. To read more, go to GordonTLong.com.

Get your Free Copy of Thesis 2013: Statism

Good luck, and good trading.

Download your FREE TRIAL copy of the latest TRIGGER$ Checkout the GordonTLong.com YouTube Channel for the latest Macro Analytics from expert Guests

Gordon T Long Publisher & Editor general@GordonTLong.com

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.