Gold and Silver Price Manipulation At London AM Fix Or New York COMEX?

Commodities / Gold and Silver 2013 Mar 15, 2013 - 04:22 PM GMTBy: GoldCore

Today’s AM fix was USD 1,593.25, EUR 1,219.39 and GBP 1,051.23 per ounce.

Today’s AM fix was USD 1,593.25, EUR 1,219.39 and GBP 1,051.23 per ounce.

Yesterday’s AM fix was USD 1585.00, EUR 1225.83 and GBP 1061.05 per ounce.

Gold was marginally higher yesterday and silver marginally lower. Gold rose just 20 cents and closed at $1,588.50/oz. Silver fell 15 cents to close at $28.75/oz.

Silver is trading at $28.80/oz, €22.40/oz and £19.20/oz. Platinum rose to $1,587.25/oz, palladium to $771.00/oz and rhodium stayed at $1,250/oz.

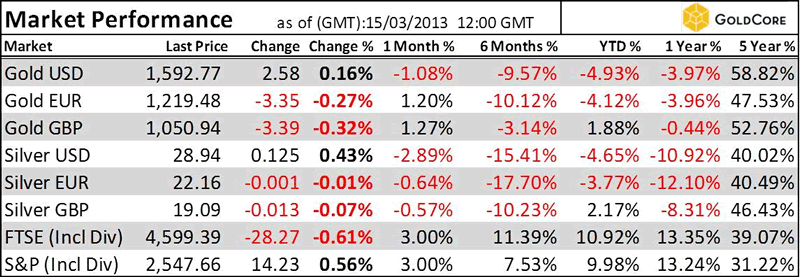

GoldCore Market Performance Table

Gold continues to trade just below resistance at the $1,600/oz level but appears to be consolidating at these levels after the recent price falls. Investment sentiment towards gold is the worst we have seen it since the start of the secular bull market in the early 2000’s.

This is bullish from a contrarian perspective as the "froth" and less informed, speculative buyers have been

washed out of the market as happens in the course of all bull markets as they climb a “wall of worry.”

Conversely, sentiment in stock markets is increasingly “irrationally exuberant” after the Dow Jones industrial average reached new record highs and extended its winning streak to 10 days on Thursday, a string of gains last seen in late 1996.

Retail investors are piling into the stock market again in the false belief that the worst of the economic crisis is over. Alas, those who are not properly diversified may again be in for a rude awakening.

Gold in USD – (5 Day) - Bloomberg

_-_bloomberg.png)

Holdings of SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, had fallen 3.432 tonnes so far this week, on course for an eleventh week of decline, although holdings were unchanged at 1,236.307 tonnes from a day earlier on March 14.

The CFTC’s very unusual announcement through “people familiar with the matter” that it is examining various aspects of gold and silver price fixings in London, including whether they are sufficiently transparent, continues to be digested.

The London gold fixing is conducted twice a day by five banks: Barclays Plc, Bank of Nova Scotia (BNS), Deutsche Bank AG, HSBC Holdings Plc and Societe Generale SA. The pricing started in 1919 and was conducted in a meeting held at N.M. Rothschild & Sons Ltd.’s offices. It began taking place by telephone in 2004.

Deutsche Bank, Scotiabank and HSBC conduct the silver fixing by phone once a day at midday. The first settlement was in 1897.

The price fixing story has been picked up by the non specialist financial media internationally including by many publications and media groups who very rarely cover the gold market and nearly never cover the silver market.

It is now in the public domain and the story could result in the gold and silver markets receiving more scrutiny and coverage.

Overnight, CFTC commissioner Scott O'Malia said that the CFTC has engaged in "a couple" of conversations about whether the daily setting of gold and silver prices in London is open to manipulation akin to Libor.

Separately, CFTC commission member Bart Chilton said interest-rate rigging means other benchmark-pricing mechanisms such as gold and silver may need reviews. “Given what we have seen in Libor, we’d be foolish to assume that other benchmarks aren’t venues that deserve review,” Chilton said.

He continued "given the clubby manipulation efforts we saw in Libor benchmarks, I assume other benchmarks - many other benchmarks - are legit areas of inquiry".

Concerns have previously been expressed by investors due to the admission that leverage in gold trading in the London bullion market - the ratio between metal traded and metal actually existing - was as much as 100 to 1. This means that the so-called physical market may not be so physical at all.

The enforcement division of the CFTC began pursuing allegations of manipulation of the New York metals exchange, the COMEX silver market in September 2008 (the COMEX is a division of the New York Mercantile Exchange or NYMEX). Chilton said in August that there had been “devious efforts” to move prices of the precious metal through the concentrated short positions of a few banks.

Many of these same banks continue to have massive concentrated short positions on the COMEX and investors have alleged that banks have manipulated prices lower in order to profit.

Thus, it is surprising that such allegations are being made without a formal investigation being planned and without the CFTC completing their investigations of manipulation on the COMEX.

The charge of manipulation at the London AM Fix may be unfounded but it is certainly a distraction from the real risk of manipulation on the COMEX by banks through the use of futures contracts.

Regulators might better serve investors and the wider public by concluding their investigations of manipulation on the COMEX and coming to definitive conclusions.

Some have suggested that this may be a an attempt by Wall Street banks to discredit the London gold and silver fixing and rivalry between Wall Street and the City of London over control of the precious metals market may be at play. London has long had a monopoly regarding the benchmark gold and silver prices and the physical settlement of gold and silver at the London AM Fix.

The UK’s GMT time zone gives it an advantage when it comes to the global pricing of bullion due to it being between time zones in Asia and the Americas resulting in it capturing end of day trade in Asia and start of day trade in the U.S. Those fixings are used to determine spot prices for the billions of dollars of the two precious metals traded each day – by both industry and investors.

Today, many governments and central banks and certain banks are openly intervening in many markets – especially bond and foreign exchange markets – therefore it would be naive to completely gold and silver manipulation.

For the sake of investors and the proper functioning of markets it is important regulators investigate allegations to the full and banks are not seen as too big to investigate and “too big to jail” as was recently admitted by none other than the U.S. Attorney General .

Regulation and enforcement is important as is a proper rational debate. Increasingly governments, banks and central banks are distorting financial markets and the free market through constant interventions.

In the western world, we have seen interest rates cut close to zero, capital injections and bailouts, lending guarantees, saving and deposit guarantees, favouring certain banks and institutions over others, banning short selling and the banning of certain sovereign credit ratings.

At the same time competitive currency devaluations are taking place globally with central banks debasing currencies and many outright interventions in currency markets in order to lower the value of national and supranational currencies in competitive currency devaluations.

Japan is the recent glaring example of this and Switzerland’s ‘pegging’ of the Swiss franc to the beleaguered euro is in the same vein.

With governments surreptitiously and openly manipulating their currencies, they and the banks they have bailed out and work closely with, have an interest in not seeing their currencies fall sharply versus gold and silver.

This would be a vote of no confidence in fiat paper currencies and government and central banks stewardship of these currencies. They are also a vote of no confidence in bankers, banks and the financial system.

Ultimately, manipulation or no manipulation, gold and silver prices will be determined by supply and demand and the free market purchases and sales by people and companies all over the world.

Investors should fade out the noise and continue to own both gold and silver bullion as foundation safe haven assets.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.