Grant Williams's Economic Theory of Disconnectivity

Economics / Economic Theory Mar 21, 2013 - 09:26 AM GMTBy: Casey_Research

Grant Williams writes: On March 14, 1879, in Ulm, a tiny town on the banks of the river Danube in the German state of Baden-Württemberg, a boy was born to a Jewish electrical engineer and his wife.

Grant Williams writes: On March 14, 1879, in Ulm, a tiny town on the banks of the river Danube in the German state of Baden-Württemberg, a boy was born to a Jewish electrical engineer and his wife.

Hermann and Pauline Einstein had no idea that their first-born son would one day change the way humans look at the world around them.

Albert was an average student who, in 1895, sat the entrance exam for the Swiss Federal Polytechnic Institute in Zurich. Sadly, he failed to attain the required standard in several subjects; but the young man did display surprising aptitude in both physics and mathematics, which led the Polytechnic's principal to twist a few arms to get young Albert a place at the Aargau Cantonal School in Aargau, Switzerland, where he would finish his secondary schooling.

Upon leaving Aargau at age 17, Einstein enrolled in the four-year mathematics and physics teaching diploma program at the Eidgenössische Technische Hochschule (ETH) in Zurich where, in a triumph for nerds everywhere, he managed to meet, court, fall in love with, and marry his wife, Mileva Marić — romancing her as they read extracurricular physics books together. What a guy!

Einstein's work is legendary, but it is his development of the General Theory of Relativity (which forms, alongside quantum mechanics, one of the two pillars of modern physics), for which he is most famous.

Published in 1916, Relativity: The Special and the General Theory is (according to Wikipedia) one of the 100 most influential books ever published, sitting proudly alongside the works of such literary giants as Homer (not Simpson), Plato, Plutarch, Dante, Darwin, and Confucius. The equation Einstein proposed in his earlier (1905) 'Annus Mirabilis' papers to answer the question 'Does the inertia of an object depend upon its energy content?' has become perhaps the most famous equation ever written (though try finding somebody who can explain it):

E=mc2

What does it mean? Well here is the simplified explanation from Wikipedia:

The formula is dimensionally consistent and does not depend on any specific system of measurement units. The equation E = mc2 indicates that energy always exhibits relativistic mass in whatever form the energy takes. Mass-energy equivalence does not imply that mass may be "converted" to energy, but it allows for matter to be converted to energy. Mass remains conserved (i.e., the quantity of mass remains constant), since it is a property of matter and also any type of energy. Energy is also conserved. In physics, mass must be differentiated from matter. Matter, when seen as certain types of particles, can be created and destroyed (as in particle annihilation or creation), but a closed system of precursors and products of such reactions, as a whole, retains both the original mass and energy throughout the reaction.

When the system is not closed, and energy is removed from a system (for example in nuclear fission or nuclear fusion), some mass is always removed along with the energy, according to their equivalence where one always accompanies the other. This energy thus is associated with the missing mass, and this mass will be added to any other system which absorbs the removed energy. In this situation E = mc2 can be used to calculate how much mass goes along with the removed energy. It also tells how much mass will be added to any system which later absorbs this energy. This was the original use of the equation when derived by Einstein.

Got that? Good, then let's move on.

The relativity relationship I want to discuss today is far, far simpler to understand than that proposed by Einstein (and far, far less likely to win me any prizes of a scientific nature, but I can live with that). Ladies and gentlemen, I am proud to unveil to you, for the first time:

'Williams's Theory of Disconnectivity'

After long and painstaking research, I have distilled my theory down to the following equation:

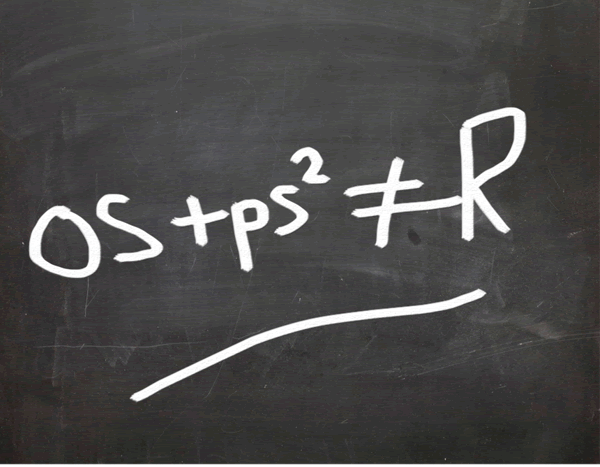

OS+ps2≠R

where OS is 'official statistics', ps2 is 'political spin' (squared) and R is 'reality'.

I must be missing something because, try as I might, I am having a hard time understanding the bull case right now. It seems to be predicated largely on the thesis that we should buy things 'because they are going up'. (Japan is the poster child for this curious strategy, as those terrible results from Sony demonstrated a few weeks ago. Despite them, Sony stock is back to where it was before the company laid out, in no uncertain terms, just how poorly it was doing. In every single division.)

Yes, I understand that, in nominal terms, money printing is good for stocks 'just because'; but sooner or later, reality is going to reassert itself (painfully, I might add). The projected growth in profits that is being forecast for 2013 doesn't tally with the projected growth (or lack of it) in GDP over the same period, and so something has got to give — a fact pointed out beautifully by Rick Santelli and his guest this past week in this video.

Although the examples I could use to illustrate this discrepancy are approximately infinite right now, I will confine my selections to a few areas where the evidence is just too overwhelming to really leave anybody in any doubt. And yet ... they doubt.

To continue reading this article from Things That Make You Go Hmmm… – a free weekly newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore – please click here.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.