Dealing with QE-Wars and Fiat Currency Devaluations

Stock-Markets / Fiat Currency Mar 21, 2013 - 03:48 PM GMTBy: Gary_Dorsch

Whether you live in Cyprus, England, Japan, the United States, or elsewhere, the battle for financial survival is taking on new dimensions. At issue is the steady dilution of the purchasing power of money that is perpetrated by the world’s central banks, and worries about confiscation and taxation of monies by government authorities. Even the giant Multi-Nationals, that stashed trillions of dollars in offshore tax havens, are feeling a bit uneasy about reports that the G-20 plans to crackdown on their money laundering schemes in the future.

Whether you live in Cyprus, England, Japan, the United States, or elsewhere, the battle for financial survival is taking on new dimensions. At issue is the steady dilution of the purchasing power of money that is perpetrated by the world’s central banks, and worries about confiscation and taxation of monies by government authorities. Even the giant Multi-Nationals, that stashed trillions of dollars in offshore tax havens, are feeling a bit uneasy about reports that the G-20 plans to crackdown on their money laundering schemes in the future.

However, - what’s most urgent right now, is learning how to profit from the QE-Wars and competitive currency devaluations that have become the “New Normal” of in today’s marketplace. And as long as governments’ budget deficits continue to spiral out of control, presumably, there’s no end in sight to how much currency that central banks will print, or how much politicians will try to tax. A key question facing investors is - what is the best strategy for staying ahead of the money printing schemes and currency devaluations that are expected to unfold in the year ahead? For many investors, the best way to hedge is by investing in selected stock market index funds, (ETF’s). In several countries, the precious metals market for Gold and Silver are seen as the best way to protect wealth.

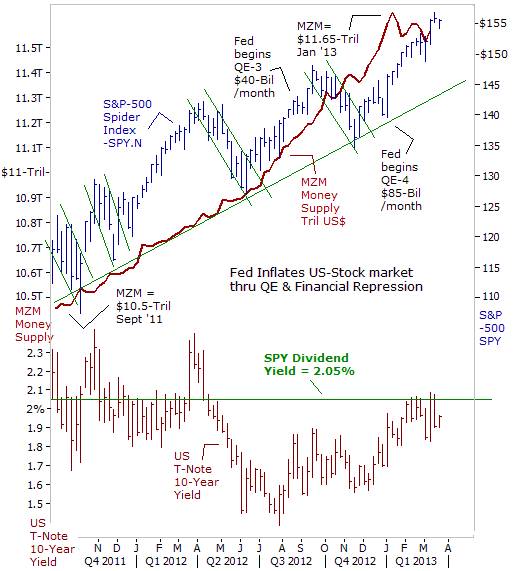

On Wall Street, the “least loved” stock market rally in history has restored $11-trillion of wealth to the top-10% of the richest Americans. As the cyclical Bull has reached its fourth birthday, on March 10th, to become the eighth longest bull market since 1928, there are many latecomers to the game that are starting to jump on the bandwagon. Many investors are just beginning to realize that the Federal Reserve is empowered with a third mandate, - to artificially inflate the value of the stock market and to ride to the rescue of the stock market Bulls whenever unforeseen developments threaten to trigger a correction.

Whereas the FDIC guarantees up to $250,000 of monies that are deposited in US-bank accounts, the Fed acts to protect the wealth of the Ultra-rich in the stock market, 24-hours per day, with a handful of price rigging techniques, although minor bouts of pullbacks in the market are allowed, so as to give the appearance of a so-called free market. Yet even as the Dow Industrials hit record heights, it might require even bigger dosages of money injections from the sugar daddy at the Fed, in order to fuel a full fledged secular Bull market.

For the past 4-years, the US-stock market rally has been climbing the proverbial “Wall of Worry,” overcoming numerous obstacles and panic attacks along the way. Most recently, the key driver that’s lifting stock markets higher around the world is the massive flow of liquidity via the infamous Japanese “Yen Carry” trade. The Bank of Japan and the Federal Reserve are telling traders through the media, that they’re poised to print a combined $2-trillion worth of yen and US-dollars, in the year ahead. Expectations of a sharply lower yen exchange rate has already catapulted the Australian Stock Exchange’s top-200 index above the psychological 5,000-level and lifted Germany’s DAX-30 index above the 8,000-level.

Still, the average lifetime of a stock market Bull on Wall Street since World War II is roughly 52-months. The current Bull market is 48-months old. It’s important to note that the average age of 52-months is skewed by the performance of giant Mega-Bulls that lasted for 18-years and 24-years respectively. Subtract out the two Mega-Bulls, and the average lifetime of a cyclical Bull is closer to 2-years of age. If history is any guide to the future, this Bull market will start to show a touch of gray, and produce more muted returns and more erratic behavior future in its fifth year of age. However, many investors believe that a third Mega-Bull is in the making, and that this rally has legs that can run for several more years.

Wall Street’s Guardian Angel - the Fed, Stock market Bulls are able to sleep well at night, knowing their wealth is protected by a guardian angel – the Bernanke Fed, which is working every single day and night to guide the stock market along an upward trajectory. The Fed, the White House, and the US Treasury, otherwise known as the “Plunge Protection Team (PPT), have tossed aside “free market” principles, and any notions of moral hazard, and instead have instilled a tyrannical policy of price rigging, through a few unorthodox measures, - namely Quantitative Easing (QE), the Zero Interest Rate Policy (ZIRP), and “Operation Twist,” sprinkled with brainwashing messages, - “Jawboning” that are fed to the media.

There’s also a technique known as “Financial Repression,” in which the Fed submerges the yield on the US Treasury’s 10-year note to below the dividend yield that’s paid by the blue-chip companies listed in the S&P-500 index. Today, the dividend yield on the S&P-500 index is 2.05%, which is slightly above the 10-year T-note yield of 1.96%. That helps to make US-companies that increase their dividends look more attractive to the Ultra-wealthy. In December, the Fed super-charged it’s QE-scheme, saying it will pump $85-billion of high octane liquidity into the money markets each month. In turn, a total of $1-trillion of QE injections this year is expected to drive the stock market indexes sharply higher.

Jeremy Grantham, an investment strategist who is best known for his bearish call on the US stock market in 2000, is a long-time critic of both Fed chief Ben Bernanke and his predecessor Alan Greenspan. In a series of his regular letters he has blamed them for creating asset bubbles by holding interest rates at artificially low levels. “The Fed is trying to “badger” people into making riskier investments in order to push up equity prices,” Grantham said. “This strategy will be seen as typical of the “Greenspan-Bernanke era.”

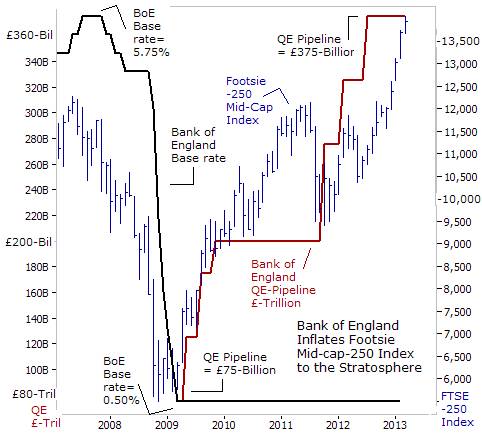

The Bank of England is also a Serial Bubble Blower - The Fed is not the only schemer, that’s rigging the stock markets these days. The Bank of England (BoE) is also engaging in QE and Financial Repression. After slashing its overnight base rate to a historic low of 0.50% in February of 2009, the BoE switched its monetary policy from regulating the cost of money to managing the quantity of British pounds sloshing in the London money markets (QE). The BoE launched its QE-scheme with an initial dose of £75-billion in March of 2009, and steadily upped the dosage of the hallucinogenic drug to £375-billion by July of 2012. Since then, the BoE has tried to go cold turkey on QE, but the withdrawal symptoms from the addictive drug is painful. It’s already flashing signals that it wants to resume QE in the months ahead.

These high-octane QE-injections combined with “negative” interest rates offered on British Gilts, fueled a spectacular rally that’s lifted the Footsie-250 index to an all-time high of 14,000. The FTSE-250 index, a measure of 250 mid-sized UK-companies, has rocketed +135% above its March of 2009 low. What caught many macro-traders off guard however, was the fact that the FTSE-250’s spectacular price gains were achieved during a time period when the local UK-economy was sputtering and grew by an anemic +3.4-percent.

Furthermore, the FTSE-250 index soared +16% above its highs of 2007 even though the size of the UK-economy is still -3.2% smaller than its peak in Q’1 of 2008. In other words, there’s been a big disconnect between the spectacular gains of the local UK-stock market and the anemic growth of the local UK-economy. For this reason, many traders believe the BoE has inflated a stock market bubble that would begin to slowly deflate under its own weight if the BoE decided to kick the QE-addiction, or worse yet, the FTSE-250 index bubble would burst more rapidly if British gilt yields turn sharply higher.

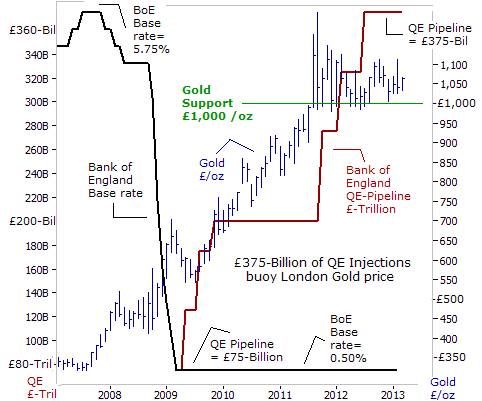

QE-injections buoy London Gold above £1,000 /oz, - The British government has issued £580-billion of new debt since the start of 2009, and the BoE has purchased (ie monetized) nearly two-thirds of it. While Britain’s economy teeters on the edge of a “triple-dip” recession, - between now and 2016, even if Britain’s austerity program is fully implemented, the UK’s national debt is expected to increase to around £1.6-trillion – more than five times what it was at the turn of the century, and 3-times more than in 2008. This enormous debt of £1.6-trillion doesn’t include public-sector pension obligations of another £1.2-trillion, – the bulk of which will be paid, over time, directly from future taxation.

As a result, Moody’s stripped Great Britain of its coveted AAA-rating, and lowered its credit profile to AA1. For the first time since 1978, Britain has lost its triple-A rating. And another downgrade could follow, Moody’s added, if it sees “a reduced political commitment to fiscal consolidation.” Signals that the Bank of England could soon resume its QE injections have already knocked the British pound -7% lower against the US$ since the beginning of this year, and the pound has been flirting with the psychological $1.500 level this month.

On a trade-weighted basis, the British pound has fallen about -30% since 2008. “Without the fall in the exchange rate that did occur from before the crisis to now, our export industry would not be growing as they are and unemployment would be a good deal higher,” said BoE chief Mervyn King on March 15th. “Sterling is now broadly stable and “at the same level we were after the impact of the financial crisis. The markets have judged that this is the right level for the pound. We’re certainly not looking to push sterling lower,” he said.

The London Gold market has been a rock solid defender of the purchasing power of British citizens against the insidious effects of the BoE’s money printing schemes and the devaluation of sterling. In London, the price of Gold has tripled compared with six years ago. That’s an annualized gain of Ápercent. For the past 1-½ years, London Gold has found good support at the psychological £1,000 /oz level. Traders expect the yellow metal to resume its Bull market run, once the BoE resumes its QE injections, which are absolutely necessary in order to finance the bulk of the UK-government’s future supply of gilt offerings.

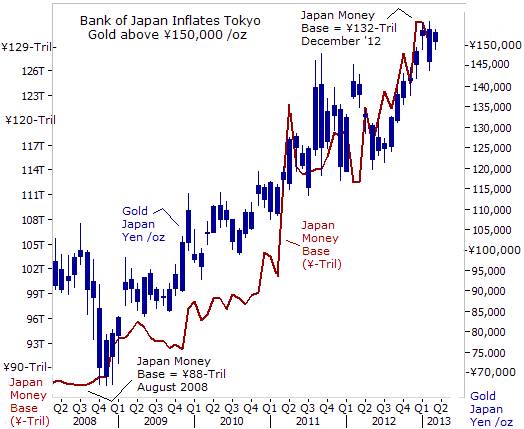

Tokyo Gold hits ¥150,000 /oz ahead of Big-Bang QE, The danger with a resumption of QE in London, is that a gradual depreciation of the British pound could escalate into currency freefall that in turn, could trigger an inflation spike, and leave the British economy with an even deeper economic slowdown. However, the possibility of a freefall for sterling seems unlikely to materialize, since the Bank of Japan and the Fed are expected to flood the world markets with a staggering $2-trillion of freshly printed Japanese yen and US-dollars in the year ahead that would greatly dwarf the size of England’s QE-scheme.

The Bank of Japan is expected to start Big-Bang QE as early as April. The newly installed BoJ chief Haruhiko Kuroda is anxious to unleash a more aggressive approach to boosting the value of the Japanese stock market. Given a +34% jump in Japanese stocks and -20% slide in the yen since mid-November in anticipation of Big-Bang QE, any failure to act in April risks disappointing investors, said ex-Bank of England central banker Adam Posen on Feb 28th.

The Nikkei-225 index has enjoyed its longest monthly winning streak since 2006, while the benchmark 10-year Japanese bond yield has dropped to just 0.59%, its lowest level in a decade. Japanese Prime Minister Shinzo Abe said on Feb 17th, that Big-Bang QE would result in a weaker yen and boost share prices, thus helping to lift corporate earnings. However, the biggest winners in Japan over the past 4-½-years are investors in Tokyo Gold, - the price of the yellow metal has doubled to above ¥150,000 /oz today. The BoJ is expected to vastly increase the size of Japan’s monetary base, and in turn, the BoJ is aiming to lift the US$’s exchange rate to above ¥100 in the months ahead. A weaker yen could fuel further gains for the Nikkei-225-index and the price of Tokyo Gold.

Is Cyprus - a Game Changer for Gold? - Cyprus is a small island in the eastern portion of the Mediterranean Sea that is inhabited by only 1-million people. The northern half of the island is mostly populated by Cypriots of Turkish origin, while the south is dominated by Greek Cypriots. The Turkish Republic of Northern Cyprus is a puppet state recognized by no country other than Turkey, while the Republic of Cyprus governs the south. The Republic of Cyprus - the southern, Greek one, joined the European Union in 2004, and with poor timing, joined the Euro zone in January 2008, just before the Western financial crisis hit.

The Cypriot banking system is an offshore haven for Russian companies that have set-up subsidiaries in Cyprus, seeking to evade a 20% Russian tax rate on income that is earned abroad. That has provoked accusations that Cyprus is a banking haven for Russian tycoons who launder dirty money. According to German intelligence, at least €20-billion belonging to Russian Oligarchs are stashed away in Cypriot banks. In January, Germany’s Finance chief Wolfgang Schaeuble demanded an investigation to learn whether Russian companies are using the island as a destination for money laundering.

The amount of customer deposits that’s held in Cypriot banks is now 8-times the size of its economy, with approximately €136-billion on deposit. However, Cypriot banks bought large amounts of Greek debt, both public and private. The value of that debt took a nosedive, destroying the balance sheets of Cypriot banks. As part of Greece’s debt restructuring, private creditors including banks, funds and insurance companies agreed to swap their old Greek government bonds for new securities with haircuts of 53% of the nominal value of their Greek bond holdings. Two of the island’s biggest banks, - Cyprus Popular Bank and the Bank of Cyprus ended up losing €2.5-billion and €1-billion, respectively.

Troubles on the Mediterranean island have resembled those of Iceland, which seized control of its banks in 2008 when they were unable to finance debt 12-times the size of its economy. Some of Cyprus’ banks are already bankrupt. Nicosia nationalized the banks and asked the Troika (the European Commission, ECB, and IMF) for a bailout to cover both the government’s financial needs, and the shortfalls of capital faced by its largest banks. The Troika offered €10-billion to fund Cypriot banks and the government. However, deposits in Cypriot banks are insured up to €100,000, and about €30-billion are in insured.

Cypriot banks are paying an average 4.45% on deposits of less than two years, and as a result, they’ve amassed large amounts of funds from wealthy foreigners. Berlin insists that all depositors in Cypriot banks should pay €5.8-billion towards the bailout, a startling condition that’s never been imposed before on any banking system in the Euro-zone. European finance ministers on March 16th ordered Cyprus to impose a levy of 6.75% on deposits of less than €100,000 - the ceiling for European Union account insurance — and 9.9% on funds above €100,000, in order to finance one-third of the necessary bailout funds.

Although Cyprus is the smallest Euro-zone country, accounting for just 0.2% of the bloc’s GDP, the idea of a government confiscating customers’ deposit monies, without warning, sent shockwaves throughout the global markets. It was the first time that the EU formally targeted savers’ banks accounts for confiscation. Yet a bailout without the levy would be perceived as a bailout of the Russian Oligarchs. If Cyprus rejects the deal it could force the bankruptcy for the island nation, and it’s eventual exit from the Euro. As a result, the cost of protecting $10-million of Cypriot government debt against default for 1-year using credit-default swaps soared to 1,300-basis points this week, - equal to $1.3-million.

There could be a run on the Cypriot banks. And since no bank has enough cash on hand to pay off all its depositors at once, runs on the bank cause banks to go bust. That's what happened to Bear Stearns, Lehman Brothers, and big banks in England during the financial crisis and in Ireland and Spain more recently. Thus, the Cypriot banking crisis could be a game changer for the Gold market, as depositors in Italian and Spanish banks seek to switch some of their savings to the “safe haven” currency, - perhaps, parked in Swiss banks. As a matter of practicality, the price of Gold in Euro terms has been tracking the credit default swap market for Cypriot debt. If Nicosia ends up with no choice but to leave the Euro, there could be contagion effects that ricochet around the Euro-zone and world markets.

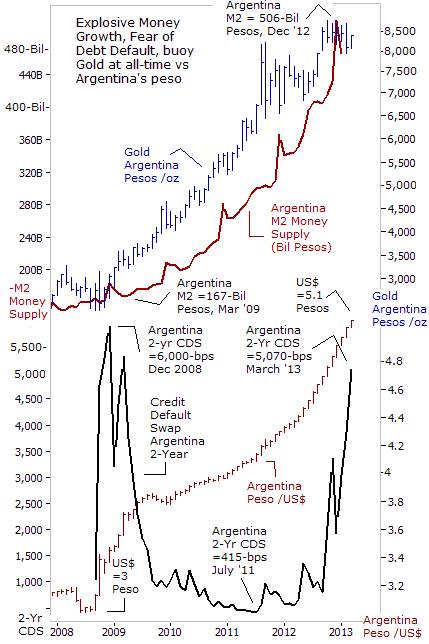

Argentines Switching Pesos into Gold, It’s not just Cyprus that could be on the brink of default on its debts. The cost to protect against a default by Argentina on its restructured debts, soared to a 4-year high, after Buenos Aires said it would halt payments on restructured bonds if a US-court ordered it to pay $1.3- billion to holders of defaulted bonds. Argentina’s 2-year credit-default swaps soared to 5,070- basis points this week. One-year swaps have soared to 7,610-bps, the highest in the world. Speculation is mounting that Argentina will opt to default on its performing debt if the three-judge panel declines to overturn a lower-court ruling forcing the country to pay a group of investors who hold debt from the nation’s 2001 default. Argentina’s attorney, Jonathan Blackman, said at the Feb 27th hearing that Argentina wouldn’t “voluntarily obey” such an order.

Argentina, South America’s second largest economy, is treated as a pariah, and is effectively shut out of the global bond markets. It hasn’t borrowed money from overseas debt markets since its $95-billion default in 2001. Instead, Argentina’s central bank is printing pesos to finance the government. Argentina’s M2 money supply has increased +36% in the past year, which in turn, is fueling a sharp devaluation of the Argentine peso. Earlier this week, the US$ rose to 5.1-Argentine pesos, up from 3-pesos five years ago. The price of Gold has more than tripled to 8,400-pesos per ounce, as local investors seek a hedge against the central bank’s massive money printing operation and the country’s 25% inflation rate.

Confiscating the savings of citizens and denying access to their property without warning, is something that Argentines have already experienced. In the last three years, Argentina's government seized private pensions to pay for pork barrel social programs, and other government spending that amounts to 38% of GDP. After losing $1-billion a month to capital flight by small investors in 2011's fourth quarter, and capital flight that reached $23 billion last year, President Cristina Fernandez banned the purchase of US-dollars in a bid to keep enough dollars in the central bank’s reserves to services Argentina’s $141-billion of foreign debts while preventing already high inflation from spiraling out of control.

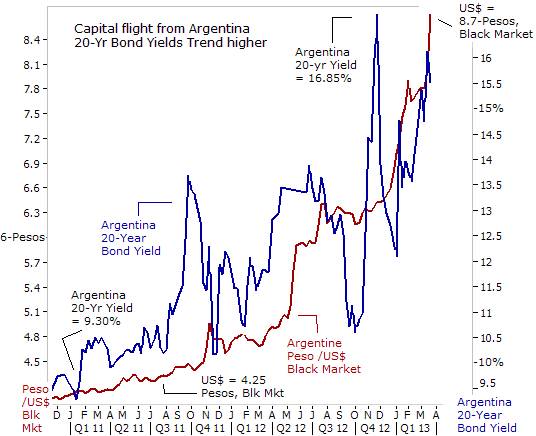

The Argentine government is allowing the official exchange rate of the Argentine Peso to slide against the US dollar. A top official from the Fernandez administration said the US-dollar could reach 6 Pesos by the end of the year. While the official exchange rate is controlled by the central bank, - for the average Argentine, there’s a black market on the streets of Buenos Aires that’s populated with illegal currency dealers. On the black market, the US-dollar soared on March 20th to as high as 8.70-Pesos, - leaving a gap of 70% with the official rate of 5.1, and sparking fears that Argentina may eventually be forced to set up a 2-tier currency market. Each day, the financial newspaper El Cronista, publishes an average of black market exchange rates collected from underground traders.

Other options for acquiring US$’s are - buying Argentine shares in Buenos Aires and reselling them in New York. Businesses, on the other hand, have been exploiting the loop-hole known as blue-chip swaps, where companies buy dollar denominated sovereign bonds in pesos, transfer them to the US and then sell them for dollars. Reflecting expectations of higher inflation rates, due to a rapidly weakening currency, the yield on Argentina’s 20-year note denominated in pesos rose to 15.5% this week, up from 10.25% in June of 2011.

At the root of Gold’s popularity is Argentina’s runaway +25% inflation rate. With concerns mounting over a -70% devaluation of the peso, - wealthy Argentines are looking for ways to protect their purchasing power. By moving money to Uruguay, Argentines benefit from a more market-friendly regime and a Swiss-like tradition of banking secrecy. Fifteen percent of Uruguay’s bank deposits, about $3-billion, come from abroad and most of that is from Argentina, according to Uruguay’s central bank.

For the first time since 2009, Argentina’s foreign exchange reserves have fallen to $41-billion. As the government uses the reserves to pay its debts and fund its spending, within a few years, it could run out of hard currency to defend the peso. The government announced some unique ideas to combat capital flight. Argentina’s tax agents are now deployed at airports with sniffer dogs that are trained to detect the ink used to print US-bills. The goal is to catch Argentines trying to leave the country with more than the $10,000 legally allowed out of Argentina without declaring it to the government. – Argentina is under tyrannical rule.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2013 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.