Can Xerox Survive in a Paperless World?

Companies / Investing 2013 Mar 25, 2013 - 02:45 PM GMTBy: Money_Morning

David Mamos writes: Xerox (NYSE: XRX) may have been an iconic part of 20th century Americana but these days it's still in the process of trying to find its way into the 21st century.

David Mamos writes: Xerox (NYSE: XRX) may have been an iconic part of 20th century Americana but these days it's still in the process of trying to find its way into the 21st century.

In a suddenly more paperless society, the company that revolutionized how businesses operate with its superior copiers and printers is struggling to stay relevant.

For now Xerox is surviving, but it is often very difficult for old, large, stodgy companies to evolve.

Like Eastman Kodak, companies not nimble enough are forced to ride off into the sunset. Yet other companies have managed to re-invent themselves, as IBM (NYSE: IBM) did when it transitioned from hardware to business outsourcing services.

Xerox, to its credit, is trying to adapt.

Its iconic copier business only accounts for 42% of Xerox's revenue -- and the percentage is dropping.

In fact, 52% of Xerox's revenue now comes from a myriad of different outsourcing services. These include information technology outsourcing, business process outsourcing, and document outsourcing. According to Xerox, these services should account for two-thirds of its revenue by 2017.

But is this enough of a change to justify the company's share price? With the company hovering near 52-week highs, here's the breakdown of where Xerox stands today.

Xerox's New Growth Driver Is Not an Original

Xerox acquired a business outsourcing services unit with the purchase of Affiliated Computer Services (ACS) in 2009. This purchase alone cost $5.5 billion. The price tag may have been high -- it did raise eyebrows at the time -- but it has now become the company's primary avenue for growth.

This growth has been very slow, though, as struggling businesses around the world cut back on corporate spending. The saving grace for Xerox during this prolonged economic downturn - with seemingly no end - may be the long-term contracts they hold with federal and local governments in the United States.

More specifically, the company is one of the major processors for Medicare and Medicaid claims, and is currently bidding on additional Medicaid contracts across the country. As Obamacare rolls out over the next few years, millions of additional people entering the system will need their claims processed-- a certain boon for Xerox.

Competition in the business outsourcing services field is fierce as tech titans like IBM, Google and Oracle all clamor for a piece of the pie.

Many have been in the business longer than Xerox/ACS, and with more varied product offerings. Therefore, it is tough to see Xerox making headway against such formidable foes -- especially when the company doesn't have a competitive advantage.

One of the long-standing talking points regarding Xerox is that it has no true catalyst, whether it is a new innovative product or some other piece of good news to spur growth. This is a valid issue for sure, but one that, in my estimation, is reflected in the share price.

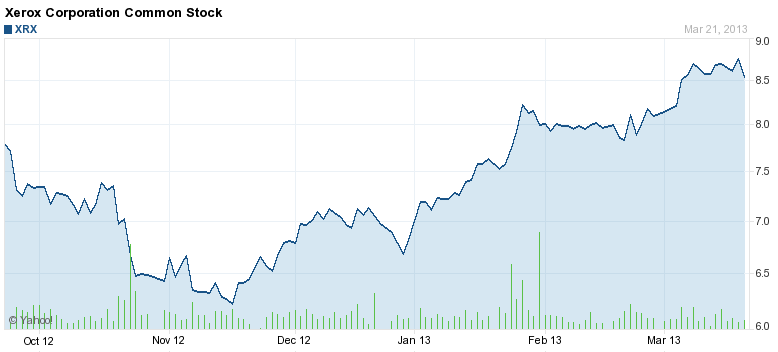

Since the purchase of ACS in 2009, Xerox's stock price has languished, trading from the highs of roughly $11.50 down to $6.23 last November. Since that low the share price has risen 38% to its current price of $8.70 as of this writing.

Source: Yahoo Finance

Xerox at 52-Week Highs

In the weeks since Xerox's most recent quarterly earnings report on January 24, the stock has risen 15%. For the quarter, the company slightly exceeded estimates on both revenue and earnings per share. However, year-over-year numbers for the quarter show a decline of 0.69% in revenue and over 9% in earnings per share.

Operating cash flow is where Xerox continues to hang its "paper" hat.

For 2012, operating cash flow increased by 31.57% to $2.58 billion. The company is slated to follow up its $1 billion stock buyback in 2012 with another $400 million buyback in 2013. Xerox also plans to retire an additional $400 million of debt.

The most visible sign that Xerox is on sound financial footing is a 35% increase in the dividend to 5.75 cents per quarter, for an annual yield of nearly 2.7%, which will take effect on April 30.

With a trailing P/E of 9.86, a forward P/E of 7.31, and a price-to-book ratio of 0.92, Xerox's stock price may still be considered cheap even after its most recent upswing.

A Buy, Sell or Hold Dilemma

Looking at the chart above, Xerox's stock has made a significant move from its lows, clearing some obvious resistance points. Is this resistance new support where we now have a long-term trend taking place? I'm not sure since the market in general has been on a tear, and Xerox may just be going along for the ride.

If Xerox traded in a vacuum, then perhaps we may not be seeing such strong upward momentum. I tend to believe that is the case, as the underlying story of the company hasn't changed all that much.

Xerox's printer business is dwindling while it fights an uphill battle against some formidable, established competition in the business outsourcing services arena.

Accounting-wise, the share price may be cheap but with Xerox management's hopes riding high that the business climate will change, I'd rather take a wait-and-see approach.

For those already with a position in Xerox, I would continue to HOLD. But at these prices I'm just not a buyer yet.

About the Author: David Mamos brings nearly 15 years of analytical experience to the table, with a background ranging from big-picture fundamental analysis to highly technical trading decisions. He began his career working as a financial advisor with Royal Alliance in 2001 and helped clients with portfolio management as well as buy-sell decisions before transitioning to the development, implementation and execution of trading strategies for aggressive investors.

Source :http://moneymorning.com/2013/03/25/buy-sell-or-hold-can-xerox-survive-in-a-paperless-world/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.