Don't Bother Raising The Minimum Wage

Politics / Employment Mar 27, 2013 - 09:54 AM GMTBy: Jeff_Berwick

Gary Gibson writes: Elizabeth Warren just realized that the minimum wage should be $22 if it had kept up with economic growth. She suspects in her tender, socially conscious heart that greedy employers have been shafting the lowest level employees. But she's laying her suspicions on the wrong bunch of people. She might want to read up on the currency debasement of the central bank, the command economy vampire that sits at the center of America's supposedly free market economy.

Gary Gibson writes: Elizabeth Warren just realized that the minimum wage should be $22 if it had kept up with economic growth. She suspects in her tender, socially conscious heart that greedy employers have been shafting the lowest level employees. But she's laying her suspicions on the wrong bunch of people. She might want to read up on the currency debasement of the central bank, the command economy vampire that sits at the center of America's supposedly free market economy.

Follow (The Debasement Of) The Money

Before 1965, quarters and dimes were 90% silver. Quarters from before 1965 are currently worth a little over $5 and dimes are worth a little over $2 based on the silver content.

But the government had to stop making money with any actual precious metals because the central bank had been debasing the money supply for decades to fund the expansion of the welfare/warfare state. Roosevelt first debased the $20 bill which used to be a certifacte for one ounce of gold, way back before 1935. Thirty years after the debasement of the paper dollar, silver coins had to be debased as well. A few years later in 1971 Nixon would legally and figuratively "remove" every scrap of gold from paper dollars. But first in 1964 all the silver was quite literally removed from all new coinage.

Minimum Silver Wages

The minimum wage was $1.00 from 1956 to 1960. It was $1.25 from 1963 to 1966. Keep an eye not on the dollar figures, but on the metal content...

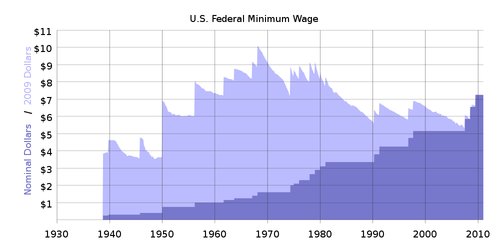

The minimum wage in the two years before 1966 was five 90% silver quarters. That 90% silver $1.25 is roughly $25 in today's money. Let me be clear: if the minimum wage had stayed at a mere $1.25 an hour and the central bank had not debased the money supply forcing the reduction or removal of the silver content, minimum wage workers would have been roughly two or three times better off today in terms of real purchasing power than they currently are with a nominal minimum wage nearly six times the nominal amount prior to 1966. Because of money supply inflation, the minimum wage is nearly six times as high...but buys roughly half as much...or less.

Put another way, a pre-debasement quarter can still buy you a gallon of gas...with change left over. A gallon of gas cost about 15 minutes of minimum wage labor in the early 1960s. Gas has actually gotten cheaper relative to gold and silver money since then. A minimum wage worker in 1963 could work for ten minutes, then send the wages of those ten minutes (two 90% silver dimes worth about four of today's dollars) forward in time and buy a gallon of gas. It takes today's minimum wage worker about three times as long to earn that same gallon.

Every nominal increase in the minimum wage after the silver was removed from the coinage has been a lie.

Real purchasing power of the minimum wage peaked in 1969. It should come as no great shock that was almost dead center between when silver was taken out of the coinage in 1964 and when gold "taken out of" the dollar in 1971.

Capitalism didn't leave the bottom earners out in the cold. The central bank has been stealing from the poor and giving to the government and the well-connected.

So, to all you minimum wage-earners: a tiny percentage of the population is indeed stealing from you. But it's not the "capitalists". It's the fasco-communist central bank on behalf of the US government. You're getting more by government decree, but you can buy a whole lot less. Don't worry, however. Every other wager earner at all levels is harmed, too (which is why it's more important than ever for all of you reading this to get the best advice possible not just on how to keep inflation from picking your pockets, but also how to multiply your purchasing power in spite of it.)

Gary Gibson, The Dollar Vigilante’s Editor, cut his teeth writing for liberty and profit as the managing editor of the now-defunct Whiskey & Gunpowder financial newsletter. He now writes for and edits The Dollar Vigilante. In his capacity as managing editor of TDV’s monthly subscription letter TDV Homegrown, Gary insists on playing Russian Roulette by basing himself in the USSA heartland so he can round up information on how the TDV readers stuck in the USSA can best survive and profit in the increasingly turbulent times in the morally and financially bankrupt empire.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2013 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.