Barrons Turns Bullish, TIme to Cash in Your Stock Market Chips?

Stock-Markets / Stock Markets 2013 Apr 26, 2013 - 11:14 AM GMTBy: Bill_Bonner

We don't like the looks of it...

We don't like the looks of it...

Advisors are too bullish. Investors are too complacent. The financial authorities are too confident.

All up and down Wall Street... in central banks and in Washington... the stuff that goeth before the fall is thick, sticky and stinky.

The economy is recovering, they say. The Fed has the situation in hand, they add. Don't worry... we know what we're doing, they assure us.

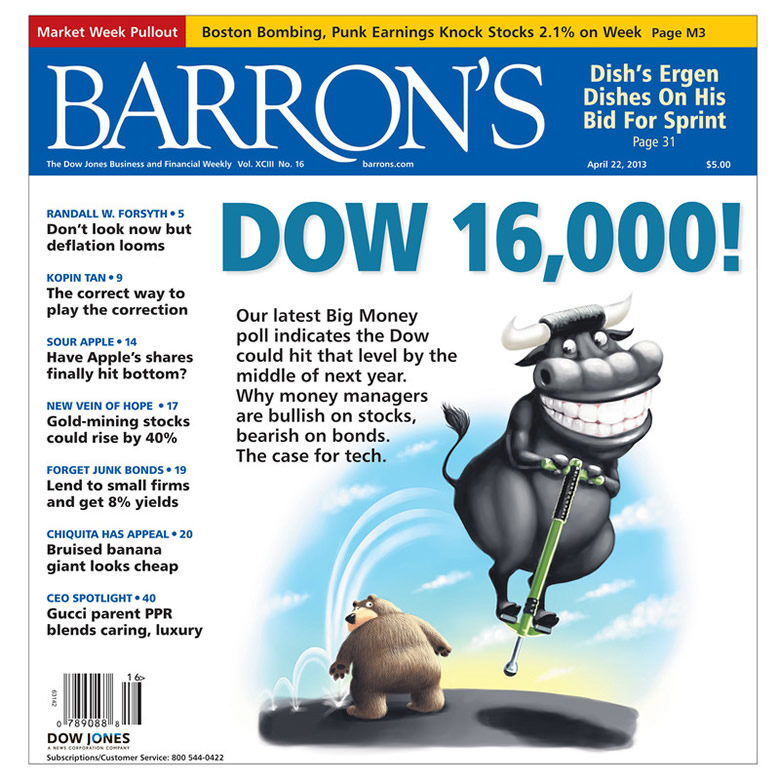

Barron's magazine says the Dow is going to 16,000, illustrated with a picture of a bull on a pogo stick.

Prime Minister Abe says he'll revive the Japanese economy by printing yen to buy Japanese bonds. And speculators take each hint from the Fed as though it were a whisper from God Himself.

And all around them, the real economy struggles to stay even. Here's David Rosenberg of Gluskin Sheff with 12 signs that the economy is weaker than we think:

- Household employment (-206,000 in March, the steepest decline in well over a year).

- Real retail sales (-0.3% in March, down for the second time in three months).

- Manufacturing production (-0.1% and also down in two of the past three months).

- Core capex orders (-3.2% in February and, again, down in two of the past three months).

- Single-family housing starts (-4.8% in March and negative for two of the past three months, as well).

- New home sales (-4.6% in February).

- Philly Fed for April down to 1.3 from 2 .

- NY Fed Empire manufacturing index down to 3.05 from 9.24.

- NAHB Housing Market I ndex down to a six-month low of 42 in April from 44.

- Conference Board C onsumer C onfidence I ndex down to 59.7 in March from 68.

- University of Michigan consumer sentiment down to 72.3 for April from 78.6, the lowest in over a year.

- Conference Board leading indicators down 0.1% in March, first decline in seven months.

Markets Make Opinions

Facts, figures, statistics...

Do you believe them, dear reader? We don't. We're just giving the dreamers a little taste of their own medicine.

"Markets make the opinions," say the old timers. When prices are up, people share the opinion that they are going up. When prices go down, opinions change with falling prices.

And when prices rise, the opinion mongers look for reasons to explain why they have become so bullish. They find indexes, statistics, numbers – all the "facts" confirm their opinion. When prices fall, their opinions grow dark and they need to find new facts that they can use to justify a counter view.

Get a feeling. Form an opinion. Find a fact and pretend that you are a rational, reasonable investor. That's the name of the game.

But are we any different?

Not at all. We're just crankier. More cynical. And less impressed by authority in all its forms. Besides, we've been living in Argentina.

If a Nobel Prize-winning economist tells us that the economy is improving, what do we really know? We know he can talk!

If the president tells us that he and his friends are making the world a better place, what do we do? We laugh!

If a leading financial magazine tells us that the "Big Money" firmly believes the Dow is headed higher, what do we do?

We seriously consider selling!

From bearish fund manager John Hussman: "Rule o' Thumb: When the cover of a major financial magazine features a cartoon of a bull leaping through the air on a pogo stick, it's probably about time to cash in the chips."

Bill Bonner

Bill Bonner is a New York Times bestselling author and founder of Agora, one of the largest independent financial publishers in the world. If you would like to read more of Bill’s essays, sign-up for his free daily e-letter at Bill Bonner’s Diary of a Rogue Economist.

© 2013 Copyright The Daily Reckoning, Bill Bonner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Bill Bonner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.