Bitcoin Hyperinflation?, An Interview with Jesus

Currencies / Bitcoin Apr 29, 2013 - 04:21 PM GMTBy: Mike_Shedlock

Of all the topics that readers have pleaded me to write about for months but I never did until now, "bitcoins" are at the top of the list.

Of all the topics that readers have pleaded me to write about for months but I never did until now, "bitcoins" are at the top of the list.

In private emails, I stated on many occasions "bitcoins are a scam". I now take that back, "scam" is not the correct word. Others whose opinions I highly respect, state the same thing.

For example, Geoff Turk at GoldMoney stated in an email response:

"I have spent quite a bit of time researching Bitcoins and have not found anything scam-like about them. Price volatility is another matter, and that is a result of an increasing demand for a relatively scarce resource. There may be individuals attempting to manipulate the price in some way, which we know is possible in any small (or even not-so-small) market. However, in my opinion the Bitcoin protocol itself is quite sound, and it creates an interesting hybrid of a commodity without corporeal existence that is nonetheless limited in supply."

That was not an endorsement of bitcoin, rather it was a statement that my labeling of bitcoin as a scam was incorrect. I agree, with apologies offered to bitcoin.

OK But What Is Bitcoin

If bitcoin isn't a scam, then what is it? I have struggled with that question, which explains why I never have written about it.

Wikipedia offers a history and description of bitcoin that is rather fascinating.

Who Accepts Bitcoins?

For months I would search for companies accepting bitcoins as payment and found scant offerings. The same could be said for gold.

Yet, the total value of gold at a price of $1,600/oz would be something like $7.9 trillion. The total value of bitcoins is extremely volatile, fluctuating around $1 billion. Simply put, there is no comparison in terms of total price or volatility.

The record 9 percent drop in the price of gold was matched by a 70% plunge in the price of bitcoins in a similar timeframe.

Bitcoin Store

A few weeks ago I decided to do another search for businesses that accepted bitcoins. I was surprised to discover that a new entity, the Bitcoin Store, offers 500,000 electronic products for sale, accepting only bitcoins a payment. The products include high-end digital cameras.

I decided to call the store up and ask a few questions. My timing was fortuitous. The owner of the Bitcoin Store, Roger Ver, answered the phone.

This was unusual since Ver lives in Japan and he just happened to be back in California, and he is the one who answered the phone.

After some small talk and he told me that he was known as "Bitcoin Jesus". I told him who I was and that I had some questions about bitcoins. He recognized my name from Coast-to-Coast AM radio where he tunes in as a subscriber from Japan.

The interview that follows is via a subsequent chain of emails.

"Bitcoin Jesus" Interview

Mish: How did you get started in Bitcoin?

BJ: I heard about them on freetalklive in late 2010.

Mish: When did you start your business?

BJ: I founded MemoryDealers in 1999 and started building BitcoinStore in 2012. BitcoinStore launched March 1st 2013.

Mish: What is your volume in business, assuming a value on bitcoins of $100.

BJ: So far this month we have averaged 115 BTC per day. $11,500 per day, $350,000 per month.

We disabled international orders on the site because we were getting so many orders that we couldn't process them all each day.

Mish: How many products do you sell?

BJ: More than 500,000 line items currently. In the near future we will add additional distributors, bringing our line card to over 1,000,000 items.

Mish: How many employees did you have when you started? How many do you have now?

BJ: Bitcoin store started with one, now there are seven. I need to hire at least two more ASAP.

Mish: Are your employees paid in bitcoins or US$?

BJ: US employees are paid in USD because the tax laws are not clear. Most of them would prefer to be paid in BTC. The international contractors are paid %100 in BTC. I don't know for sure what they do with them, but I suspect they keep them in BTC.

Mish: Who is your merchandise supplier?

BJ: Ingram Micro. They are the world's largest.

Mish: Do you pay them in bitcoins or $US?

BJ: I pay them in USD, but I hope to get them to accept at least partial payment in Bitcoin in the future.

Mish: Are all of your profits kept in bitcoins? What about expenses before profits? Describe your bitcoin currency risk.

BJ: All of BitcoinStore's sales are kept in Bitcoin. Expenses are paid via Bitcoin or USD depending on the vendor. I want to be exposed to as much Bitcoin currency risk as possible. I hold on to as many Bitcoins as I can.

Mish: What happens to you and your business if the value of bitcoins plunges to $10?

BJ: Personally I would lose a lot of money on the value of my Bitcoins, but it wouldn't affect the business model of BitcoinStore at any time. If needed, the bitcoin payment processor, Bitpay, can instantly convert the Bitcoins to USD at the time of each sale, so a guaranteed USD profit can be achieved on each sale.

Mish: Why did you move to Japan?

BJ: I moved to Japan following an unwarranted conviction for selling firecrackers. I wrote up some of the details in a Daily Anarchist article Bitcoin Venture Capitalist Roger Ver's Journey to Anarchism.

Mish note: Please read the article. It's fascinating. Ver is a libertarian student of Ludwig von Mises, Adam Smith, Fredric Bastiat, Leonard Reed, Henry Hazlitt, Friedrich Hayek, and especially Murray Rothbard.

Mish: Please explain how you got the name "Bitcoin Jesus".

BJ: Not only am I a true believer in the model, I have converted numerous skeptics who are now true believers as well. Everywhere I go, I tell everyone about bitcoin, from taxi drivers, to restaurant workers, to girls at night clubs. It doesn't matter when or where, I'm so excited about Bitcoin that I feel the need to tell everyone about it. Someone along the way said you are like a "Bitcoin Jesus" and the nickname kind of stuck.

I also give out $1 worth of Bitcoins to everyone I meet who doesn't already have any.

I just did an interview on Fox News on April 12 and I gave the sound guy at the studio his first $1 worth of Bitcoin after he installed the Blockchain App on his iPhone.

Mish: Anything else you wish to add?

BJ: Yes thanks. It is important to realize that Bitcoin has two independent functions:

1. As a currency 2. As a payment system

To use Bitcoin as a payment system, it doesn't matter if they are worth $1 or $100,000 each. You simply buy the correct USD amount, and send it to the recipient who immediately exchanges them back into whatever other currency they want.

I don't think Bitcoin's usefulness as an unblockable, uncontrollable, potentially anonymous payment system can be disputed. Time will tell how useful the bitcoins within the Bitcoin payment system become as an actual currency.

I'm sure all your readers will enjoy the article. Thank you for letting me contribute.

Mish: Thanks Roger. Good luck to you and Bitcoin Store.

Not A Convert

I am neither a convert nor a true believer. I will stick to gold thank-you. I see things similarly to Ron Paul who said in a Bloomberg Interview "If I can't put it in my pocket, I have some reservations about that."

Link if video does not play: Ron Paul on Gold: No One Knows Value; I'm Buying.

Bitcoin is a Game

My friend Hugo Salinas Price had some pertinent thoughts regarding bitcoins on April 10 in his piece Of bubbles and Bitcoins

The newest invention in monetary affairs are the so-called Bitcoins. Their creators and promoters explain them as follows: 'Bitcoins are digital money. They are transferred person to person through Internet without going a bank or a clearing house, so they are independent of the current monetary system. Several currency exchanges exists where you can trade your Bitcoins for dollars or euros, and some small business and freelancers are starting to accept them in payment'.

The Bitcoin is a game. We live in a highly confused and perplexed world regarding what real money has to be. Let's get this straight: real money has to be the commodity that is generally accepted by society as payment in full for goods or services received.

Throughout history, the commodity most generally accepted in payment has been gold. Silver has taken the second place after gold. Gold and silver were chosen by humanity thousands of years ago, as the commodities with which to make payments.

The Bitcoin is an example of the tremendous hold that the idea of the omnipotence of technology to solve human problems has upon humanity. However, technology cannot create matter; it cannot create commodity-money, as it cannot create petroleum. Technology may give various forms to matter, but it cannot create matter or substance, and money must be the substance that is most accepted in commerce. All the Ph.D.s and Nobels in Economics are playing games to keep the world entertained. The less their pronouncements make sense, the wiser they think we will consider them.

You tell me: What is the future that awaits a humanity so confused that it can no longer distinguish between an abstract concept and what is real and material? Very confused people are participating in speculations in imitation currencies - dollars, pounds, euros, yen, yuans, Bitcoins - in the hopes of obtaining some profit or benefit, because unable to think for themselves, they can do nothing but speculate - and ruin themselves.

Understanding the Game

Even though I am not a bitcoin convert, it's easy to understand why people gravitate towards them.

Yes, people like games and speculation, but they are also fed up with unlimited monetary expansion of Central Banks, especially the Fed and the Bank of Japan.

Bitcoins may also play a role in capital flight. How so? Consider Cyprus or China (See Wall Street Journal February 28, 2013 China Forex Regulator: More Easing of Capital Controls Needed).

Purchase bitcoins, leave the country, convert the bitcoins to a currency of your liking, and voilà!

Yet, should that happen or even be suspected, how long will it take before there is a government crackdown on bitcoin? Should such a thing happen, the value of bitcoin can plunge to next to nothing if confidence is lost.

Bitcoin Hyperinflation?

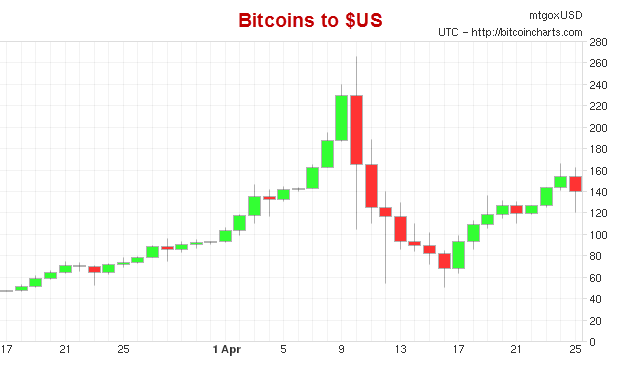

In its initial days bitcoin hovered near six cents (click on link to see).

It's quite amazing to me that it soared to over $260 at one point. Is it so inconceivable that the value of bitcoin would plunge back to 6 cents?

Perhaps, but what about $1 or $5. A drop from $260 to $5 would wipe out 98% of the value. Should that happen, in a short time frame, what else would you call it but hyperinflation? Curiously such a plunge would not be associated with printing.

Bitcoin Jesus would say that is unlikely, but is it?

I do not know, but I do know history. And when given a choice, the free market has always decided on gold and silver as money, when available.

In my Presentation at the Wine Country Conference, I stated "I cast my vote with history". I still do. Yet, I offer encouragement to those like Roger Ver willing to "fight the Fed" in a literal sense.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2013 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.