Gold - 15 Days in April

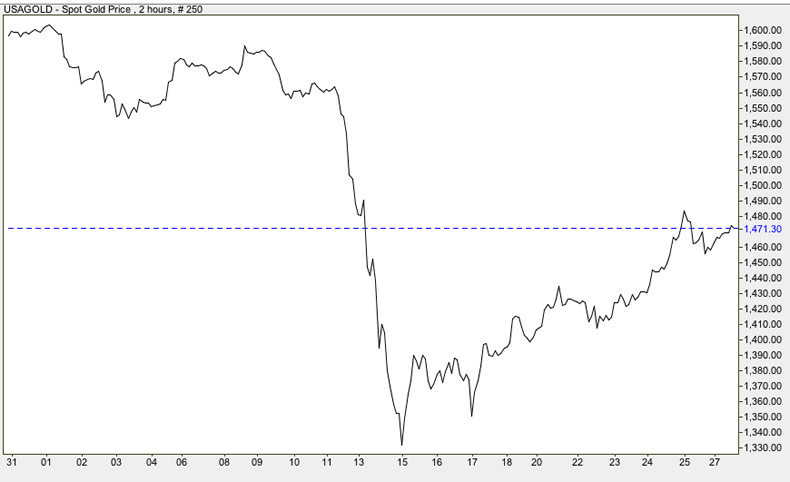

Commodities / Gold and Silver 2013 May 01, 2013 - 04:28 AM GMTEditor's note: Assembled below are fifteen of the best insights and observations on one of the strangest and confusing fifteen day periods in the history of the gold market -- a flash crash, a global rush to purchase and a healthy bounce.

1. Peter Grant/USAGOLD (as quoted at Kitco News): "The price discovery occurs in the paper market. The paper market drove the price down for physical. And there had been a large amount of pent-up demand that just absolutely came out of the woodwork. We were as busy last week and into this week as we've been since the financial crisis of 2008-09. It was absolutely unbelievable demand for physical. Physical buyers are not speculators," he continued. "Our clients are primarily concerned with wealth preservation, portfolio diversification, hedging and so forth. They are not speculators. When the paper market provides a gift (of lower prices), and it was an unnerving gift to be sure…the physical buyers do indeed tend to come out in force to underpin the market."

2. Chris Hart/Johannesburg Sunday Times: "Of major interest is the state of the physical market. Over the past six months, gold has been subjected to relentless selling and has frequently been 'bombed' -- where a large number of contracts are dumped on the New York Commodities Exchange (Comex) over a very short period. On April 12 the market was bombed with more than 500 tons of gold in a manner that caused great downward price pressure and panicked the market into selling. . . The drop in Comex inventories [See Egon von Greyerz below], U.S. gold trade data and Hong Kong trade data suggest the mobilisation of physical gold has resulted in a large transfer from western to eastern vaults.

3. Egon von Greyerz/Matterhorn Asset Management, Switzerland, KingWorldNews: "Coming back to what is happening in the gold market, it's extraordinary. The attack on the gold price through the paper market has totally backfired and failed. The $300 drop that we saw, in a few days, has already retraced 50%. That's nothing compared to what will happen.

The attack in the paper market was always doomed to fail in the light of unprecedented demand and major shortages in the physical market. If you look at the Shanghai gold exchange, deliveries from January are 1,030 tons. That (1,030 tons) is against world gold production for the same period (since the beginning of 2013) of only 934 tons. That is absolutely astonishing volumes (of physical gold demand) you are talking about in China.

If you look at JP Morgan, their eligible gold, which is the stock they can deliver, has been down 65% just in the last couple of days. And COMEX, their stock is also down to about half of what it was over a year ago. Premiums now in Singapore are up $3 per ounce. If we now look at the Swiss refiners, remember Swiss refiners refine 70% of the world's gold, the Swiss refiners are increasing premiums substantially."

4. Josh Noble/Financial Times: "Asia is witnessing one of the strongest waves of physical gold buying in 30 years, with bargain hunters using the drop in prices to secure jewellery and gold bars. The feverish buying has left many of Hong Kong's banks, jewellers and even its gold exchange without enough yellow metal to meet demand. In Shanghai, the gold exchange saw volumes – often seen as a proxy for demand – rising to a record on Monday, while queues formed outside some jewellery shops in Beijing."

5. Marc Faber/Gloom, Boom & Doom Report: "I love the markets. I love the fact that gold is finally breaking down. That will offer an excellent buying opportunity. I would just like to make one comment. At the moment, a lot of people are knocking gold down. But if we look at the records, we are now down 21% from the September 2011 high. Apple is down 39% from last year's high. At the same time, the S&P is at about not even up 1% from the peak in October 2007. Over the same period of time, even after today's correction gold is up 100%. The S&P 500 (.INX) is up 2% over the March 2000 high. Gold is up 442%. So I am happy we have a sell-off that will lead to a major low. It could be at $1400, it could be today at $1300, but I think that the bull market in gold is not completed."

Editor's Note: Faber's comment were among the earliest in this gold market episode....and the most prescient.

6. Doug Ehrman/The Motley Fool: "Earlier this month, the price of gold collapsed by roughly $200 in two days. The decline included the worst single-day dollar drop ever and the worst percentage drop since 1980. The skid prompted near jubilation for those who have been waiting for the exterminator to hit the gold bugs for the last 12 years. The reversal in gold prices we have seen since are letting those same gold bugs fire back with a vengeance. The apparent shift from paper gold (including longer-term futures and gold ETFs) to physical gold (including bullion and spot contracts) has several possible explanations. The head of commodities research at UBS AG's wealth management division, Dominic Schneider, said: "Some of the central banks might take this drop as an opportunity to buy as some physical players did."

7. Swansy Alfonso/Bloomberg: "Gold consumers in India, the world's biggest importer, thronged jewelry stores across the country for a second week on speculation that bullion may extend a rally after the biggest plunge in three decades. "We waited for sometime to see if prices will fall more but when we saw them moving up again, we decided it's time," said Sripal Jain, a 77-year-old silver dealer who came with his younger brother, daughter and daughter-in-law to buy gold necklaces at Mumbai's Zaveri Bazaar. "We don't have any wedding or occasion coming up. The rates fell, so we decided to buy.". . . Bullion slumped 14 percent in two days, reaching the lowest price in two years on April 16, triggering a frenzy among coin and jewelry buyers from the U.S. to India, China and Australia. The surge in demand has helped prices rally 12 percent since April 16, and jewelers in India are paying premiums of as much as $10 an ounce to secure supplies, according to the Bombay Bullion Association."

8. USAGOLD's Daily Market Report (April 17, 2013) Lower prices almost always generate both greater demand and ultimately shrinking supply, the one truism of free markets that needs to be remembered at times like these. The free market, as long as it breathes, has a way of taking care of itself. At the core, those who believe in the long-term value and viability of the metal see dips as opportunities. Early on, the big dump in gold lit up demand starting with the United States and Europe on Friday and carrying over to the Far East and Middle East on Monday....

[Citigroup's chief technical analyst] Tom Fitzpatrick makes an important observation. In this new era for gold, institutional paper selling begets institutional, sovereign wealth fund, and central bank buying. That was not the case in the beginning years of this bull market. The days of uncontested short positioning in the gold market are over and that perhaps explains why in recent years sharp corrections have been followed by quick recoveries. The best strategy for the small private investor is to quietly accumulate and watch the big players battle it out.

Editor's note: If you want to take the pulse of the gold market on any given day, we invite you to visit our Daily Market Report. It's worth a bookmark........By the way Fitzpatrick believes gold is headed for $3400 per ounce.

9. Sophie Song/International Business Times: "With Asian gold supplies depleted because the recent drop in prices spurred massive demand, the Chinese Gold & Silver Exchange Society is rush-ordering four times its usual amount of gold bars from Switzerland and London to meet the increased demand.....'In every corner of Hong Kong, local residents and tourists from mainland China alike are buying up anything gold,' Huang Feichang, president and CEO of Luk Fook Jewelry, said. "I have never seen anything like this in my 30 years in the business.'"

10. Keith Barron/Gold mining company consultant, KingWorldNews: "I was just asked by one of the major brokerage houses in Toronto to give a presentation on what has taken place in the gold market. Many people inside the firm simply could not understand what happened with gold. I told them what we had just witnessed was an orchestrated takedown. If the Dow, Nasdaq, or the S&P had tumbled in the same manner as what the gold market experienced, there would have been trading curbs, enquiries would have been made, etc. In contrast, all we saw in the gold futures market were more and more margin calls. But what is cleaning up this mess right now is the enormous physical demand."

11. Jonathan Barratt/Barratts Bulletin, Sydney: "One of the interesting things we've seen is the dramatic pick-up in physical purchases and it has been astronomical. People want to hold physical gold at this level and that's not just in India. In Australia, we had a queue outside one of our bullion houses about half-a-kilometer long and I haven't seen something like that for years."

12. Eric Sprott/Sprott Asset Management, KingWorldNews: "If it was the central planners that knocked it down, man did they lose that game because it just ignited the interest in (physical) gold and silver. I just think we are going to be many times higher than we are today. It's going to be a long-run, we are going to have this bull market go on for another 5 to 7 years."

13. Svea Herbst-Bayliss/Reuters: "Billionaire investor John Paulson told investors on Wednesday (4/24/13) he is staying the course on gold even though there may be more short-term volatility in the price of the metal. The New York-based hedge fund manager has long stuck by his thesis that gold will someday be a powerful hedge against inflation, and it was no different on the investor call he held, two people who listened to the call said. John Reade, a partner at Paulson & Co, said that the firm, which oversees about $18 billion, is not veering off its course even as he cautioned that there could be more price fluctuations in the short term."

Editor's Note: In that same telephone update, Paulson told investors that he owns the bulk of the assets in his $3 billion gold fund making "any sort of investor run on the fund unlikely."

14. James Sinclair/JS Mineset, King World News: "Take into consideration that the recent and violent drop in the gold price, especially if followed by an equally violent recovery, was primarily for the transfer of physical gold from financial and other entities to the families that are running the Western governments and financial world. In my opinion that's exactly what has just happened. A very strong and immediate recovery, that is sustained, makes the message clear that gold is an ingredient for these wealthy families to maintain their wealth and power, not simply over a generation, but over multiple generations."

15. Alisdair Macleod, GoldMoney: "This will likely develop into another financial crisis at the worst possible moment, when central banks are already being forced to flood markets with paper currency to keep interest rates down, banks solvent, and to finance governments' day-to-day spending. Its importance is that it threatens more than any other of the various crises to destabilize confidence in government-backed currencies, bringing an early end to all attempts to manage the others systemic problems. History might judge April 2013 as the month when through precipitate action in bullion markets Western central banks and the banking community finally began to lose control over all financial markets."

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael Kosares has over 30 years experience in the gold business, and is the author of The ABCs of Gold Investing: How to Protect and Build Your Wealth with Gold, and numerous magazine and internet articles and essays. He is frequently interviewed in the financial press and is well-known for his on-going commentary on the gold market and its economic, political and financial underpinnings.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.