Platinum and Palladium: A Fundamental Shift

Commodities / Platinum May 24, 2013 - 08:10 AM GMTBy: Jeff_Clark

Platinum is a precious metal, as is palladium, though to a lesser degree. However, like silver, both are also industrial metals. Unlike silver, it's their industrial use that is the primary price driver for both platinum and palladium – and that use is undergoing a fundamental shift.

Platinum is a precious metal, as is palladium, though to a lesser degree. However, like silver, both are also industrial metals. Unlike silver, it's their industrial use that is the primary price driver for both platinum and palladium – and that use is undergoing a fundamental shift.

The largest source of demand for platinum and palladium is the automotive industry, for use in autocatalysts. In turn, the fortunes of the auto industry are sensitive to the health of the world's major economies. We've been bearish on platinum-group metals for years, primarily because we weren't convinced a healthy – much less roaring – world economy could be sustained when so many governments continue spending beyond their means.

We reconsidered the market last year, when strikes in South Africa – home to 75% of global platinum production and 95% of known reserves – threatened supplies. But as we wrote last December, the strikes ended without great impact on long-term supply.

Since then, however, the fundamentals of this market have changed. Others may disagree with our economic outlook, which is still bearish, but it's due to supply issues – not demand – that our interest is now drawn to these metals, and particularly to palladium.

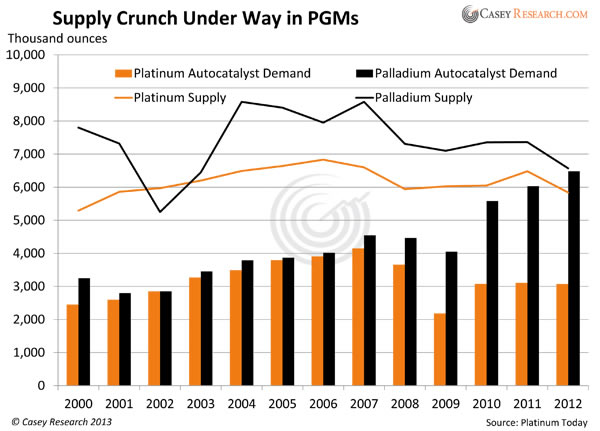

Here's a look at global supply against auto-industry demand for both metals.

Approximately 55% of platinum and the bulk of palladium supply was used in catalytic systems last year. The shrinking supply that's under way with both metals is obvious, and palladium is approaching a supply/demand crunch.

Here's what's going on…

Platinum

The fall in platinum supply has been so great that it moved from a surplus in 2011 to a deficit in 2012, with Johnson Matthey estimating that deficit to hit 400,000 ounces, the highest level since 2003.

Why the shift?

- Labor strife and power outages. The mining industry in South Africa is, frankly, a mess. Labor strikes continue to haunt the platinum mining companies. The largest mining union in South Africa, AMCU, recently refused to sign a collective bargaining agreement on worker compensation, and CNBC is predicting a massive strike. Amplats, the world's largest platinum producer, is threatening to cut 14,000 jobs and mothball two operating mines due to various issues. Meanwhile, power outages, a longstanding problem, continue unresolved; they have already forced the closure of some mines and are widely expected to cause further cuts in production. As a result, supply from mining is expected to decline another 10% this year.

- Recycling. This important source of supply is falling in reaction to lower metals prices. It is estimated that recycling fell by 11% in 2012.

- Emission systems. Demand for platinum in autocatalysts dropped by 1% in 2012, mostly due to lower vehicle production in Europe and lower market share of diesel engines. However, emission-system demand from Japan and India is expected to increase, and diesel-emission controls recently introduced in Beijing will also support industrial demand for both metals. Auto sales in China rose a whopping 19.5% in the first two months of the year and are 6.5% higher in the US than a year ago.

- Jewelry. Worldwide demand for platinum jewelry rose last year, with strong demand coming from China and growth in India, and is mainly the consequence of lower prices. Jewelry accounts for 30% of total platinum demand.

- Investment. Although it represents just 6% of total demand for the metal, investor demand nonetheless grew 6.5% last year, adding to pressure on supplies.

Given these factors – primarily the first one – a supply deficit stretching into 2014 seems almost certain. Until South Africa can resolve its labor and power issues, pressure on platinum supply will remain, producing a favorable environment for rising prices.

Palladium

Palladium, platinum's "little brother," also faces a market imbalance. In 2012, the deficit totaled 915,000 ounces, the highest level since 2001.

- Supply. Russia is the second-largest producer of palladium, and some analysts report that rumors of its stockpile being close to depletion are true. Recycling is also falling, and production disruptions in South Africa – the largest producer of palladium – are the same as outlined for platinum. Overall supply of the metal is falling.

- Demand. Autocatalytic demand rose by 7% in 2012, as palladium can be easily substituted for platinum in emission-control systems for gas-powered motors (but not diesel-powered ones), such as are favored in China and India. In fact, several experts we consulted were more bullish on palladium than platinum due to this "substitution factor" – and China just mandated catalytic systems for all cars in the country.

Palladium investment demand was positive last year, though palladium jewelry has yet to gain traction in China, one of the world's biggest jewelry markets. Total jewelry demand for palladium was 11% lower in 2012. However, we expect a greater shift to palladium in the expanding Asian automotive market, which in turn will boost palladium prices.

The fundamental drivers of the palladium market are similar to those for platinum, which makes the palladium market an equally attractive investment.

If this all weren't bad enough, most companies' production costs are now above current platinum and palladium prices. This can only be solved one way: higher metals prices.

Bottom Line

The supply disruptions in South Africa combined with secondary factors have led to deficits in both metals that won't be erased overnight. Such imbalances, together with mainstream expectations of global economic growth, create a favorable environment for PGM price appreciation.

This much seems like a safe bet. There is, however, a great deal of speculative upside in the not-inconceivable case of South Africa going off the rails in a major way. Massive – not marginal – supply disruptions in the world's main source of both metals would send their prices through the roof. You get this speculative potential "for free" when you bet on the more conservative projections that call for rising prices regardless.

While we wait for our gold positions to rebound, an investment in platinum and palladium could be very profitable. How to invest? You can learn which company is our #1 pick for this space with a risk-free trial subscription to BIG GOLD.

Note: our longer-term outlook remains in place: most G7 economies are not fundamentally sound and continue to print money. Gold is still our priority asset class, so we don't recommend that investors replace their gold holdings with platinum and palladium investment vehicles. This PGM trend is simply an addition to and diversification of our current investment strategy.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.