How to Find Great Value In The Energy Stocks Sector

Companies / Oil Companies Jun 21, 2013 - 10:41 AM GMT This will be the second in a series of articles designed to find value in today’s stock market environment. However, it will be the first of 10 articles covering the 10 major general sectors. In my first article (found here), I laid the foundation that represents the two primary underlying ideas supporting the need to publish such a treatise. First and foremost, that it is not a stock market; rather it is a market of stocks. Second, that regardless of the level of the general market, there will always be overvalued, undervalued and fairly valued individual stocks to be found.

This will be the second in a series of articles designed to find value in today’s stock market environment. However, it will be the first of 10 articles covering the 10 major general sectors. In my first article (found here), I laid the foundation that represents the two primary underlying ideas supporting the need to publish such a treatise. First and foremost, that it is not a stock market; rather it is a market of stocks. Second, that regardless of the level of the general market, there will always be overvalued, undervalued and fairly valued individual stocks to be found.

Additionally, my focus in this and all subsequent articles will be on identifying fairly valued dividend growth stocks within each of the 10 general sectors that can be utilized to fund and support retirement portfolios. Therefore, when I am finished, the individual investor interested in designing their own retirement portfolio should find an ample number of selections to properly diversify a dividend growth portfolio with.

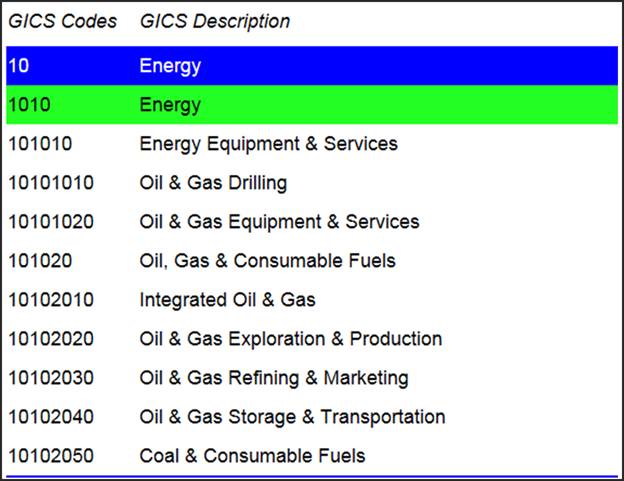

With the above second notion in mind, this article will look for undervalued and fairly valued individual companies within the general sector 10 - Energy. Within this general sector, there are several subsectors which I list as follows:

My Selection Methodology

Before I go any further, an important disclosure is in order. I will produce a list of companies in this article (and all subsequent articles), that are names that I have hand-selected from a much larger universe. My selections were made by reviewing the individual earnings and price correlated F.A.S.T. Graphs™ on all appropriate companies that I identified within the sector. Some might say my method of identifying them was not very scientific, but I would counter that it was very thorough and comprehensive. On the other hand, I will admit to it being somewhat arbitrary and based on my own judgments.

Here is the basic method that I utilized. In order to find undervalued or fairly valued companies within the Energy Sector, I utilized the assistance of the F.A.S.T. Graphs™ screening tool in the following manner. First, I asked the screener to only look for companies within the sector 10-Energy. Then I asked to search for any company within the sector that had a current dividend yield of 2% or better. The only reason I chose a dividend yield of 2% or better is because it is above the current dividend yield of the S&P 500. Finally, I included ADRs and all companies listed on the Canadian stock exchanges.

This produced a gross list of 219 individual companies. Then I created a personal portfolio comprised of these 219 individual companies and sorted them in alphabetical order. Next, I reviewed the individual graphs of each company and either rejected it or added it to my final list of potential candidates based on whether or not I felt it had an adequate history and a reasonable level of consistency within that history. But most importantly, I looked for companies that I felt were reasonably valued, or close to it today, based on current earnings and expected future earnings growth. Then I broke my refined list into two categories:

1. Conservative Growth and Income - 14 companies made this list.

2. Aggressive Growth and Income - 40 companies made this list

Before I present each of these lists, and my featured selection from each, it’s important that the reader understands that these are prescreened lists of potential candidates prior to the necessary more comprehensive research effort. In other words, I am not recommending any of these stocks for current investment. Instead, I am recommending them as companies with good historical records that appear reasonably valued, and therefore, worthy of investing the time and effort to take a closer look at.

The Energy Sector: General Characteristics and Considerations

As I reviewed all the individual selections from my screened list of the Energy Sector, several attributes became readily apparent to me. First of all, a majority of companies in the Energy Sector seem to be very sensitive to recessions. More plainly stated, earnings tend to fall when recessions hit, and stock prices tend to follow. On the other hand, there is a tendency to see earnings grow rather dramatically after recessions end. This creates a certain degree of cyclicality, but not as much as a true deep cyclical.

Furthermore, I feel it goes without saying that the Energy Sector is actually quite diverse. What I’m alluding to here is that many energy companies have their prospects tied directly to the underlying prices of the commodities that they operate in. Of course, I am referring to oil, gas and coal as the primary commodities. On the other hand, there are companies in the Energy Sector whose prospects are not directly tied to underlying commodities prices. These would include pure transportation and storage companies. What this means is that a portfolio can actually hold more than one energy company and still be arguably diversified, rather than overweight energy.

Additional diversity characteristics of companies in the Energy Sector relate to the various business configurations and capital structures of many publicly-traded energy concerns. Of course, we have the traditional C Corp, which includes well-known majors such as Chevron, Exxon and BP, etc. These typically corporate structured energy companies operate and look like most every other publicly-traded company. However, the Energy Sector also is privileged, thanks to the Tax Reform Act of 1986 and the Revenue Act of 1987. These reforms allowed companies dealing with natural resources liquidity, tax benefits and unique structures, the most common of which is the MLP (Master Limited Partnership). Although there are tax considerations with including MLPs into qualified retirement accounts, they are not precluded. Royalty Trusts are an additional corporate structure that can be found within the Energy Sector.

Regarding capital structures, there are other important characteristics that require special attention and consideration. Traditional C Corps, display a tendency to reward shareholders consistent with other similarly-structured companies in other industries. In addition to raising their dividends regularly, the traditional publicly-traded energy company will often buy back, and therefore, reduce share count, as a method of increasing earnings. In contrast, MLPs display a tendency to be continuously issuing new shares to fund additional infrastructure, thereby raising share count. Royalty Trusts typically have a fixed number of trust units. Also, earnings tend to be of high importance to C Corps, while FFO (Funds From Operations), a close cousin the operating cash flow, are more relevant to MLPs.

As a result of the above, I have included mostly traditional C Corps in my conservative growth and income selections, and MLPs and Royalty Trusts make up most of the aggressive growth and income selections. These distinctions are predicated on risk considerations, as well as growth considerations. Royalty Trusts and MLPs tend to have high yields, and moderate prospects for growth. However, since there are exceptions to every rule, there are many MLPs that offer above-normal dividend yields and above-average capital appreciation and dividend growth.

Perspectives on Valuation

My research into the Energy Sector also revealed that ascertaining the fair market value of most energy companies is different than calculating the intrinsic values on most traditional companies. Over the past decade at least, it is readily apparent that Mr. Market has tended to apply a discounted fair market value to energy concerns instead of traditional intrinsic value assessments. To put this more plainly, for the past 10 years or so, the market has valued energy companies lower than it values companies in other sectors with the same or similar fundamentals.

One could hypothesize many reasons why this reduced valuation might be the case; however, to my way of thinking, it’s more important to know that this is a reality, than it is to know why it is. But perhaps it has to do with all the uncertainty associated with energy supplies, which include the risk of discovery, drilling, politics, environmental issues, etc. But regardless of why, it’s critical that the investor recognizes that energy companies are valued lower than other equivalent companies in different industries, thereby avoiding the mistake of overpaying when valuations on energy companies exceed historical norms, even when they are consistent with valuations on traditional companies in other sectors.

Conservative Growth and Dividend Income

As I previously mentioned, the majority of the companies I placed in the conservative growth and dividend income list are comprised of traditional C Corporations. Many of the most widely-recognized major oil companies made this list. If you don’t see one of your favorites on the list, it more than likely means that I currently consider it overvalued, and therefore, excluded. The following lists the companies that all appear reasonably priced based on historical norms, and I would consider all of these companies to be high-quality stocks. However, this does not mean that I am recommending each of these companies for purchase. Instead, I offer this list as a fertile field of potential candidates for those desirous of adding an energy dividend growth selection to their portfolios.

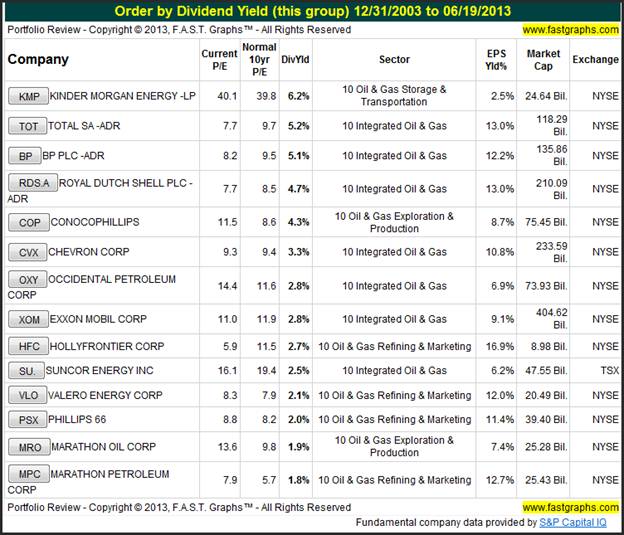

One key characteristic of fair value that I tend to follow is an earnings yield of at least 6% to 7% or greater. Every company on this list meets or exceeds that bogey. However, the astute reader might notice that Kinder Morgan (KMP) is only listed with an earnings yield of 2.5%. Remember, and as I stated earlier, Kinder Morgan is an MLP, and as such, is valued based on FFO rather than earnings. Consequently, since my table was automatically generated based on earnings, the FFO distinction was lost. Therefore, I submit that the FFO yield on Kinder Morgan is 13.7%, almost double my minimum.

Furthermore, since the focus of this series of articles is on fairly valued or undervalued dividend growth stocks, I have generated my table in order of highest dividend yield to lowest. Moreover, there is one Canadian selection, Suncor Energy Inc (SU.), on the list, and a couple of ADRs, Total SA (TOT) and Royal Dutch Shell (RDS.A), with the remainder comprised of US companies listed on the New York Stock Exchange.

Chevron Corp - My Featured Conservative Growth and Income Selection

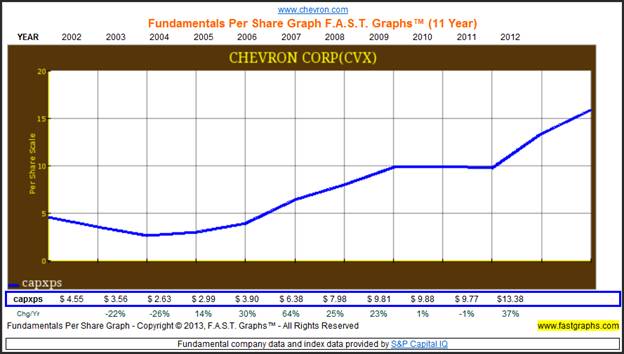

Chevron Corp (CVX) is among the world’s leading integrated energy companies. According to the Value Line Investment Survey, they are the world’s fourth-largest oil company based on proven reserves. Although Chevron has many opportunities to add to their reserves over time, recent operating results have been restrained as a result of weakness in oil prices and an increase in capital expenditures as the company moves more into oil exploration. The following F.A.S.T. Graphs™ plots Chevron Corp’s capital expenditures per share since 2002. Although this put a damper on recent earnings growth, I believe the long-term opportunity for future growth is enhanced by these actions.

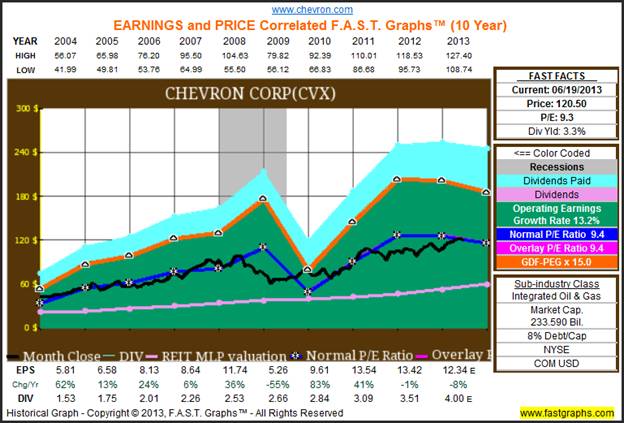

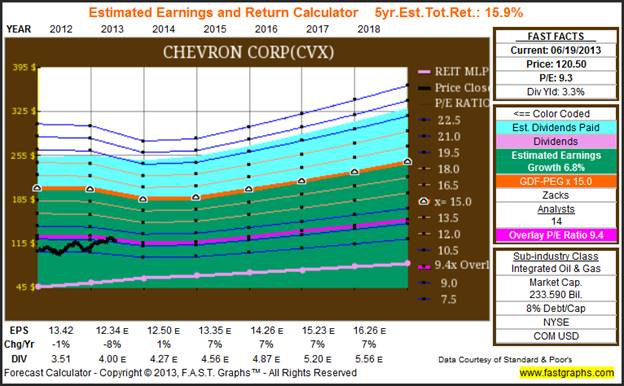

The following earnings and price correlated F.A.S.T. Graphs™ on Chevron Corp clearly reveals the discounted valuation to it shares that I discussed above. The orange line on the graph represents a fair value P/E ratio of 15, which I consider the company’s true intrinsic value. The dark blue line on the graph represents the normal P/E ratio of 9.4. Clearly, this discounted valuation of 9.4 times earnings has been the norm for this blue-chip energy company since 2004. Consequently, Chevron Corp’s shares appear to be fairly valued based on historical norms, and highly undervalued based on intrinsic value calculations.

To put that into perspective, Sherwin-Williams Company (SHW), with approximately one third the dividend yield, but an almost identical earnings growth rate of 13.3% versus Chevron’s 13.2% earnings growth rate, currently commands a P/E ratio of 25.3. Or you could compare this to Wal-Mart (WMT), the world’s leading retailer, with a lower operating earnings growth rate of 10.2% that commands a current P/E ratio of 14.7. In other words, apply the same operating results to similar quality companies in other industries, and the market values their shares much higher than it does Chevron.

For additional clarity, an explanation of the following graphic will hopefully prove useful. First allow me to provide a discussion of the orange and blue valuation lines. The orange line represents an intrinsic value P/E ratio of 15. Clearly, Chevron’s stock price has rarely achieved that level of valuation over the last 10 years. The blue line represents a normal P/E ratio of 9.4, and we see that the stock price has tracked that valuation very closely over the entire time period.

The next areas I would like to clarify are the areas representing dividends paid and dividends prior to being paid. The light pink line plots the company’s dividends per share since 2004 (prior to being paid out), and here we see that Chevron’s dividends have steadily increased. The green shaded area represents total earnings. Therefore, the green shaded area below the light pink line represents a graphical view of Chevron’s payout ratio. The light blue shaded area on top of the orange line depicts the dividends after they’ve been paid out of the earnings. Note that because the dividends are stacked on top of earnings (the orange line) the graphic presents an illusion that Chevron’s dividend may have been cut. This is why the simultaneous display of dividends prior to being paid and after being paid is so important.

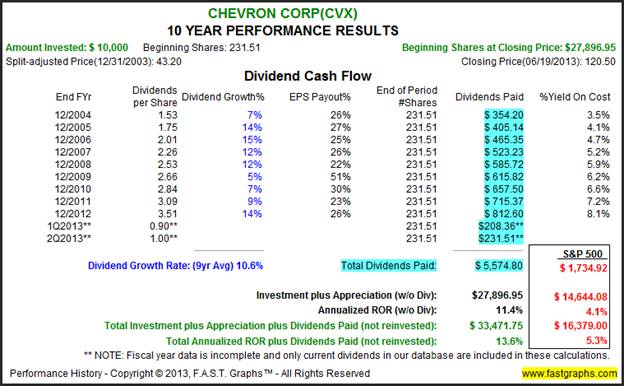

When you evaluate the performance that Chevron delivered to shareholders since 2004, we discover that it has been exceptional in spite of the market’s unwillingness to apply a fair value to it shares. A $10,000 investment on December 31, 2003 would have grown to $27,896.95 producing a 11.4% annualized rate of return. Add in the $5,574.80 worth of dividends, and the total return balloons to 13.6% per annum. Compared to the S&P 500’s total annualized rate of return of 5.3%, Chevron’s returns are clearly exceptional in spite of its chronic undervaluation by Mr. Market.

In regards to the future, analysts are rather conservative regarding Chevron’s future growth prospects. The following estimated earnings and return calculator reflects the expectations of approximately 14 analysts reporting to Zacks. After a very small drop this fiscal year, followed by very little growth next fiscal year, these analysts expect the long-term five-year earnings per share growth rate for Chevron at 6.8%.

Now remembering that Mr. Market has a penchant for undervaluing Chevron shares, the orange earnings justified intrinsic value line should be ignored, and our valuation considerations should more appropriately be based on Chevron’s historical normal P/E ratio of 9.4. Utilizing the PE overlay function of FAST Graphs™, I have added that 9.4 P/E ratio as expressed by the bright purple line. Here we see that Chevron is currently very fairly valued on that basis.

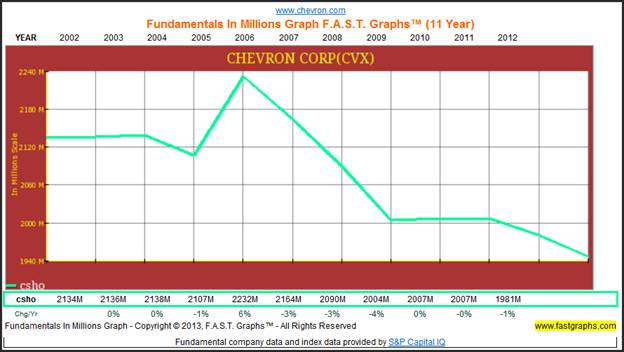

As I previously stated, most of the selections in the conservative dividend income selections are comprised of C Corps which have a propensity to reward shareholders through dividend increases and share buybacks. The following graphic shows that Chevron has reduced their share count from 2.134 billion shares in 2002, to 1.981 billion shares by year-end 2012. This lower share count should support earnings growth going forward.

Kinder Morgan - Energy Addendum Selection to Conservative Growth and Income

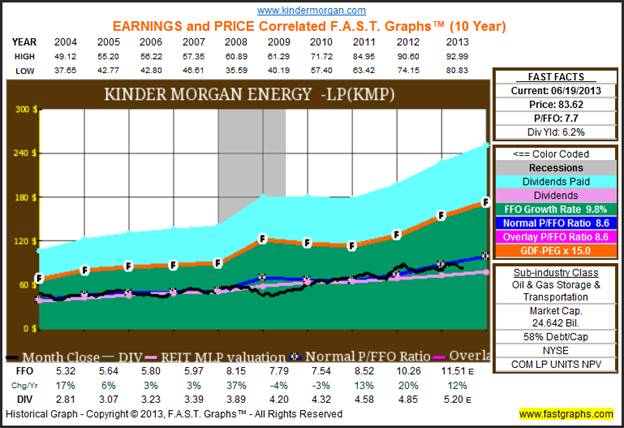

As a bonus, I have included Kinder Morgan Energy, the nation’s largest Pipeline Master Limited Partnership, as a featured selection of my conservative dividend growth candidates. Most MLPs were included in the more aggressive selections which follow later. However, there were several reasons why I felt it appropriate to include this MLP in the conservative area. First of all, remember that MLPs are best evaluated based on FFO, rather than earnings. As we can see from the following graphic, Kinder Morgan Energy has produced an exemplary and very consistent record of FFO growth since 2003.

However, it’s also interesting to note that just like Mr. Market values C Corps like Chevron at low multiples of earnings, Mr. Market also has typically applied a low price to FFO (P/FFO) multiple on MLPs. The P/FFO multiple for Kinder Morgan is 8.6. Moreover, valuing an MLP based on its dividend has also proven itself as a reliable measure. Therefore, the pink dividend line on the following graph represents, in essence, another kick at the valuation cat when reviewing MLPs. Therefore, since Kinder Morgan Energy’s stock price sits clearly between the income valuation line (the pink line) and the normal price to FFO line (the blue line), we see that Kinder Morgan Energy is very reasonably valued today. This also shows us that Kinder Morgan Energy pays out approximately half their FFO (a close cousin to operating cash flow) to shareholders in the form of dividends.

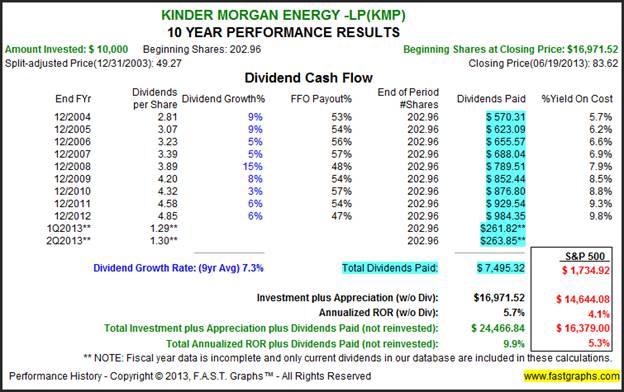

The consistent record of growing FFO that Kinder Morgan Energy has achieved is also reflected in their performance results. However, in the case of this high-yielding MLP, I believe special emphasis should be placed on their dividend over capital appreciation. When you compare this MLP’s performance to the S&P 500, we see that it truly distinguishes itself by the amount of dividends that it has produced. Kinder Morgan Energy’s total dividends paid since December 31, 2003 of $7,495.32 significantly outpaces the dividends of $1,734.92 for an equal $10,000 investment in the S&P 500.

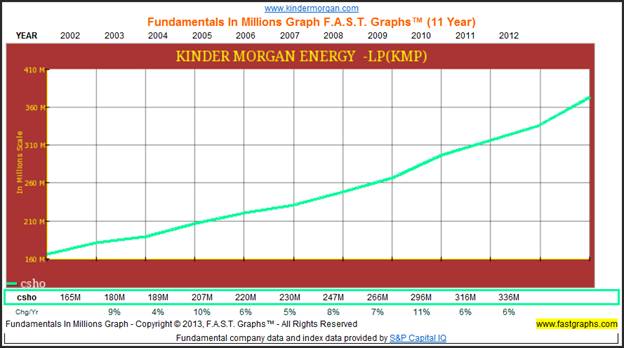

Although I would agree that it’s somewhat debatable whether or not this company deserves to be put into my conservative growth and dividend income selections, I do believe the normal risk associated with investing in an MLP is overcome by this company’s long-term record of consistent growth. However, as I previously discussed, prospective investors should take into consideration the expanding common shares outstanding that is so typical of MLPs. In other words, although the money gained from issuing new shares is utilized to expand the company’s capacity for growth, it is also dilutive in nature at the same time. The following chart plots Kinder Morgan’s common shares outstanding since 2002.

Aggressive Growth and Dividend Income

When scanning the Energy Sector for value, 40 companies made my aggressive growth and income list. However, in contrast to my conservative growth and dividend income list, most of the companies that made this list were MLPs or Royalty Trusts. Since I do consider these companies riskier than the major oil companies, I caution prospective investors to research any that catch their eye very carefully.

There is a lot of dividend yield on this list and that is obviously very attractive in today’s low interest rate environment. Therefore, the following portfolio review is listed in order of dividend yield highest to lowest. Since a majority of the names on this list are MLPs, it has been created utilizing FFO as the valuation metric in lieu of earnings. Therefore, I direct the reader’s attention to the FFO yield percentage, which indicates that these selections are comprised of what appear to be very reasonably priced MLPs. (Note that Sabine Royalty Trust does not compute FFO)

Sunoco Logistics Partners L.P.

My featured aggressive growth and income selection is Sunoco Logistics Partners L.P. (SXL), the following brief description of the company is taken directly from their website:

“Sunoco Logistics Partners L.P. is a publicly traded master limited partnership formed in 2002 to acquire, own and operate a diverse mix of crude oil and refined products pipelines and terminalling and storage facilities, as well as crude oil acquisition and marketing assets.

Our goal is to generate growing cash flows, increase distributions and provide attractive returns to investors. Strategies for growth include increasing pipeline and terminal throughput, utilizing our crude oil distribution and marketing expertise to address regional crude oil supply and demand imbalances, and pursuing organic growth opportunities as well as strategic acquisitions that are synergistic with existing assets. Strong cash flows have allowed us to consistently increase our distributions.”

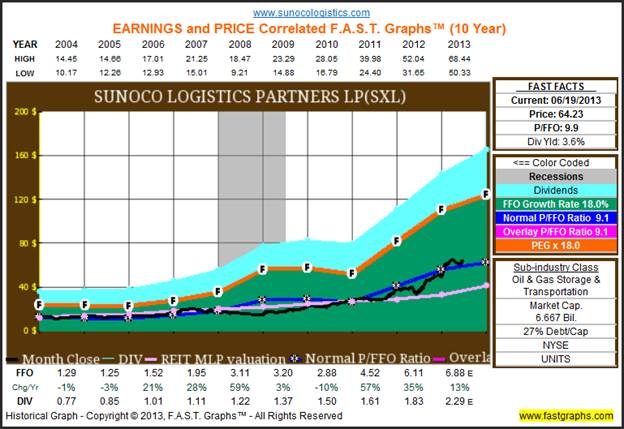

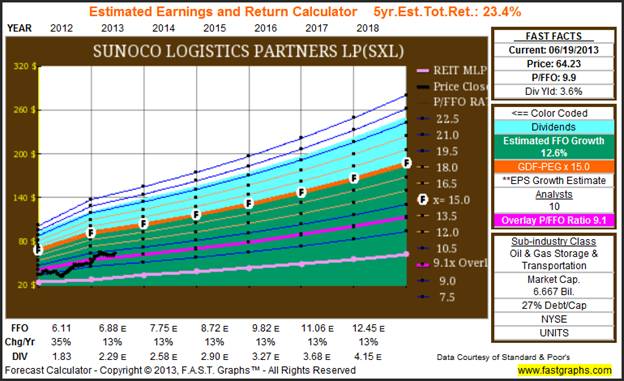

Always check the FAST FACTS tables to the right of the F.A.S.T. Graphs™ for the pertinent values and metrics that created the graph. With Sunoco Logistics Partners we see that the company has increased FFO (operating cash flows) by 18% per annum. We also see that the company is reasonably valued with a current yield of 3.6%. And perhaps more importantly, we see that the dividend yield is well covered by cash flows.

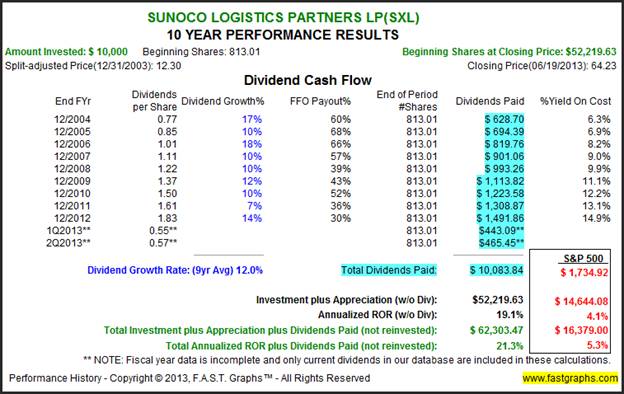

Since Sunoco Logistic Partners is my aggressive growth and income pick, it logically follows that it should have aggressive performance to go with it. Clearly this company has a history of lavishly rewarding shareholders through both a high level of dividend income, and superior capital appreciation.

Analyst forecast continued earnings growth of over 12.6%. The following estimated earnings and return calculator assumes that FFO growth will track earnings growth. Remember, the reddish purple line indicates the normal P/FFO.

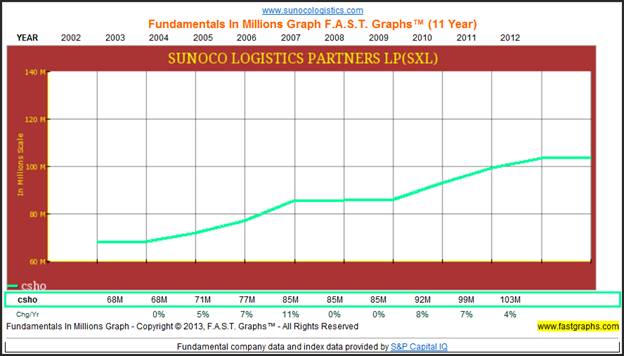

The following chart plots Sunoco Logistics Partners’ common shares outstanding since 2002. Like many MLPs, Sunoco Logistics Partners has continuously increased their share count, which raises money to fund future growth and simultaneously is dilutive to current shareholders.

Summary and Conclusions

Clearly, the Energy Sector is comprised of many different types of companies from operating in different industries, to having entirely different corporate and capital structures. Nevertheless, there is a lot of value to be found in this sector even after the strong market environment that we’ve had recently. However, it also needs to be considered that the Energy Sector is also a sector that the market place tends to discount. Therefore, any buy, sell or hold decisions should always take into consideration that fact. As I previously stated, why this is true is nowhere near as important as the fact that it is true.

On the other hand, if and when that were ever to change, investing in energy could provide a significant amount of leverage if the market decided to value energy stocks in the same more rational and justified manner as it does the traditional companies in other sectors. The bottom line is that I feel that the Energy Sector offers many high quality companies that are good values relative to equivalent companies in other sectors. Moreover, I believe that a side effect of the Energy Sector’s chronic low valuation is lower downside risk than you will find in more fully valued sectors. Consequently, I believe that the Energy Sector is a fertile field for dividend growth investors looking to fund their retirement portfolios with above-average yield and potential above-average capital appreciation.

In closing, it’s important to remind the reader that what I’ve produced here are sample companies in the Energy Sector that appear to be good values at today’s levels. However, these are not recommendations to buy, they’re merely recommendations of companies that might be worthy of closer scrutiny. Therefore, it is imperative that each prospective investor conduct further due diligence; my goal was just to narrow the playing field. Moreover, I am not contending that these are the only companies in the Energy Sector worthy of further research. There were several companies that I excluded because they either do not have enough history, there were no analysts providing estimates, or where valuation might have been just out of the range that I am comfortable with. The next article in this series will cover the general sector 15 - Materials.

Disclosure: Long KMP, SU., CVX, COP, KMP, OXY, PSX, SU, ARLP, BPT, BWP, EPB at the time of writing.

By Chuck Carnevale

Charles (Chuck) C. Carnevale is the creator of F.A.S.T. Graphs™. Chuck is also co-founder of an investment management firm. He has been working in the securities industry since 1970: he has been a partner with a private NYSE member firm, the President of a NASD firm, Vice President and Regional Marketing Director for a major AMEX listed company, and an Associate Vice President and Investment Consulting Services Coordinator for a major NYSE member firm. Prior to forming his own investment firm, he was a partner in a 30-year-old established registered investment advisory in Tampa, Florida. Chuck holds a Bachelor of Science in Economics and Finance from the University of Tampa. Chuck is a sought-after public speaker who is very passionate about spreading the critical message of prudence in money management. Chuck is a Veteran of the Vietnam War and was awarded both the Bronze Star and the Vietnam Honor Medal.

© 2013 Copyright Charles (Chuck) C. Carnevale - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Chuck Carnevale Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.