Gold and Silver Analysis- What Goes Up Must Come Down,,,,

Commodities / Gold & Silver Mar 24, 2008 - 07:45 AM GMTBy: Joe_Nicholson

“The current trend now is clearly down as confirmed by violation of the 5-week sma on Tuesday and it should be expected that rallies will be used as an opportunity to further liquidate long positions. And because gold in has moved so far so fast a substantial decline will likely ensue. But it would take a move below $750, that's over 25% from Monday's high, before there's serious damage to the bull market. It may not look pretty between now an then, but until conditions change, the 50-week moving average serves as support for the bull market.” ~ Precious Points: Gold Gets Sold , March 19, 2008

“The current trend now is clearly down as confirmed by violation of the 5-week sma on Tuesday and it should be expected that rallies will be used as an opportunity to further liquidate long positions. And because gold in has moved so far so fast a substantial decline will likely ensue. But it would take a move below $750, that's over 25% from Monday's high, before there's serious damage to the bull market. It may not look pretty between now an then, but until conditions change, the 50-week moving average serves as support for the bull market.” ~ Precious Points: Gold Gets Sold , March 19, 2008

As mentioned in the last update, losing the 5-week simple moving average was a clear signal of a new downtrend in gold. Notice two important indicators may be showing short term support ahead in gold, the RSI reaching levels not seen since December, and the moving average convergence on the MACD. Simply put, the Fed having reached the end of its rope in terms of rate-cutting firepower removes some of the downward catalyst in the dollar and upward catalyst for precious metals. This alone, however, will not end the bull market.

The chart above shows that a return to the $800-850 level last seen in December, would closely correspond to the selloff seen in May 2006. While such dramatic corrections are a hallmark of commodities trading and the reason to constantly exercise caution, they also create the best buying opportunities within a raging bull market. Interestingly, the 50-week sma, which this update has used as a proxy for the bull market in metals, is quickly approaching the $800 support level, further evincing a strong risk/reward trade in that area. In the meantime, managing risk and remaining flexible is the name of the game for those seeking to make short term forays into precious metals. Watching for resistance at the 50-day and 5-week moving averages (935 and 963 respectively) may also be helpful.

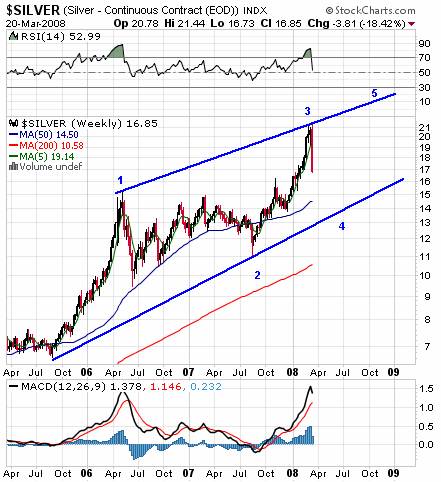

On a percentage basis, silver has already fallen further than gold and is already in the vicinity of historically oversold levels on the daily RSI. There's also potential support at the 50% retrace of the move from last summer. But the main idea is that silver, too, could see significantly more downside without damaging it's larger bullish outlook. Having put in a clear three waves up from the 2006 selloff low, silver may be putting in an internal fourth wave that will find support near the $15.92 or $14.15 Fibonacci retrace levels shown below.

The May 2006 selloff was roughly a .618 retrace of the previous advance, which would be a viable target for the current correction except it would overlap with wave 1 and invalidate the count as labeled. In this event, silver may be describing a diagonal, which would still offer at least one more new high for completion, as shown below. The bearish alternative, that the impulsive move up from 2006 is a “b” wave top, appears out of proportion and is unlikely, but would gain some credence on a move below $11, with an eventual target close to $9.

Join TTC

If you're thinking twice about paying for a reliable service, consider what we did this week which shows the bargain TTC members find week in and week out.

So, do you want to learn how to trade short term time frames? Would you like access to next week's charts posted in the weekly forum right now? Ten to twenty big picture charts are posted every weekend. If you feel the resources at TTC could help make you a better trader, don't forget that TTC will be closing its doors to new retail members this year. Institutional traders have become a major part of our membership and we're looking forward to making them our focus.

TTC is not like other forums, and if you're a retail trader/investor looking to improve your trading, you've never seen anything like our proprietary targets, indicators, real-time chat, and open educational discussions. But the only way to get in is to join before the lockout starts - once the doors close to retail members, we'll use a waiting list to accept new members from time to time, perhaps as often as quarterly, but only as often as we're able to accommodate them. Don't get locked out later, join now.

Have a profitable and safe week trading, and remember:

"Unbiased Elliott Wave works!"

by Joe Nicholson (oroborean)

This update is provided as general information and is not an investment recommendation. TTC accepts no liability whatsoever for any losses resulting from action taken based on the contents of its charts,, commentaries, or price data. Securities and commodities markets involve inherent risk and not all positions are suitable for each individual. Check with your licensed financial advisor or broker prior to taking any action.

Joe Nicholson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.