Resources Sector Nuclear Winter? Not Yet!

Commodities / Resources Investing Jun 25, 2013 - 10:06 AM GMTBy: Casey_Research

By Andrey Dashkov, Research Analyst

By Andrey Dashkov, Research Analyst

The late 1990s for the resource sector was so challenging that it is now often referred to as the "nuclear winter" of the industry. Some analysts are comparing our current circumstances to that period, while others purport we haven't hit bottom yet.

In its Business Risks in Mining and Metals 2013-2014 report, Ernst and Young states that capital allocation and access is now the number-one challenge the resource sector is facing. While production-stage companies are rationing capital expenditures to meet long-term goals, the juniors don't have this luxury; they need to raise money just to keep the lights on.

The report says the current situation is the worst market in ten years. Since International Speculator deals mostly with the early-stage companies, we set out to see exactly how bad it is.

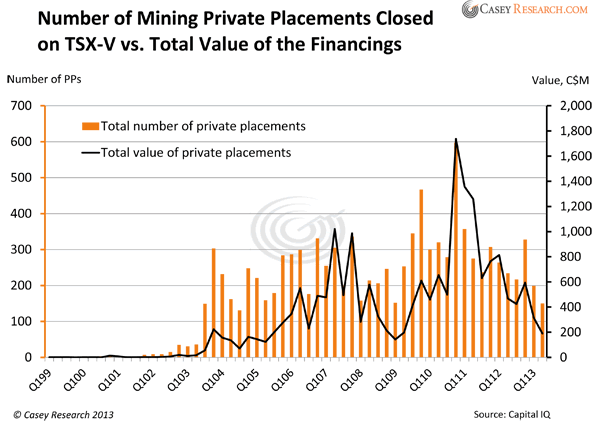

To do that, we pulled data on 10,521 private placements (PPs) closed by TSX-V-listed metals and mining companies since January 1, 1999 and compared the financing market now to the infamous "nuclear winter." Here's what we found.

The data show that metals and mining companies closed only 36 private placements in Q2 2003, raising C$17.6 million. By comparison, so far in the second quarter of 2013, metals and mining companies closed 150 financings for a total of C$192.6 million. This clearly shows that the current market, while definitely under pressure, is not as bad as it was ten years ago.

The market is also stronger now than in 1999-2001, when little financing activity took place. That period indeed was a desert for a metals and mining company.

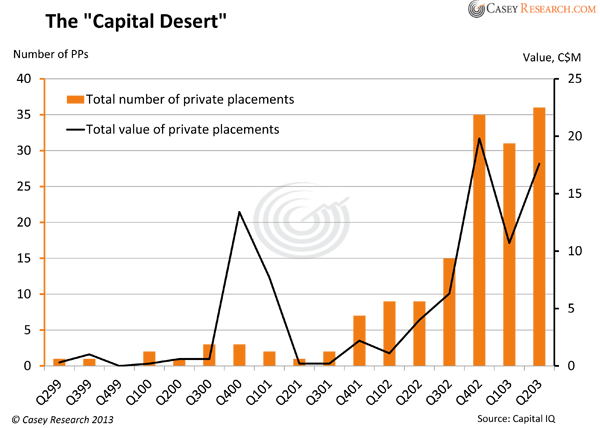

For a clearer picture, let's zoom in on that period.

Before things picked up at the end of 2002, the junior metals and mining sector was in a miserable state for at least two years, as the chart shows. Further, a few large deals skewed the data; for example, Mazarin Inc. and Regency Gold Corp. raised about C$10 million each in Q4 2000. These financings were huge compared to their peers, but wouldn't be considered that big today.

Conclusion

While the current state of the junior market couldn't be described as strong, these data show we haven't reached a nuclear-winter phase, at least not yet. Juniors still can finance, though clearly investors are much less generous now.

Keep that 1999-2001 period in mind the next time someone tries to convince you the bull market is over. That is what a nuclear winter looks like.

Our situation is much better than ten years ago. The best companies are still able to raise funds to explore and develop. This is where investment dollars should be focused, because when the market does turn around, it is the better-managed and better-capitalized companies that will be the first to deliver the tremendous returns this volatile sector is known for.

| Despite the spectacular fall in gold prices in recent weeks, sales of the physical metal are going through the roof. Is the gold market dying, or is it getting ready to rebound with a vengeance? To answer these questions, Casey Research has partnered with TheStreet to produce an exclusive video event to help investors sort out the complex world of the gold market – Gold: Dead Cat or Raging Bull? This must-see webinar premiers tomorrow at 2 p.m. EDT and features investment guru Jim Cramer, our own Doug Casey, Sprott Inc. founder and chairman Eric Sprott, and a number of other renowned precious-metals experts. Click here to learn more and to register. |

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.