How to Survive Hyperinflation - When Prices Double Every Day and a Half

Economics / HyperInflation Jun 27, 2013 - 04:19 PM GMTBy: Don_Miller

What does life actually look like when your country and its currency collapse? In a recent Casey Daily Dispatch, two guest columnists – one from Zimbabwe and another from Bosnia – shared their respective feats of survival amid the horrors of hyperinflation and civil unrest. Sadly, their stories are not outliers. During my lifetime, far too many societies have reverted to barter, theft, and gang rule.

What does life actually look like when your country and its currency collapse? In a recent Casey Daily Dispatch, two guest columnists – one from Zimbabwe and another from Bosnia – shared their respective feats of survival amid the horrors of hyperinflation and civil unrest. Sadly, their stories are not outliers. During my lifetime, far too many societies have reverted to barter, theft, and gang rule.

With Cyprus' volatile banking situation back in March and central banks in Europe, Japan, and the US printing money faster than Superman can fly, we have to stop and think: Just how safe are we, really?

At a 2011 Casey Research Summit, I met and heard the firsthand accounts of three gentlemen from Zimbabwe, Argentina, and Yugoslavia, who had survived hyperinflation in their home countries. Although these may sound like exotic locales with foreign problems, their terrifying histories have a lesson to teach us.

Hyperinflation is like fire. We all install smoke alarms, keep fire extinguishers handy, and buy insurance to protect our homes, but most of us will never fall victim to an unplanned fire. However, when a fire does ignite, it can be catastrophic – which is why prudent people simply plan ahead.

If our currency became worthless, would we have anything to barter? Do we have goods to trade for food? If so, can they be stockpiled and held for long periods of time?

As I wrote in my book, Retirement Reboot, when the government initiated the first TARP bill and our annual deficit had topped $1 trillion, I was doggone concerned about inflation and unsure how to tailor my investments to deal with it.

My mentor at the time was the late Glen Kirsch of Asset Strategies International. He suggested I start with "junk silver," meaning coins circulated prior to 1965 that contain 90% silver.

Why junk silver when a one-ounce gold piece could easily be worth a whole lot more? Because silver is priced lower and available in smaller denominations, it would be easier to use for barter if the need arose, and I would not be afraid to carry it.

Prices Doubled Every 1.4 Days

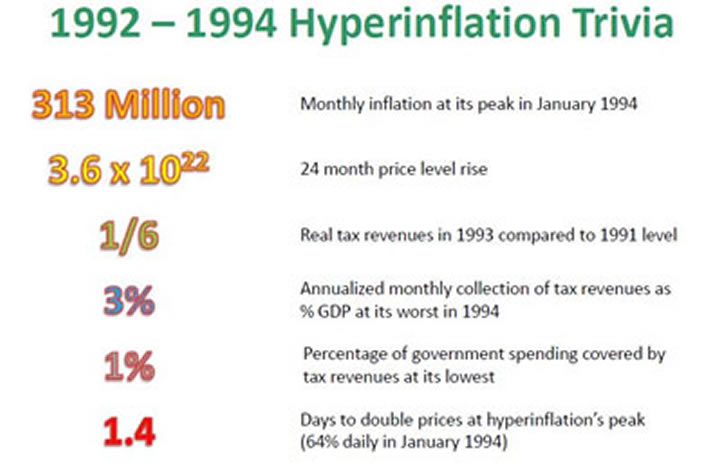

As the speaker from Yugoslavia mentioned, after a period of rising inflation, prices in his country rapidly jumped into the stratosphere. At one point, they doubled every 1.4 days on average. He also shared the slide below with a little Yugoslav hyperinflation trivia.

Rapid hyperinflation can be difficult to even conceptualize. The Yugoslav speaker showed a 500-billion-dinar note that had the same purchasing power as a 500-dinar note just twenty months earlier. This almost makes it possible to imagine using money as kindling to heat your home or cook whatever food you could scrounge up.

To drive the point home, let's crunch some numbers based on a doubling of prices every 1.4 days. If you had a $100,000 CD, it would take approximately 29 days for the buying power of that CD to be worth less than $1.00. Imagine your current net worth, then reduce it to 1/100,000th of what it is today – that's how much purchasing power you would have at the end of the month. It's practically apocalyptic.

At that rate, hyperinflation turns the currency into a game of hot potato. No one wants it, and those who have it want to spend it as fast as possible, since it is losing value at a supersonic rate.

But even if inflation never escalates quite that rapidly or to that extreme in the US, investors here still need to plan for it. The Yugoslav speaker, along with the others, made it clear that hyperinflation totally wiped out seniors and savers. That's a situation I never want to find myself in.

Silver coins for barter, however, offer only the most basic protection; we need more insurance.

Stealing Gold

During the Great Depression, FDR confiscated gold from US citizens by executive order, and criminalized its possession, other than for small jewelry like wedding bands and an aggregate amount of gold coins under $100. Folks received $20.67/oz. (in 1933 dollars) as "compensation" for surrendering their gold. Once the federal government had stockpiled the gold of American citizens, its price on purchase from the US Treasury was raised to $35/oz. Almost overnight, this significantly devalued all those dollars the government had just "paid" to Americans by 41%.

While that was not inflation to the billionth degree, it was certainly scary enough. Our government has already done it once. We'd be foolhardy to think it could not or would not do it again.

We saw another storm cloud recently when a Dutch bank defaulted on physical gold deliveries to customers. Basically their customers thought they had gold in their bank, but the bank defaulted and said it would give them the paper money equivalent instead. They informed their customers that there was no physical gold available.

Does History Repeat Itself – Or Just Rhyme?

The excessive printing of money leads to inflation. During difficult economic times, debt-laden governments have either collapsed or massively devalued their currencies to stay afloat. Are conditions in the US ripe for the latter?

Inflation is on the rise, and our government is printing $85 billion every month. To make matters worse, the government's official inflation statistics lie to the public. At the very least, this should make us uncomfortable, and at worst, terrified of what's to come.

Should we take heed and prepare ourselves? Well, is the United States immune from the laws of economics? I sure don't think so. The federal debt is unsustainable, and I think we are past the point of no return. At this point, I am more worried about how bad the fallout will be and how long it will take to recover from it. High inflation hurts everyone. We just want to protect ourselves as best we can.

Americans are not the only folks at risk. As already mentioned, the largest Dutch bank recently announced that it could not take physical deliveries of gold bought by its gold contract customers. It's a poignant reminder that where we store our wealth matters.

Storm clouds are on the horizon and – as the weathermen say – conditions are ripe for a significant event. It's time to gather provisions and take cover! Even if I'm wrong and the looming storm passes, it's much better to protect our life savings. It sure beats the alternative. Do nothing and your life savings could be wiped out in a matter of days.

The Shelter that Has Yet to Collapse

Any number of currencies have collapsed throughout history, but precious metals – gold and silver – hold their value. China and Russia have been stockpiling gold for good reason. Germany and Venezuela are bringing their gold back home after storing much of it overseas, particularly in the US. Sure, they played down their moves, but it looks to me like they are preparing for a storm.

A rather boisterous US Congressman keeps calling for an audit of Fort Knox. It has not been audited for decades, and no one (at least no one who's talking) knows just how much gold currently sits in US vaults. And I know I'm not the only member of the "I don't trust any government" club.

In 1971, President Nixon took the US off the gold standard. So just how well has gold kept up with inflation since? One dollar's worth of gold in 1971 would be worth $42.46 today. It looks to me like gold has done doggone well as an inflation hedge, even with recent headwinds in price.

The Next Level of Protection

A desperate government frantically trying to protect itself will go to great lengths to confiscate as much wealth as it possibly can. We must be equally as diligent in protecting ourselves, and that means holding assets that are not easily confiscated.

Oh, there are still plenty of naysayers who might call me a doomsday prophet, but I am well beyond being concerned about ridicule. I believe a prudent investor should have hard assets in his core holdings. Historically, they have kept up with inflation, and as folks my age know, history repeats itself.

We each need our own, legal Fort Knox in a friendly jurisdiction, out of our government's reach. On a very practical level, this makes government confiscation much more difficult. But it's also nice to know that should our government collapse, relocating might actually be a viable option. I have a hard time with the idea of leaving my homeland, but having a backdoor emergency exit no longer seems like a silly idea.

Wherever you hold precious metals or your other core holdings, whether in the US or internationally, they are inflation hedges and emergency funds. We have fire extinguishers for fires, and core holdings to protect us from economic catastrophe. I hope we never have to use either.

And beyond holding some gold you want to consider spreading your assets in various countries as well. This does not mean you have to move, though certainly that’s an option, but it does mean not keeping all of your assets, whether gold, stocks, cash, or whatever, locked in your home country. What happened to savers in Cyprus and more recently Argentina (again) certainly explains why.

A newly released publication, called Going Global 2013 shares with you exactly how to diversify from your home country. You’ll learn the seven best ways to diversify starting as soon as today. It's all laid out in easy-to-read plain English with detailed, step-by-step instructions. Click here for short letter with details on how to get started.

If you would like to learn more about protecting your finances and building a successful portfolio, I invite you to not only check out the Going Global 2013 report mentioned above but also to take a look at The Cash Book as well. I'd readily admit that even just a few years ago considering putting any of my money overseas would have been a non-starter. However, times have changed and it's relatively easy to diversify yourself and your assets. And you don’t have to be a super-wealthy investor to make it worth your while.

The Cash Book will show you how to legally get around the FDIC's $250,000 cap on deposit insurance, how the average person can open an account in Switzerland without attracting extra scrutiny from the IRS, the two best currencies for diversifying out of the US dollar, and the simplest way to do it, and much more.

The Cash Book is usually reserved only for Money Forever subscribers, but it’s so important that you diversify your money we've made it available on its own. Click here to get your copy.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.