Bankster Bankruptcy Bail-Ins Are Retirement Accounts Next?

Stock-Markets / Credit Crisis 2013 Jun 30, 2013 - 03:54 AM GMTBy: Andy_Sutton

One of the biggest concerns of savvy investors since the ongoing crisis began in 2008 has been the safety and longevity of the various types of retirement accounts and systems. Throwing gasoline on the flames have been the decisions rendered by courts of ‘law’ regarding the treatment of customer money in the case of the bankruptcy of several brokerage firms, most notably, MFGlobal. The susceptibility of bank deposits has already been firmly established in prior issues of this column. To our alarm and dismay it appears, at least on the surface, as though few are doing anything to prepare for such an eventuality.

One of the biggest concerns of savvy investors since the ongoing crisis began in 2008 has been the safety and longevity of the various types of retirement accounts and systems. Throwing gasoline on the flames have been the decisions rendered by courts of ‘law’ regarding the treatment of customer money in the case of the bankruptcy of several brokerage firms, most notably, MFGlobal. The susceptibility of bank deposits has already been firmly established in prior issues of this column. To our alarm and dismay it appears, at least on the surface, as though few are doing anything to prepare for such an eventuality.

Our hope in authoring this collaborative piece is that it will cause more people to assess matters as circumstances pertain to them, and then take proper evasive action. If you still believe in the system and that it exists for your benefit and protection then you may stop reading now.

The bail-in concept actually began to be implemented here in the United States before anywhere else. When a federal appellate court gave its stamp of approval in the Sentinel case, it gave the green light to the theft of customer funds whether they be segregated in a brokerage account (but held in street name) or held as deposits in a traditional banking arrangement. The quiet and subtle change in status from depositors to unsecured creditors that took place back in 2010 has been well documented in this column. The fact that, since the publishing of that seminal work on 4/12/2013, Japan, Britain, and the EU have officially adopted the bail-in doctrine should be very alarming, yet it is nearly uncovered by the lapdog media.

The outrage over the theft of segregated money in the cases of Sentinel, MFGlobal, and PFGBest has been all but absent. Nobody seems to care that they’re fleeced. The Cypriots are looted over the course of several weeks and other than the cries of the people of Cyprus there is nary a whimper of protest. So, how safe is the $18 trillion in retirement assets in America? Well, after the latest ‘clean-out’ beta test (more on this later) it is probably a good portion less than $18 trillion.

The Sustainability of QE

Most thinking individuals will quickly come to the conclusion that quantitative easing (aka printing money from nothing to buy debt) or monetization is not sustainable in the long run. This creates an immediate problem because our economy and financial system are now addicted to these monthly liquidity injections. The economy and financial system are hooked on the bubbles QE produces. The bottom line is someone has to buy all those new Treasury bonds otherwise deficit spending goes away and an instant depression ensues. It is that simple: someone has to buy the bonds otherwise the economy buys the farm.

There is another problem with QE. Unlike retirement savings, QE is not capital. The work of von Mises and Rothbard, among others, clearly delineates the differences between capital and currency so we won’t expound on that topic here. QE is currency. It is anti capital. Basically QE destroys capital. When all the capital is gone, the economy is gone and in this case, so is the goose that lays the golden eggs for the banksters. And we can’t have that. There is still plenty of fleecing to be done. People are still lining up to take on more debt and pledge more of their future economic output to people who create the enslaving debt from thin air without breaking a sweat. Why should they work when you’re willing to do it for them? Who in their right mind would want to put an end to such a great racket prematurely?

It is this very unsustainable nature of QE that will cause the banksters to go hunting for other liquid sources of capital. There are two big ones in America: bank deposits and retirement savings.

Potential Mechanisms for Confiscation

Contrary to the popular undertone of most hucksters (even in the alternative media) who are constantly warning of ‘imminent financial/economic collapses’ and the theft of everything including the nickel between the couch cushions, it won’t necessarily work that way. We’ve got a distinct socialist trend going in America now and have had one for quite some time.

One likely eventuality is that the government, acting in its now accustomed role as the primary enforcement arm of the banking establishment, would ‘nationalize’ the retirement system. This would likely start with public pension plans and a mandate that these plans invest a minimum percentage of their portfolio in Treasury securities. The Thrift Savings Program (TSP) here in the US is already a major purchaser of Treasury securities for its ‘G’ Fund. Coercing other public pension plans to do the same is the next logical step although it is not without severe consequences. The actuarial models of nearly all pension funds are based on the idiotic notion that portfolios always produce a near 7% rate of return over the long run.

The last decade has put a huge dent in these models, which is one reason why many plans are now underfunded. Demographics and wage shifts are other major problems. We know, you have 101 reasons why your plan is the only one that is safe. We’ve heard them all. We also heard the 101 reasons why your house was the only one on the block that was immune from the housing crash and so forth. Regardless, nearly all plans are underfunded now, to varying degrees. If these plans were forced to take a significant position in Treasury bonds above what they already own, those actuarial models would become absolutely worthless. That is, unless interest rates adjust dramatically upward, which would cause a raft of other problems.

What the nationalization concept would mean for nearly all recipients of pension payments is an immediate and significant cut in their distribution. There are laws against that, right? There are also laws against stealing client money and we saw how well that worked out for the clients so we would suggest taking this possibility rather seriously.

The second potential mechanism is an outright bail-in where the funds are re-hypothecated (stolen) under the guise of some type of 2008-style crisis, whether it be manufactured or real. Under this type of eventuality, there would be the perceived need for recapitalization of the banking system either in its entirety or majority and the segregated monies in retirement accounts and bank deposits would be used to bail-in the system. The securities in those accounts could be sold to raise more funds to complete the bail-in. Obviously in this scenario the pensioner or IRA account owner would be left with little or nothing. At a minimum they’d get what was dubbed a ‘haircut’ when it was done in Cyprus.

Potential Timetables & Triggers

At current there is no timetable for any of this nor are we going to propose one. There is a smattering of information here and there, mostly from sources who are either dubious or compromised, however there is a certain tenor that we can establish from the actions of central banks, policy think tanks, and governments around the world that strongly suggests the eventual nationalization/confiscation is one of the next steps.

Our best projections regarding potential signposts are precisely the kinds of events we’ve seen over the past two weeks: massive volatility and sell-offs, particularly in the bond markets. Japan is a huge potential trigger. The BOJ is walking the razor’s edge with its Abenomics sham and one mistake and over they go and the rest of the globe with them. Increases in both the frequency and magnitude of central bank easing are another signpost. Stunts such as the Bank of Japan directing pension plans where to invest are another good signpost that it is well past time to begin planning.

The past few weeks have produced what we’re going to call a beta test of one of the potential takedown mechanisms. We’ve previously mentioned the addiction of western economies and their financial systems to QE stimulus. For months now market and economic spectators have been wondering aloud what would happen if and when all this QE stops. The mere mention of such an eventuality causes volatility. There is no possible way that the monetary ‘authorities’ don’t know this.

So in that context we present Ben Bernanke’s suggestion a few weeks back that QE may be ‘tapered’. Then the banksters stepped back and watched the fireworks. Predictably the world sold off. Stocks, bonds, and commodities all went down. It was a mini deleveraging event. Then the banksters stepped in and restored a bit of stability to the system before things really got out of hand.

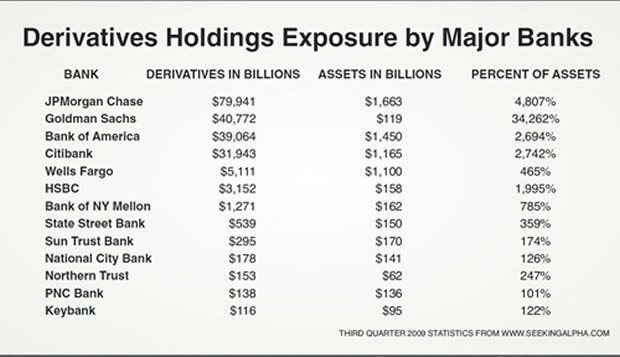

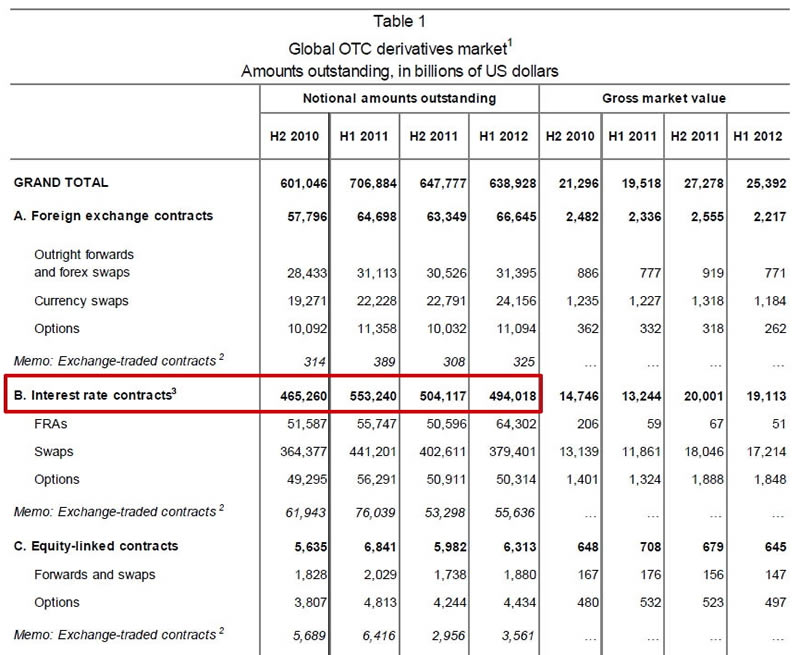

That exercise demonstrated several things. First, it proved beyond any shadow of a doubt that nobody has any idea what any financial asset is actually ‘worth’. All we know is that they are worth more when there is QE than when there isn’t. We have a QE pumped market, which we already knew, but there have been some detractors that have been painting the picture of a bull market based on fundamentals. That is utter nonsense. Secondly, the shock to interest rates caused some major cracks in the financial façade. Interbank rates in China skyrocketed and at least one bank allegedly hit the mat and had to be bailed out (CIBC). There were probably more. Keep in mind there are several hundred trillion dollars worth of derivatives tied to interest rates alone.

The trigger is obvious. The ‘end’ or even suggested end of QE causes a spike in interest rates, which wipes out a good portion of the world’s banks. Essentially allowing what started after Bernanke’s speech to proceed unchecked and gain momentum. The bail-in is on. There aren’t nearly enough deposits or retirement savings to cover the derivatives market. The leverage is enormous and even the smallest of moves is going to cause problems. The banksters, including their spokesman, the little professor in DC, know all this.

Others might not be willing to say this, but we are. If we end up with a spike in interest rates because of the end (or threatened end) of QE with the banks of the world needing to be bailed in with your savings, then it was done intentionally. It was not an accident as will undoubtedly be reported. It wasn’t a ‘black swan’. They did their test the other week and saw the results. We are hostages to QE forever. Without it, the entire system perishes. And, as we pointed out earlier, even that isn’t enough. One way or another America’s retirement savings are on borrowed time. Sadly there are no other conclusions that really make sense given all that has already happened.

Conclusions

One thing we wonder at with amazement is the absolute unwillingness of most first world citizens to even consider making changes in their standard of living. A simple 20% cut in standard of living by Americans would provide a huge degree of flexibility with regards to weathering the storm that lies dead ahead, yet people won’t do it. They won’t even talk about it for the most part and your authors have seen this mentality on two continents. Standard of living is sacrosanct. The second thing that is truly amazing is the lengths people will go to in order to remain in denial. We cannot state strenuously enough that you ignore the events going on around you at your own extreme risk and peril.

We’ve gone out on a limb here, presenting what is basically a circumstantial case against central banks and governments when it comes to the matter of your retirement accounts. We’ve demonstrated the need for your capital to keep their Ponzi scheme going. We’ve demonstrated their willingness to swipe other types of assets with the full blessing of the judicial system. We don’t have whitepapers such as the FDIC/BOE and BIS position papers on bank deposits - yet. We have no inside information and don’t purport to have secret contacts with Dick Tracy watches as many others do. We’re merely presenting what has already taken place and the fact that the current paradigm is in great jeopardy unless your savings are separated from you and placed under their control to some degree or another. The world would be much better off if the paradigm just ended, however it won’t go quietly into that good night and neither should you. However, with information and knowledge come responsibility and a call to action. Posterity strongly suggests it. Freedom absolutely demands it.

Graham Mehl is a pseudonym. He currently works for a hedge fund and is responsible for economic forecasting and modeling. He has a graduate degree with honors from The Wharton School of the University of Pennsylvania among his educational achievements. Prior to his current position, he served as an economic research associate for a G7 central bank.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.