A Rare Anomaly in the Gold Stocks Market

Commodities / Gold and Silver Stocks 2013 Jul 02, 2013 - 05:10 AM GMTBy: Jeff_Clark

Gold stock investors have been pummeled, including myself. Worse, we've had to hear "I told you so" from all the gold haters in the media.

Gold stock investors have been pummeled, including myself. Worse, we've had to hear "I told you so" from all the gold haters in the media.

There are a few commentators expressing mild interest in gold at these levels, but one thing I haven't heard any of them talk about is a metric that gold analysts are rarely able to use, because gold stocks just don't get this undervalued.

Mainstream analysts sometimes talk about book value, especially when a stock appears cheap. Book value (BV) is a metric that, in essence, sets the floor for a stock price in a worst-case scenario. BV is equal to stockholders' equity on the balance sheet, and is the theoretical value of a company's assets minus liabilities – sometimes you'll hear this called "net asset value" (NAV). So when a stock price yields a market capitalization (share price x number of shares outstanding) equal to BV, the investor has a degree of safety, because if it dropped lower, a buyer could theoretically come in, buy up all shares, liquidate the company's assets, and pocket the difference.

Price to book value (P/BV) shows the stock price in relation to the company's book value. A stock can be considered "cheap" when it is trading at a historically low P/BV. Or, even better, it can be considered objectively " undervalued" when it is trading below book value.

Given the renewed selloff in the gold market, I wanted to see if gold equities were getting close to book values, not just because it would point to opportunity but also the margin of safety it would imply.

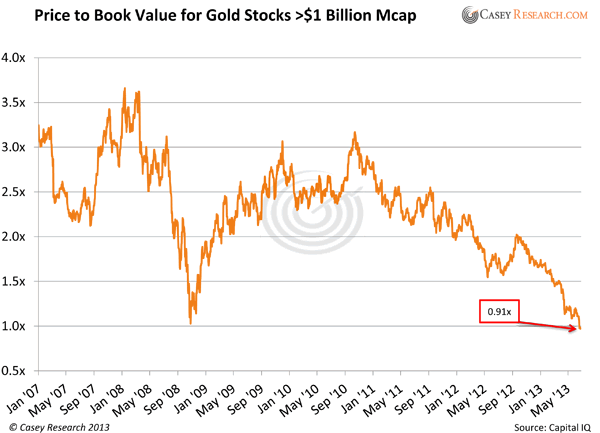

We analyzed the book value of all publicly traded gold producers with a market cap of $1 billion or more. The final list comprised 31 companies. We then charted book values from January 1, 2007 through last Thursday, June 27 (index equally weighted). Here's what we found.

This chart makes clear the current dramatic undervaluation of gold stocks.

- As a group, gold producers are now selling below their book value.

- Based on this metric, gold stocks are now cheaper than they were at the depths of the 2008 waterfall selloff.

- The chart doesn't show it, but gold stocks were trading above book value (about 1.1x) when gold bottomed at $255.95 on April 2, 2001, which was the beginning of the bull market.

Here's an even more dramatic fact:

- We went back as far as 1997 and could not find one episode where gold producers as a group traded below book value – and the late '90s was known as the "nuclear winter" for the gold mining industry!

Needless to say, we're in rare territory.

So does this mean we should buy now? To be sure, book values fall when precious metals prices decline, and costs have risen substantially since 2001 as well. So it's possible values could fall further. But in that scenario the relationship between stock prices and book value would remain in rarified territory, making the anomaly even more appealing to a contrarian investor.

While the waterfall decline in gold stocks is painful for those of us already invested, the reality is that this is a setup we get a shot at only a few times in our investing life. It's a cruel irony that those who are fully invested are now faced with the buying opportunity of a lifetime; however, it would be a shame for anyone to miss this blood-in-the-streets opportunity. Our future profits should be higher by an order of magnitude, when the market does turn around.

It's times like these when I remember what Doug Casey told me the first time I interviewed him:

"You don't make money buying when you're optimistic. You have to actually run completely counter to your own emotional psychology."

The extent to which each of us is able to take advantage of the opportunity shaping up is of course dependent upon our personal set of circumstances. For some, this might mean doing nothing; for others, it might mean being bold for the first time in their life. I suspect most readers fall somewhere in between.

Either way, the opportunity is clear: book values for gold producers are at rarely seen levels. Gold stocks may not reverse tomorrow or could get even cheaper when producers start reporting this quarters financial results, but history shows this opportunity will not last forever. It will probably never occur again in this cycle, once gold turns – and it should be fantastically profitable.

| If you've been on the fence about whether or not to give BIG GOLD or International Speculator a try, the July issues for both come out this week. We can tell you exactly which companies to buy and also which have the most upside potential. Your timing, in retrospect, could turn out to be one of the great investing decisions of your life. |

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.