Stock Market Flash Crash Still Probable

Stock-Markets / Financial Crash Jul 03, 2013 - 08:27 AM GMT SPX revisited the 50-day moving average this morning at 1624.06 and has since declined toward Short-term support and rally trendline at 1650.50. Once beneath these supports, we should see the SPX fall away pretty rapidly. The probability of a Flash Crash is very high, with a potential bottom date of Tuesday, July 9. Beyond that, there may only be a short but powerful bounce that will rollover into a deeper decline ending in the first week of August.

SPX revisited the 50-day moving average this morning at 1624.06 and has since declined toward Short-term support and rally trendline at 1650.50. Once beneath these supports, we should see the SPX fall away pretty rapidly. The probability of a Flash Crash is very high, with a potential bottom date of Tuesday, July 9. Beyond that, there may only be a short but powerful bounce that will rollover into a deeper decline ending in the first week of August.

There may considerable pressure to keep the markets elevated into the July 4 holiday. We all know that this is a political “hot potato” and it would be preferred not to have too many people upset going into their holiday. Cycles may be pushed and prodded to look good at quarter-ends and holidays. But the decline and its targets are only postponed.

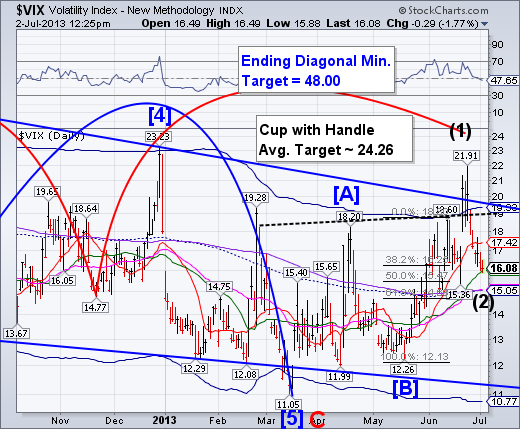

VIX stopped its decline at Intermediate-term support at 16.02 and is ready to resume a short, but very powerful rally that could top out on Monday. This lines up with the thesis that a Flash Crash still awaits the equities.

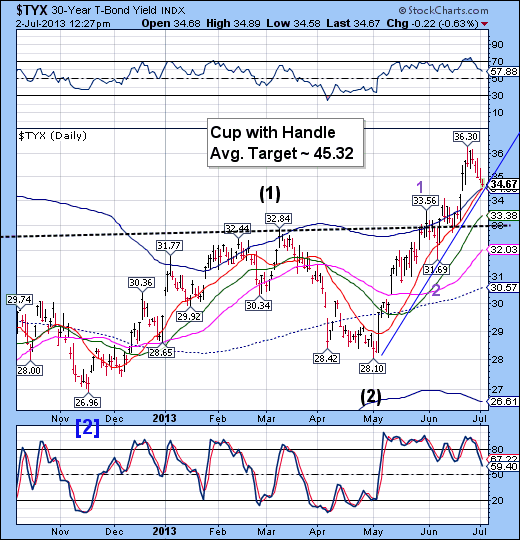

TYX has pulled back to a triple support at 34.49. This portends a spike in 30-year Treasury rates to 4.00%! This could also happen by next Tuesday. More evidence for a Flash Crash…in bonds as well as stocks. From there, another pullback that lasts a week, then rates go higher still.

CAF bounced from its Head & Shoulders neckline and its retracement also appears to be over. The next decline may be the worst yet as the Head & Shoulders neckline is sure to be violated.

The Nikkei also closed near its 50-day moving average yesterday. Last night it went over 14000.00. Japan is the country with the most pressure to print its way out of its malaise. However, once the US market rolls over, it should be unable to maintain its current support level.

Euro Stoxx appear to be in the worst shape among the global equity indexes. It has long ago left the 50-day moving average behind and is now retesting the 200-day moving average. It has also pierced the bottom of its Orthodox Broadening Top, so the next decline will be the trigger for a crash to 1925.00 – 1950.00. There is a high probability that Stoxx will also bottom next week, or early in the following week.

I am monitoring all of these indices in my Model. This gives me a pretty fair assessment of what may be coming and the intensity of the declines. The next decline in Stoxx will be the most intense, since it will be a Primary Cycle decline.

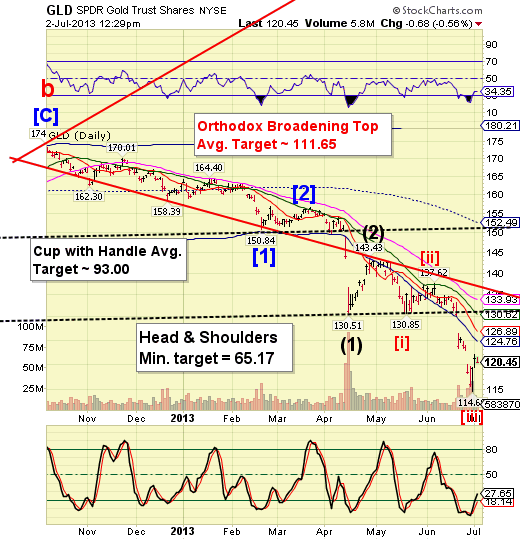

GLD doesn’t have much time left for its rally. The probable top may be at the close on Wednesday (Remember, the market closes at 1:00) or early on Friday. Cycle bottom resistance appears to be the limit for the rally at 124.75. Short-term resistance is only two points above, if it should go higher.

I will be doing a write-up on the currencies next.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.