Goodbye Privacy: Big Data Is Coming to Town

Companies / Internet Jul 16, 2013 - 03:28 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: Just like the Christmas song, "He knows when you've been sleeping, he knows when you're awake, he knows when you've been bad or good..."

Keith Fitz-Gerald writes: Just like the Christmas song, "He knows when you've been sleeping, he knows when you're awake, he knows when you've been bad or good..."

But nowadays it isn't Santa, it's Big Data. And it's becoming big business.

What can companies do with big data?

Get this:

Retail giant Target (NYSE: TGT), thanks to its proprietary big data and it's big data mining techniques, reportedly figured out that a teenage girl was pregnant before her parents did.

As the story goes, the girl's unsuspecting father was understandably upset a) because the store supposedly sent maternity coupons to the family's house and b) he wasn't adequately supervising his daughter's extracurricular activities, according to Forbes.com.

This certainly begs the question of where does a store's ability to predictively target its sales begin to infringe upon your privacy? - I'm not so sure we know as a society...yet.

But I do know that until there are proper guidelines - and probably thereafter - big data will be big business.

Now, I'll admit right up front that I'm the first person in line when it comes to keeping the government's greasy meat hooks out of my personal information and corporations from mining my data.

But even I couldn't resist a look at MIT's Immersion program when I heard about it.

They're All Watching

That's what the Cambridge-based university calls a unique program it's developed with the intention of learning exactly who knows what about whom beginning with Google.

Forget Snowden and his NSA hype. This is what our educational institutions and private corporations are capable of doing - right out in the open and with no law enforcement required. It's free. It's interesting, and like a bad movie, so appalling that I can't take my eyes off the screen.

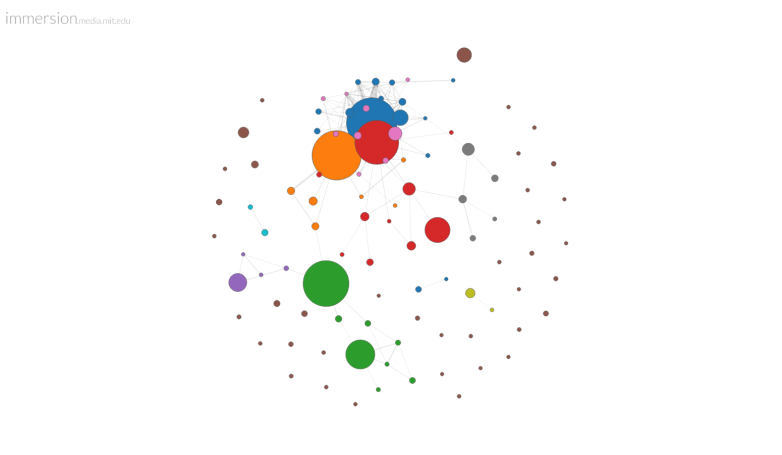

Here's what my "Immersion experience" actually looks like over the past three years:

Now let me tell you what you're looking at - the interrelationships between 40,000+ emails and more than 120 of my "collaborators" - the people with whom I've exchanged emails over the past three years.

The large dots are the people I correspond with the most and the dot clusters are those who share a relationship with one another. Most of them are centered around my companies.

The small lines connecting the dots show the relationships between those whom I email and their collaborators.

By the way, the large green dot represents my wife while the smaller green dots represent my family. Who says we don't communicate enough?!

Connecting the Dots

But back to why this matters.

One of the fundamental challenges in any law enforcement situation or marketing program is the ability to tie data together. In the old days it was lots of gumshoe investigating that did the trick together with huge pools of people who did nothing but look for connections.

The best investigations were typically thousands of man-hours deep and limited by the human brain. Those doing the investigating had to know what they were looking for and, many times, imagine connections that they set out to prove by unearthing the facts.

Obviously the potential for error was high not to mention a lot got missed. Research was much the same.

Now, though, we have something called "big data" to contend with. You've heard me mention the term before but just in case you aren't familiar with it, big data is what scientists call the ability to render data in previously unimaginable ways. It's not truly about the moniker "big."

What's interesting to me is that "big data" is really about the distillation of data that we've never considered "data" before - like the words in specific books, for instance. Patient records, GPS data, credit card info, purchasing.

We've always considered that information as having meaning, but now it's the relationships that matter.

If you're in law enforcement, big data gives you the ability to put people, places and things together in such a way that your investigation can actually be dramatically more forward looking - dare I say it, given the Snowden debacle.

If you're a doctor, you can begin to understand how specific correlations are more important than the cause of illnesses, especially when it comes to preventative medicine.

If you're a marketing executive, you can begin to understand how, why and where your customers are as well as what prompts them to buy. You can even offer them anticipatory marketing because, thanks to big data, you'll know what's happening in their lives before they do.

Something like what Shigeomi Koshimizu is doing at the University of Industrial Technology in Tokyo is relatively benign, even humorous on the surface.

He's developed a digital code that is 98% accurate at identifying specific people based just on how they sit in a car seat using over 350 sensors to measure height, weight, posture, etc. In other words, his sensor array is so good that your butt might as well be your fingerprint.

My point is that thanks to big data and huge jumps in computational power w e can now measure things that we couldn't before and that there's a ton of money in that.

I'm not alone in my thinking either. The last data I've seen suggest that more than 50% of today's technology leaders are investing in big data projects or planning to.

Gartner, a leading IT consulting firm, reported earlier this spring that more than 20% of global 1000 companies have a focus on information management - that's comparable to application management.

Clearly big data is coming into its own.

I've been following the trend for about a decade and now believe it's finally ready for prime time. I've loosely grouped the world into five primary data sets so far and am following big data very closely as companies grow into "it."

- Intelligence, reconnaissance and surveillance

- Networked data and systems

- Security and communications

- Command and control.

- Preserve and explain

And I've identified a slew of companies in a variety of industries that I believe will capitalize on the big data equation.

The march to profits will dwarf the Internet Age which was merely a warm up enabler.

Here are three mainstream choices to get you started.

First up - Symantec Corporation (NASDAQ: SYMC)

The c ompany is undergoing restructuring amid turbulent times, but still seems destined to extend its reach.

Symantec is primarily known as a data security company for the individual PC user as well as large corporations. But with the rise of big data it's going to be known as a big company security platform a few years from now.

The company is going under a large reorganization campaign where it is weeding out a lot of the redundancies and refocusing its efforts. Published reports suggest the company is slashing 8% of its global workforce as I type.

Symantec expects to redeploy resources to the storage and server management segments, which have now surpassed its security sector and in its most recent quarter accounted for 36% or $2.5 billion in sales.

Second up - Acxiom Corporation (NASDAQ: ACXM)

Acxiom is a little known company with a market cap of $1.8 billion which can, however, boast about having some very well-known clients. Wells Fargo, E*Trade, Toyota, and Macy's are just a few using Acxiom's stealthy services. What Acxiom does for these big players is both astonishing and scary.

Many claim Acxiom may have the world's largest commercial database on consumers. This database contains information on 500 million consumers worldwide where each person has archived approximately 1,500 data points. If true, this makes MIT's Immersion exercise look like a child's toy.

That's a lot of info on your habits, purchases, likes and dislikes. Any savvy marketing department would be very well served by Acxiom's ability to garner such delicate insight into its customers. Acxiom is able to put together advanced individual profiles on all of our online, mobile and even offline selves.

Realizing that is still on the cusp of a future technology where it can predict consumer behavior, the c ompany is looking for more brain power in the form of recruiting away talent from the big boys - Microsoft, Google and Amazon.

Is anybody thinking of moving to a deserted island yet? Yeesh...

Third up - ADT Corporation (NYSE: ADT)

Perhaps the idea of having all your information floating around in cyberspace has you thinking about some protection and privacy. Your data is long gone and there's nothing you can do about it. The Snowden issue is but one tiny sliver of what's already out there.

ADT is the largest security services provider to residences and businesses, but is expanding beyond that to include other types of monitoring such as fire, carbon monoxide, flood and even providing personal medical alert monitoring.

But it doesn't end there. As an offshoot of "big data" growth -ADT is pushing heavily into web, smartphone and tablet applications with its ADT Pulse System. With the system a slew of monitoring, viewing and communicating data is now available at the owner's fingertips. The goal is a virtual Fort Knox- like environment driven by the smart device of your choice.

In the months ahead I'll have follow-up reports and delve into some of the more fringe players in what I am certain will become one of the dominant investment trends of our time - whether we want it to be or not.

By the way, if you use Gmail and want to see what Google knows about you, click here to try the Immersion tool for yourself. And, yes, you will have to fork over your email to do it.

If you think that's atrocious, don't hold your breath. Facebook just rolled out something called "Graph Search" which is designed to pre-sort Facebook's data pile into consolidated results unique to you and your "friends" - all 800 million of them.

And, finally, don't think for a minute that the actual search terms you key in aren't data, too. I'm sure the NSA will very interested in seeing who's searching for what about whom.

Betcha Snowden knows...

Source :http://moneymorning.com/2013/07/16/goodbye-privacy-big-data-is-coming-to-town/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.