Be Very Afraid Of The Stock Market, Amongst Other Things...

Stock-Markets / Stock Markets 2013 Aug 06, 2013 - 05:01 AM GMTBy: Michael_Noonan

We live in the Land Of Oz where the Wizard is in total control, and just as in the story of Oz, the Wizard behind the corporate federal government is just as hollow. The problem is twofold. 1. Most do not know they live as a fictional entity, [14th Amendment "citizens"], within a fictional government. All corporations are fictional entities, created by the State, and that, ironically enough, includes the State, at every level. 2. If 1. is somewhat on the radar of knowledge, those who reach level 2 still do not know that the Wizard is a phony, all-powerful, but in essence, powerless if people would only wake up.

We live in the Land Of Oz where the Wizard is in total control, and just as in the story of Oz, the Wizard behind the corporate federal government is just as hollow. The problem is twofold. 1. Most do not know they live as a fictional entity, [14th Amendment "citizens"], within a fictional government. All corporations are fictional entities, created by the State, and that, ironically enough, includes the State, at every level. 2. If 1. is somewhat on the radar of knowledge, those who reach level 2 still do not know that the Wizard is a phony, all-powerful, but in essence, powerless if people would only wake up.

The New World order has ensured that will not happen. People too openly opposed to the NWO scam often die mysteriously, from 2 presidents, assassinated, to a reporter who died in a car crash. Many simply disappear. That is the truth within the fictional Land Of Oz. [A third assassination was attempted on Reagan, he who wanted to reduce the NWO's federal government, but he survived. He then went on an incredible expansion of the impossible-to-shrink federal government. All was well, again, and he lived for many more days to come. After all, another assassination attempt may look suspect.]

We have Mr Snowden to thank for peeking behind the curtain and exposing what lies behind, all based on lies and deceit. The NSA spying on everyone, all around the world, not just in the United States. We posted an article earlier today on how yet more secret operations are being used against U S citizens, without their knowledge, and covered up so they are never supposed to know. [See U S Agents Illegally Setting Up Arrests of Citizens, click on http://bit.ly/13IqFk7].

Things like this are vastly more pervasive than most can imagine. Many of these illegal assaults go on every day at every airport by TSA agents, who are now spreading onto road stops. ["Do you have your papers, Comrade? Where are you going, and why?"] We could go on for pages, pointing out so many other facts about which almost all Americans are ignorant, and in that chosen ignorance will defend the government, the avowed enemy of the people, [so declared by your own government in the Trading With The Enemy Act, amended]. [We do not make any of this up.]

With the above situations in mind only recently being exposed, again thanks to Edward Snowden, it helps put what follows into a different perspective. Wall Street, the financial arm of the NWO, including the Federal Reserve, runs the government. As a consequence, this is why no bankers ever go to jail. Wall Street operates with impunity. Within the laughable Department of Justice, where the blind are leading the blind, Eric Holden has been unable to find any Wall Street wrongdoing since he has been in office.

Elect-me-and-I've-got-your-back Obama is on record, [again], stating: "What Wall Street is doing may be immoral, but it is not illegal." The leader of the federal government is telling everyone outside of Wall Street, "Tough titty." They protect their own.

This brings us to the reason for being afraid of the house-of-cards stock market, helium now replacing most of the volume as prices are inexorably pushed higher and higher via the privately owned Federal Reserve.

This is the Wall Street equivalent of the NSA and the SOD, rigging the markets with high frequency false quotes, all designed to front-run public, and no so public orders. Doing God's work has its rewards.

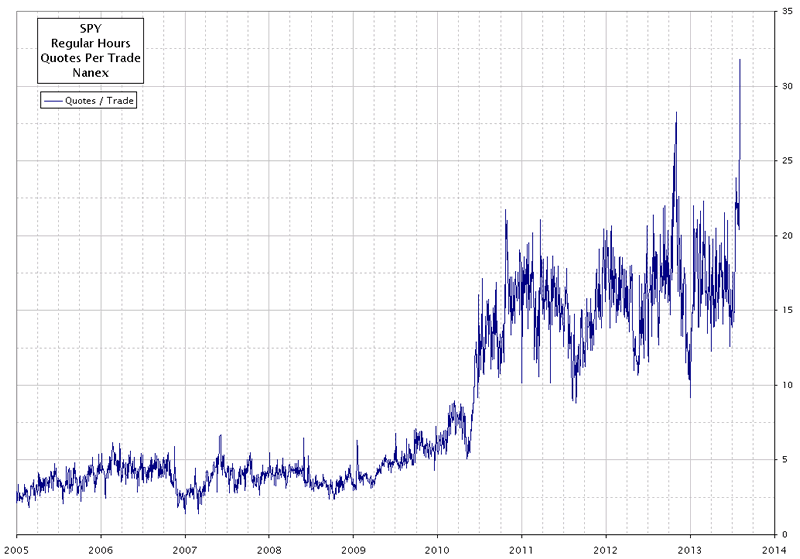

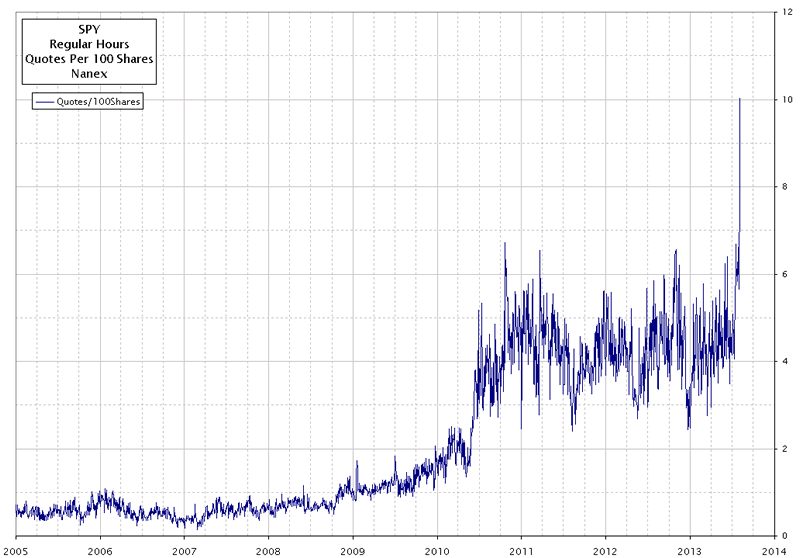

On the lowest volume in over six years, chart 3 has set a record for the highest number of quotes for SPY. Chart 4 also sets a record high in the number of SPY quotes per 100 shares. Who trades 100 share lots? The little guy, as it were. The game is rigged and set up so people fail financially as the Wall Street-sanctioned cheaters fleece everyone.

Wall Street and U S agencies have got you covered, but not in a good way.

From Zerohedge:

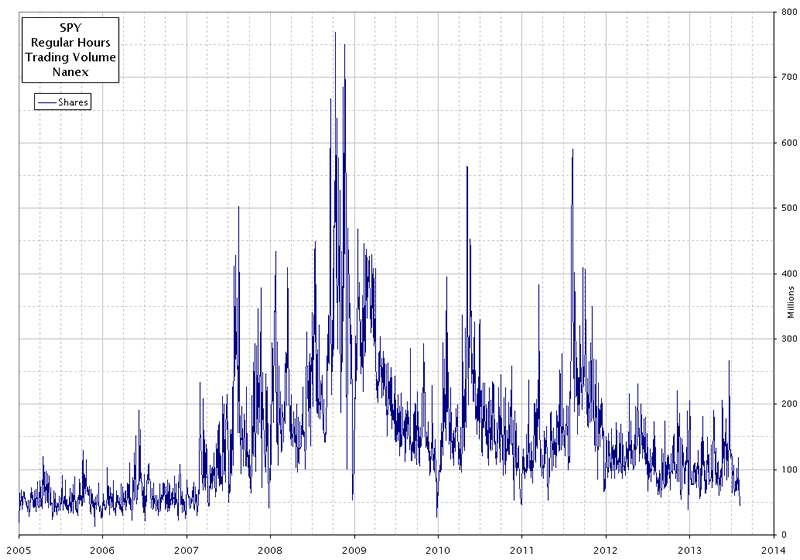

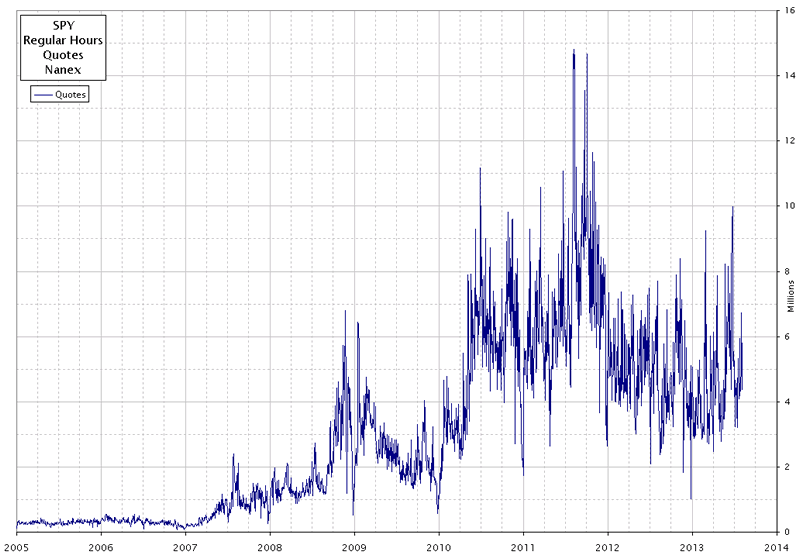

Nanex ~ 05-Aug-2013 ~ SPY Lowest Volume Since 2007. On August 5, 2013, SPY recorded the lowest non-holiday volume since February 16, 2007. August 5th also turned in a record high quote/trade ratio, as High Frequency Quote Spam persists. Charts below show daily counts of quotes and shares during regular trading hours in SPY from January 3, 2005 through August 5, 2013.

1. SPY Trading Volume (millions of shares).

2. SPY Quote Counts (millions). No record low.

3. SPY - Quotes Per Trade - New All Time Record.

4. SPY - Quotes Per 100 Shares - This ratio leaps to record highs.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2013 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.