War on the Horizon as Defense Stocks Outperform

Companies / Sector Analysis Aug 27, 2013 - 05:16 AM GMTBy: Clif_Droke

After two years of winding down the U.S. military's presence in Iraq and Afghanistan, the rumblings of war are being felt in Syria. Calls for American intervention in Syria's civil war have been increasing lately, especially after reports indicate that Syria's government used chemical weapons on civilians.

After two years of winding down the U.S. military's presence in Iraq and Afghanistan, the rumblings of war are being felt in Syria. Calls for American intervention in Syria's civil war have been increasing lately, especially after reports indicate that Syria's government used chemical weapons on civilians.

According to a Reuters /Ipsos poll, 60 percent of Americans surveyed said they don't favor the U.S. intervening in Syria, even if it's confirmed that chemical warfare is being used in that country. Only 9 percent believe President Obama should act now.

Regardless of what Americans want, it may well be war that they get. A prescient barometer for gauging the likelihood of military conflicts in the near future suggests war is on the horizon. The Dow Jones U.S. Defense Index (DJUSDN), a composite measure of defense stocks, has been one of the stock market's top performers this year.

Defense stocks are conspicuously outperforming the S&P 500 (see graph below), just as they did in 2001 in the months leading up to and following the 9/11 terrorist episode. During this same period the broad market as measured by the S&P 500 was suffering a bear market.

In 2001 the defense stocks clearly saw war on the horizon and proved to be an accurate barometer for the launching of Operation Enduring Freedom in Afghanistan in late 2001. This time around it's Syria that is the potential catalyst to another military escapade. Americans have clearly become weary of war, yet with the Federal Reserve's proposed strictures on monetary policy another war would act as a surrogate financial market and economic stimulus. This could provide the excuse needed to launch a military initiative in the near future, especially if the bond market continues to sag.

Also worth mentioning is that the 24-year cycle of war, a component of the 120-year Kress cycle series, is due to bottom late next year. Historically wars have been fought around this critical cycle bottom.

With the mainstream media continuing its almost daily focus on the alleged atrocities in Syria, the calls for another U.S.-led military intervention will only increase. Given the added incentive of a tightening monetary policy and continued weakness in the job market, Washington might just take the bait.

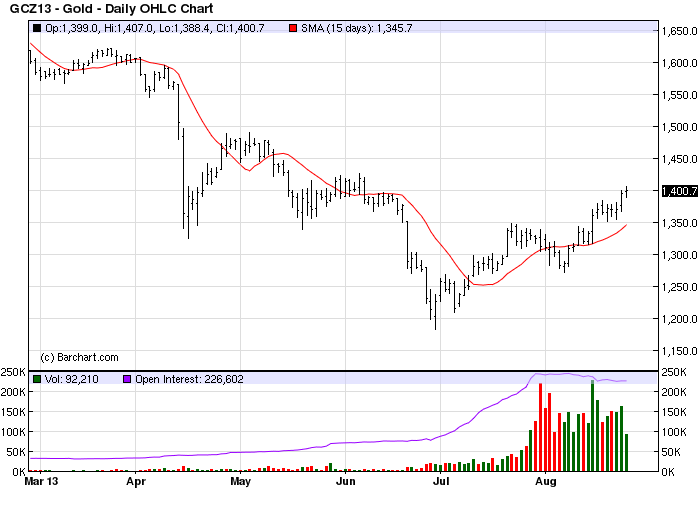

Gold

Investors continue to fear that the Fed will start to slow its $85 billion monthly asset purchases, with most predicting September as the beginning of the end of the aggressive quantitative easing (QE) program. This fear was manifested beginning in June as foreign investors sold U.S. Treasuries to the tune of $489 billion in that month alone. The annualized rate of Treasury notes and bonds sold over the last three months was $271 billion. In more recent days, Asian currencies have declined as investors fear tighter Fed policy will starve emerging markets of investment funds.

Although last week's FOMC minutes provided no concrete timetable for the slowing of QE3, the handwriting is clearly on the wall. Investors, particularly foreign investors, sense the end of the Fed's easy money policy is near and have acted accordingly by selling stocks and bonds. U.S. investors have been much slower to react but even they are beginning to sense that QE's days are numbered.

Concerns over the Fed's unwinding of its $85 billion/month asset purchase program have resulted in rising bond yields and weaker foreign currencies. In the past three months, large emerging countries such as Indonesia, India, and Brazil have seen their currencies drop 10 percent, 12 percent, and 15 percent respectively. The U.S. dollar has also been weak lately, which has provided support for gold prices. With a weak bond market and weak global currencies, gold is once again being viewed favorably by investors as a safe haven relative to other financial assets.

The holdings in the largest gold ETF, the SPDR Gold Trust (GLD), have increased to 914.12 metric tons since the trough of 909.33 metric tons as of Aug. 8, according to Sharps Pixley. Meanwhile, the demand for the 99.99 percent purity of gold, the benchmark spot contract in China, has been strong whenever prices drop, based on the data from the Shanghai Stock Exchange. However, the supply overhang of 217 tons, based on the data from the World Gold Council, is still large. Physical demand would need to stay strong to counter the excess supply, according to Barclays.

As we talked about in the previous commentary, some of gold's recent rebound can be attributed to safe haven demand; however, much of the rally is a result of the unwinding of short positions from the last couple of months. There are no guarantees when it comes to near term price predictions, but a test of the nearby $ $1,420-$1,425 benchmark area in the immediate-term (1-3 week) is also increasingly likely.

While some analysts are betting on even higher prices if this zone is overcome on the upside (on the assumption that additional short covering will be triggered), I recommend we play it safe and continue to raise stop losses on our conservative long position in the gold ETF - using the 15-day moving average as a rolling stop-loss guideline - in the event that this event fails to materialize.

2014: America’s Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to – and following – the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America’s Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form – namely the long-term Kress cycles – the worst part of the crisis lies ahead in the year 2014. The book is now available for sale at:

http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.