New Dow Components Enter Index on a Whimper

Stock-Markets / Stock Markets 2013 Sep 24, 2013 - 11:02 AM GMTBy: PhilStockWorld

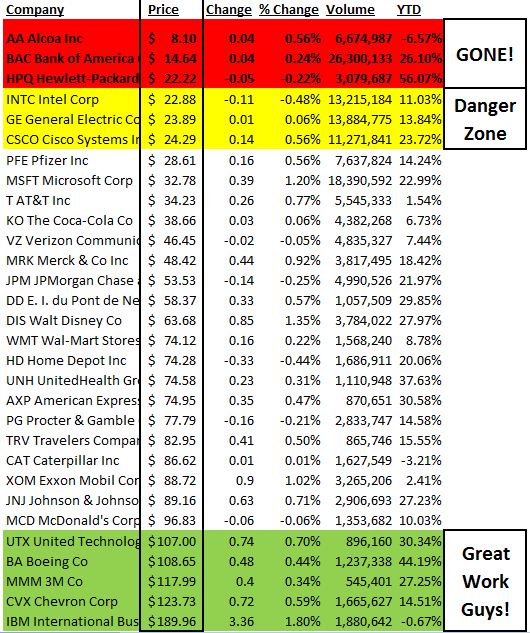

Welcome GS ($165), V ($196) and NKE ($69) - Goodbye to AA ($8), BAC ($14) and HPQ ($21).

Welcome GS ($165), V ($196) and NKE ($69) - Goodbye to AA ($8), BAC ($14) and HPQ ($21).

The changing of the Dow replaced $43 worth of stocks with $430 worth of stocks and, in the price-weighted index, this is a major shift of balance. Rather than over-analyze it, let's just say that it shifts the Dow to a far more consumer-spending orientation and GS pumps up the sensitivity to the banking sector. What we're taking away from, once again is the "Industrials" which, much like America, are barely a part of the Dow Jones Industrial Average anymore.

Consider the original Dow components and how much America has changed since 1896:

Only two companies in the index of 12 didn't have a national or local identifying name. All of the companies employed US citizens fairly exclusively and were a good mix of the US economy at the time. Now we have multi-nationals like XOM, JNJ, MSFT, P&G, V, etc. that do more business overseas than in America and don't even get me started on how many jobs are outsourced. Also, who let in the blood-sucking bankers (AXP, GE (half) GS, JPM, V)?

If Charles Dow and Edward Jones had wanted banks to qualify as "industrial" companies – I'm sure they would have found one at the time, right? In fact, not counting GE, who morphed into a semi-bank, it wasn't until May 6, 1991 when JPM was added to the Dow that the Banksters were given such a prominent seat at the table (AXP came in in Aug 1982 as the first Financial). C was added in November of 1999 and the index promply collapsed (cause and effect?) and Bank America was added in Feb 2008 and the index promply collapsed again.

Now we're adding GS and Visa, again at the top of a market, again at the peak of their values and we expect different results? The last two times Banks have been added to the Dow Jones at tipping points – points at which their excesses have become so extreme that they begin to damage the broad economy. In Forbes last week, there was an article featuring Goldman Sachs proclaiming "It's Time for the 99% to Give Back to the 1%" and it would have been funny, had they been joking. In fact, in all seriousness they say:

Here’s a modest proposal. Anyone who earns a million dollars or more should be exempt from all income taxes. Yes, it’s too little. And the real issue is not financial, but moral. So to augment the tax-exemption, in an annual public ceremony, the year’s top earner should be awarded the Congressional Medal of Honor.

I'm not going to rip this idiocy apart, Matt Taibbi does an excellent job of it in Rolling Stone this week. The main point is that we've once again gone too far and, once again, we're adding to the prominence of Banksters instead of beating them back into the darkness from whence they sprang.

Like it or not, the Dow Jones is the Index that represents America to the rest of the World, when it goes down, we go down and adding GS (up 200% since 2009) and V (up 400% since 2009) at this point in their cycles and giving them far more weight than the BAC they are replacing is a recipe for disaster.

So why was it done? Well, now Lloyd Blankfein and Jamie Dimon can stare down Congressional Investigators and sneer: "Hurt us and you hurt the United States of America!" Too big to fail has already proven too big to jail (though, in JPM's case, not too big to fine) and now they've manouvered themselves to the point where action against these Banksters would have immediate negative repurcussions on the stock market. In short, they have us by the balls or, as Taibbi concludes about Goldman Sachs:

So even forgetting the fact that this company on a good day makes its money rigging metals prices, stage-managing IPOs to help insiders, falsifying documents, selling phony mortgages to institutional investors while betting against their own product and engaging in highly dubious high-speed proprietary trading programs that mysteriously allow the firm to pick winners every single time – even all that wasn't enough, and Goldman still would have gone out of business, had all of us parasites not been pressed into service to rescue the company with our tax dollars.

This is not the same as putting the inmates in charge of the asylum – this is more like putting the disease in charge of your well-being. It's our economy's and our society's well-being that's at stake here and weighting us more towards reliance on the Financials, who produce nothing at all and, in fact, suck the profits out of other productive enterprises – is a huge step in the wrong direction for this country. Again…

Meanwhile, they put Cramer in a suit and have him hosting the morning BS on CNBC so the market must be in trouble again and they need the sheeple to BUYBUYBUY while the Banksters and Fund managers head for the exits (the advance/decline volume was 1:2 yesterday). We're not expecting a big dip this week (see yesterday's post for Fed schedule) but a rising Dollar is going to spell trouble for the indexes and commodities this morning (see morning note to our Members).

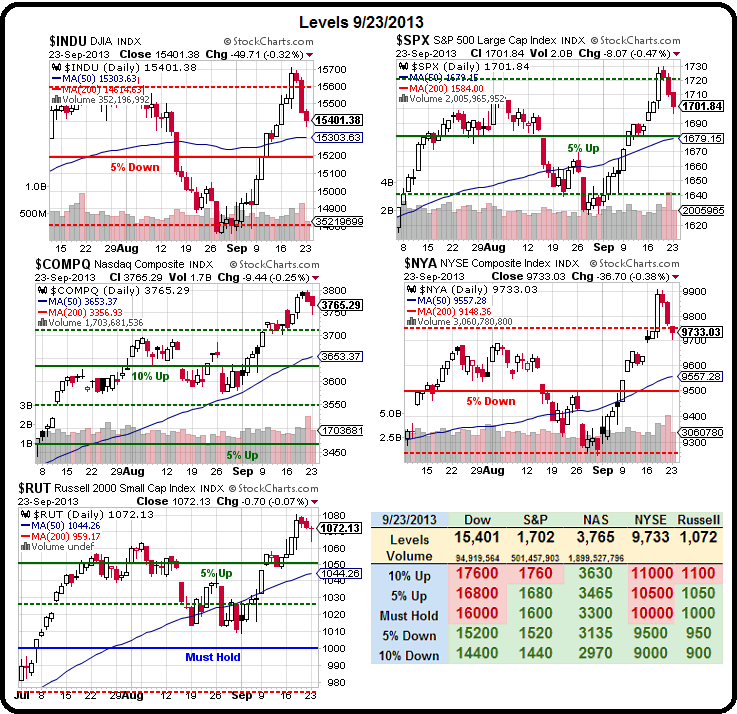

As you can see from our Big Chart, we had a run from Dow 14,800 to 15,700 (6%) which was a 1% overshoot of a 5% move and we look for a 1% pullback not from 15,700 but from 14,800 x 1.05 = 15,540 and 99% of 15,540 is – TA DA! – 15,384 and where did we bottom out yesterday – TA DA! – 15,384. This is just math folks….

The S&P had a trip from 1,630 to 1,730 (6%, what a coincidence) and that makes 1,695 our watch line and yesterday's low was – TA DA - 1,695 (see Dave Fry's SPY chart). This is about whether we are breaking down here or forming an "M" pattern that takes us to another test of the highs at the end of the week – that will be determined today and, given it's the end of the quarter and give that manipulative criminal organizations like JPM and GS are worshipped in our society, I'd bet on that "M" being formed – and there will be hell to pay in October as earnings disappoint.

AAPL saved the Nasdaq and that's another thing the worshippers of squiggly lines fail to take into account – mitigating factors! AAPL went up – TA DA! – 5% yesterday and, at 14% of the Nasdaq, that was good for +0.7% of the indexes -0.25% loss so a non-linear thinker would see that the Nasdaq would have dropped 1% had it not been for the intevention of AAPL.

Since we are math guys, our 5% Rule™ tells us that the Nas bottomed out at 3,575 and 1.05 x that is 3,754 and 3,745 was yesterday's low but we held that and it's not a big deal of a breakdown until we fail 3,718 (4% over the Aug low) but, if we subtract AAPL's 0.75 from the Nasdaq we end up at 3,727 – a lot closer than it looks on the chart but, like the Dow and the S&P, still holding the line!

Isn't math fun? The NYSE came up from 9,250 all the way to 9,900, a 650-point run that was 7%, but they fell harder, all the way back to 9,733, which is just about 5% over that bottom and 1.04 x 9,250 = 9,620, which looks safe so far.

That brings us, finally, to the Russell, which had a wild ride from 1,010 to 1,080 and that's 7% like the NYSE but, unlike the NYSE, the RUT recovered from the 1,063 back to 1,070 (up 6%) that it's not worth mentioning. 1,010 x 1.04 = 1,050 and that's been the 5% line on the Big Chart all year so – let's hope it holds!

Keep in mind, our 5% Rule™ told us these levels a month, even months before they happen. It's not voodoo, you don't need to draw lines on charts with the blood of a servant to divine the direction – IT'S JUST MATH – and the system works best in Bot-driven markets where machine code drives the results, not people. That's exactly the kind of market we're trading in – and guess who has their finger on the buttons that control the machines?

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.