Tesla Motar: Where Retail Investors Rushing in and Nest Eggs Cracking

Companies / US Auto's Sep 29, 2013 - 12:03 PM GMTBy: EconMatters

Every year there seems to be a few momentum stocks defying logic, reality while bleeding all shorts getting in the way. This year, Tesla Motor (Nasdaq: TSLA) is one such stock which hit $188.64 on Friday, Sept. 26. We are talking about a $35ish stock just on Jan. 2, 2013, and the company only reported its FIRST EVER profitable quarter in May. Goldman Sachs (GS) did do a reality check on Tesla's margin in July, and the stock did go down by $18.21 in one day on July 15.

Every year there seems to be a few momentum stocks defying logic, reality while bleeding all shorts getting in the way. This year, Tesla Motor (Nasdaq: TSLA) is one such stock which hit $188.64 on Friday, Sept. 26. We are talking about a $35ish stock just on Jan. 2, 2013, and the company only reported its FIRST EVER profitable quarter in May. Goldman Sachs (GS) did do a reality check on Tesla's margin in July, and the stock did go down by $18.21 in one day on July 15.

However, a forgiving market with crazy liquidity (thanks to Fed's infinite QE), investors just blew GS off and the stock's never looked back.

|

| Chart Source: Yahoo Finance, Sept. 28,2013 |

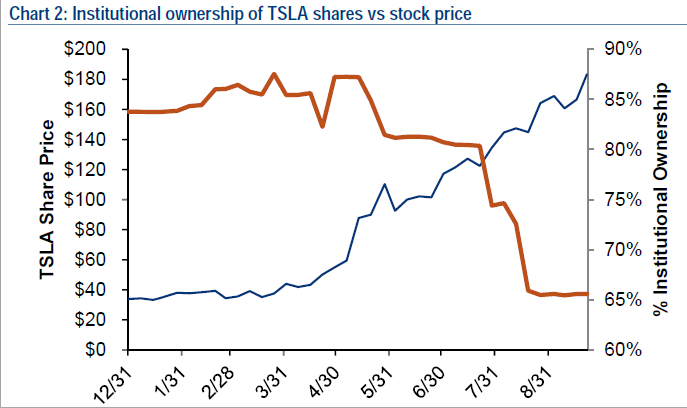

Now the latest Tesla warning came from BofA Merrill Lynch dated Sept. 23 -- Smart-money big boys are getting out of Tesla, and guess who are the buyers...Retail Investors!

"Institutional ownership of Tesla stock has faded throughout 2013, from approximately 84% of shares held in January to about 66% today. As a result, it now appears that retail investors are playing an increasing role in driving the stock price higher and could be at risk when a correction, which we believe is long overdue, ultimately occurs."

More importantly, BofA Merrill Lynch thinks Tesla price objective (PO) should be at $45! (That's 76% lower than the closing price on Friday.)"We continue to view Tesla shares as vastly overvalued and maintain our $45 PO, which is based on a 2015e EV/EBITDA multiple of about 12X (currently 12.7X). We note that our valuation multiple is relatively consistent with the simple average of 2015 EV/EBITDA multiples for a group of 35 growth oriented tech companies, based on consensus estimates."

|

| Chart Source: BofA, Bloomberg |

The reason for such pessimistic view on Tesla going against the market herd? BofA noted:

We estimate that Tesla’s current share price implies approximately 628K vehicle sales in 2020 (versus an estimated 21K in 2013).....Generating luxury margins on a mass market vehicle is likely to prove incredibly challenging, and represents another major hurdle to the bull case, in our view.

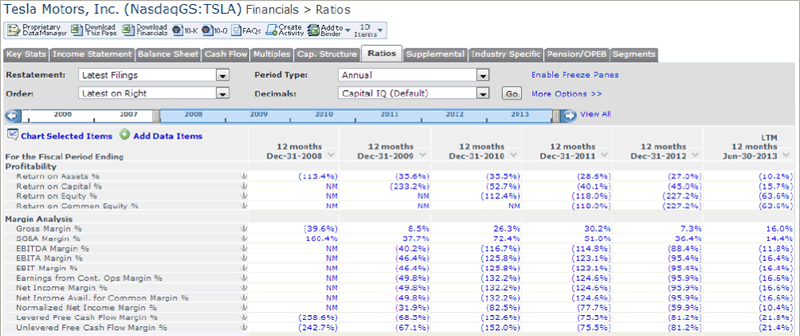

In other words, the current valuation might remotely be reasonable if Tesla were the only game in town without the competition from GM, Toyota and BMWs. Fundamentally, I can see why even a typical bull like GS would have concern -- TTM financial ratios related to profitability and margins of Tesla are ALL NEGATIVE or meaningless since 2008! (See Screen Shot from S&P Capital IQ) Does This Look Like a $188 Stock to you?

|

| Source: S&P Capital IQ |

Some analysts argued that Tesla requires an unconventional approach to valuation due to Tesla's special 'advantages'. However, I think the current price point of Tesla stock is unlikely to be justified by any reasonable and logical model, however unconventional it needs to be. And it looks like a lot of the institution smart money investors agreed and have already cashed out judging from the BofA analysis. Approaching it from a common sense point of view, Tesla is already exhibiting signs of a bubble when you see quotes like this:

“It’s what Marty McFly might have brought back in place of his DeLorean in Back to the Future.” ~ Consumer Reports, May 2013

And when Tesla’s chief designer, Franz von Holzhausen, pulled out the Apple and 'iPhone Moment' card when he tried to explain why the car has a touchscreen:

“It’s like the leap of faith Apple (AAPL) took with the iPhone. The screen is the hero. We are in the midst of that transition toward a new way of thinking. For me, it’s that iPhone moment.”

My take is that it seems a pretty smooth move implying Tesla, essentially an auto maker in the manufacturing sector, is a 'peer' of Apple, an international icon tech company. The Christian Science Monitor (CSM) just published an interesting article questioning how Tesla could be worth almost half (46%) of General Motors in terms of market cap. This caught my eyes because typically CSM is not a site where you find articles talking about stock valuation. As such, CSM did not cite the financial lingos such as forward PE, etc, but rather based it purely on the fact that

"GM has built over 450 million cars in its 105 years while Tesla has made about 25,000 over 10 years." A lot of times, the most basic question is usually the most important one that retail investors should ask before getting into Tesla.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2013 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.