Gold Price Forecast to Fall to $1180

Commodities / Gold and Silver 2013 Nov 07, 2013 - 03:18 PM GMTBy: Gregor_Horvat

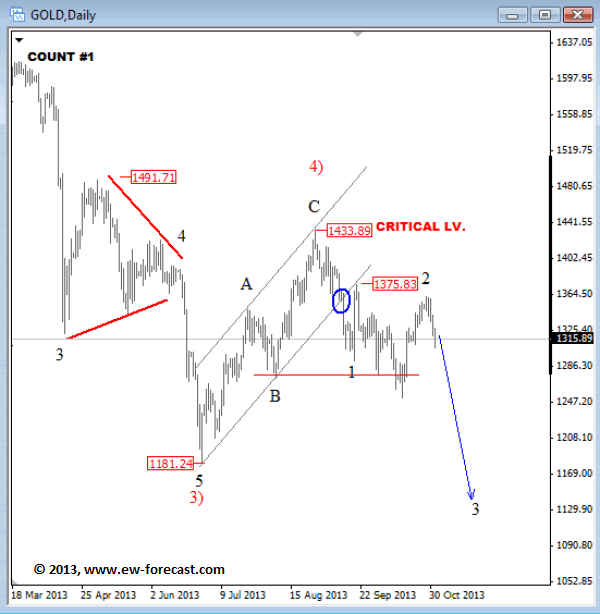

GOLD reversed sharply to the downside at the start of September, through the rising trend line of a corrective channel. As we know that's an important signal for a change in trend, which means that bearish price action is now back in view that could accelerate to the downside in the next few weeks if we consider possibly completed flat correction in wave 2. A fall and daily close beneath 1251 is needed for a wave 3 down back to 1180.

GOLD reversed sharply to the downside at the start of September, through the rising trend line of a corrective channel. As we know that's an important signal for a change in trend, which means that bearish price action is now back in view that could accelerate to the downside in the next few weeks if we consider possibly completed flat correction in wave 2. A fall and daily close beneath 1251 is needed for a wave 3 down back to 1180.

GOLD Daily Elliott Wave Analysis

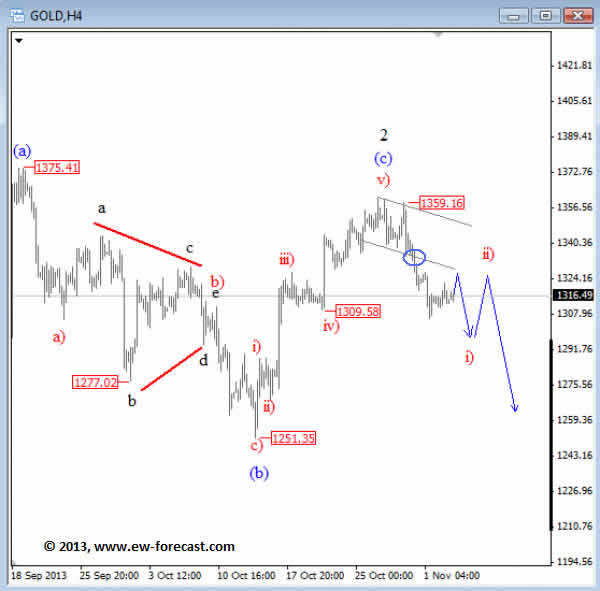

On the 4h chart below we can see recent reversal down from 1360 where a five wave move from 1251 probably accomplished that flat correction in wave 2 as mentioned and presented on the chart above. Notice that current weakness also extended through the small base channel line (blue circle) which usually occurs in impulsive price action. With that said, further weakness is expected as we think that price is in now moving lower in red wave i) that may find a support around 1280-1290 and then will make a retracement up in red wave ii) which could be a very good position for short opportunity.

GOLD 4h Elliott Wave Analysis

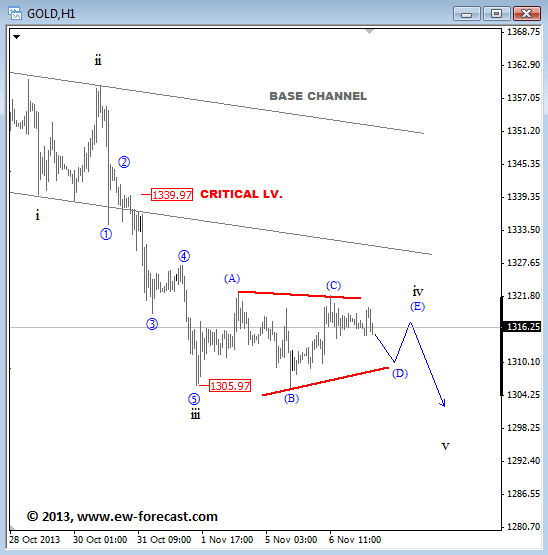

On Intraday Chart GOLD was slightly higher yesterday but price did not go beyond the wave (A) so a triangle in wave iv remains valid count. Waves (D) and (E) yet to come before we go down, through 1305 support that will open the door for 1290.

Written by www.ew-forecast.com | Try our 7 Days Free Trial Here

Ew-forecast.com is providing advanced technical analysis for the financial markets (Forex, Gold, Oil & S&P) with method called Elliott Wave Principle. We help traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our view and bias as simple as possible with educational goal, because knowledge itself is power.

Gregor is based in Slovenia and has been in Forex market since 2003. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets; from candlestick patterns, MA, technical indicators etc. His specialty however is Elliott Wave Theory which could be very helpful to traders.

He was working for Capital Forex Group and TheLFB.com. His featured articles have been published in: Thestreet.com, Action forex, Forex TV, Istockanalyst, ForexFactory, Fxtraders.eu. He mostly focuses on currencies, gold, oil, and some major US indices.

© 2013 Copyright Gregor Horvat - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.