Gold Price Corrective Rally Before Turning Lower

Commodities / Gold and Silver 2013 Nov 14, 2013 - 12:54 PM GMTBy: Gregor_Horvat

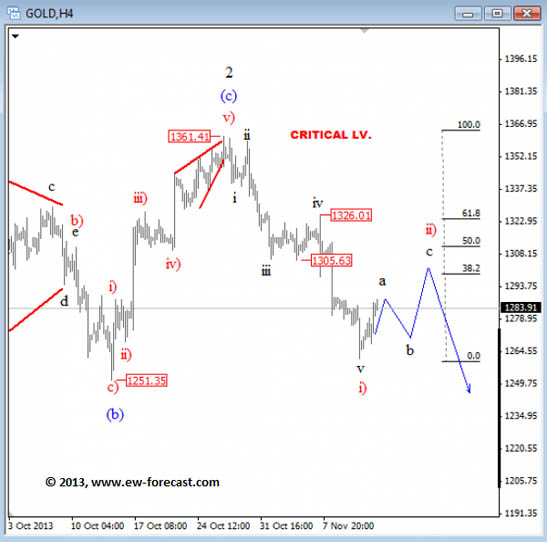

GOLD 4h

GOLD 4h

GOLD finally found some support and it seems that price is now at the start of a larger three wave retracement in wave ii) back to 1305-1326 region. As such, be aware of a slow and choppy recovery in the next few days before downtrend resumes. From a timing perspective, this wave ii) could complete the path on Monday or Tuesday.

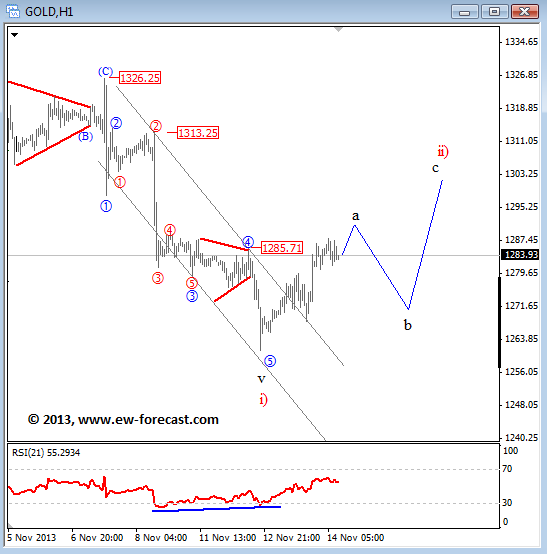

GOLD Intraday

GOLD retraced back to 1285 highlighted yesterday after completed five waves down, followed by a recent push out of a downward channel which we think is causing wave a up, first leg of a three wave rally in wave ii).

Elliott Wave Education: Motive And Corrective Wave

Elliott’s pattern consists of motive waves and corrective waves. A motive wave is composed of five subwaves and always moves in the same direction as the trend of the next larger size. A corrective wave is divided into three subwaves. It moves against the trend of the next larger size.

A picture above shows, these basic patterns build to form five and three-wave structures of increasingly larger size (larger “degree,” as Elliott said).

Waves 1, 2, 3, 4 and 5 together complete a larger impulsive sequence, labeled wave (1). The impulsive structure of wave (1) tells us that the movement at the next larger degree of trend is also upward. It also warns us to expect a three-wave correction — in this case, a downtrend. That correction, wave (2), is followed by waves (3), (4) and (5) to complete an impulsive sequence of the next larger degree, labeled as wave 1. At that point, again, a three-wave correction of the same degree occurs, labeled as wave 2.

Note that regardless of the size of the wave, each wave one peak leads to the same result a wave two correction.

Within a corrective wave, subwaves A and C are usually smaller-degree impulsive waves. This means they too move in the same direction as the next larger trend. (In Figure 2 below, waves A and C are in the same direction as the larger wave (2).) Note that because they are impulsive, they themselves are made up of five subwaves. Waves labeled with a B, however, are corrective waves; they move in opposition to the trend of the next larger degree (in this case, they move upward against the downtrend). These corrective waves are themselves made up of three subwaves.

Written by www.ew-forecast.com | Try our 7 Days Free Trial Here

Ew-forecast.com is providing advanced technical analysis for the financial markets (Forex, Gold, Oil & S&P) with method called Elliott Wave Principle. We help traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our view and bias as simple as possible with educational goal, because knowledge itself is power.

Gregor is based in Slovenia and has been in Forex market since 2003. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets; from candlestick patterns, MA, technical indicators etc. His specialty however is Elliott Wave Theory which could be very helpful to traders.

He was working for Capital Forex Group and TheLFB.com. His featured articles have been published in: Thestreet.com, Action forex, Forex TV, Istockanalyst, ForexFactory, Fxtraders.eu. He mostly focuses on currencies, gold, oil, and some major US indices.

© 2013 Copyright Gregor Horvat - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.