Gold Bullion - Indian Paying Equivalent $1,565 Per Ounce For Physical Gold Bullion

Commodities / Gold and Silver 2013 Nov 14, 2013 - 06:07 PM GMTBy: Jesse

“Let us not, in the pride of our superior knowledge, turn with contempt from the follies of our predecessors. The study of the errors into which great minds have fallen in the pursuit of truth can never be uninstructive...

“Let us not, in the pride of our superior knowledge, turn with contempt from the follies of our predecessors. The study of the errors into which great minds have fallen in the pursuit of truth can never be uninstructive...

Hitherto no difficulty had been experienced by any class in procuring specie for their wants. But this system could not long be carried on without causing a scarcity. The voice of complaint was heard on every side, and inquiries being instituted, the cause was soon discovered. The council debated long on the remedies to be taken, and [John] Law, being called on for his advice, was of the opinion, that an edict should be published, depreciating the value of coin five per cent below that of paper.

The edict was published accordingly; but, failing of its intended effect, was followed by another, in which the depreciation was increased to ten per cent. The payments of the bank were at the same time restricted to one hundred livres in gold, and ten in silver. All these measures were nugatory [pointless] to restore confidence in the paper, though the restriction of cash payments within limits so extremely narrow kept up the credit of the Bank.

In February 1720 an edict was published, which, instead of restoring the credit of the paper, as was intended, destroyed it irrecoverably, and drove the country to the very brink of revolution...”

Charles MacKay, Extraordinary Popular Delusions and The Madness of Crowds

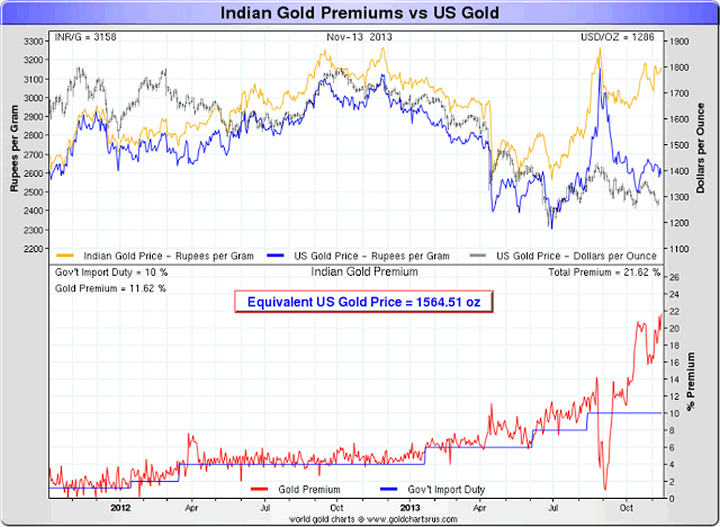

When the Reserve Bank of India and the government tried to staunch gold imports by increasing duties and limiting supply in order to help their western central bank counterparts, who were deeply embarrassed by their inability to return Germany's gold, the experiment in currency controls had the effect of making the premiums paid for actual gold jump to 21.6% over western paper 'spot' prices.

What good is a 'spot price' for gold if it is just a construct derived from the paper gold price on the increasingly gold deficient Comex, and not from a physically transacting market? And what good is a price set on a so-called physically transacting market like the LBMA if it is done in secret, with leverages said to be approaching 100 to 1?

Recent revelations about the manipulation of price benchmarks, from LIBOR to derivatives to basic commodities, seem to have knocked the efficient market hypothesis into a cocked hat, which is where it always belonged, if the dustbin was full. Markets are naturally efficient to the extent that men act naturally like angels.

Here is an interview that Tekoa da Silva recently conducted with an Indian gold dealer about the future of demand for physical gold in India, which he believes will be strong, and more importantly, why.

Let's see, if one region of the world is willing to pay, for substantial amounts, a 21% premium for a physical commodity that is easily transportable, what might an astute economist predict would happen?

The 'average person' might expect them to predict a substantial flow of that commodity from west to east. And that does seem to be the case if one looks at the data which is available. Gold Seen Flowing East As Refiners Recast Bars For Asia.

These days, however, far too many economists, analysts and pundits see what they have been told to see, by whomever is paying them. Academia, politics, and the media are not naturally efficient, for the same reasons as markets.

Is it any surprise that in a culture that glorifies personal greed and the arrogance of power, virtue is in scarcity and deceit becomes routine? Bad behaviour can drive out the good, until a system or culture can become a festival of shamelessness, and a feast for predators.

India is not an isolated example. The situation is simply worse there for the moment because some Indian officials are historically compliant to Anglo-American interests. But China, Russia, Latin America, and the Mideast are increasingly less complacent to be so ill-used these days.

Change is happening. And there may be some significant volatility associated with this historic difference of objectives and opinions about what value is, and how and by whom it is set.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.