Investing - Can You Have Too Much of a Good Thing?

InvestorEducation / Learning to Invest Nov 26, 2013 - 05:35 PM GMTBy: Don_Miller

I have received numerous emails from subscribers asking about individual stocks and how much they should buy. While I am not licensed to give individualized advice, each time I read these questions, the experiences shared seem eerily similar to my own.

I have received numerous emails from subscribers asking about individual stocks and how much they should buy. While I am not licensed to give individualized advice, each time I read these questions, the experiences shared seem eerily similar to my own.

, Back in 2008 many retirees had their CDs called in overnight. They had a large amount of cash and an urgent need to do something to recover the 6%, low-risk income that no longer existed. Many thought moving all of their capital into the stock market was all that they needed to do. Oh boy, they were in for a surprise.

Seniors and retirees have to invest differently than other folks. Since they are no longer working, their risk tolerance is much lower than folks still drawing a paycheck. On top of that, the resources out there about portfolio allocation lack something investors need. Nearly every model portfolio is presented as a pie chart with a certain percentage in various sectors. They make sense, but it's definitely not the whole story.

These allocations are too general to fit everyone’s needs. Every retiree needs his own, custom-fit portfolio allocation. For example, my wife owns part of a farm that has been in her family for over a century. She might be able to put more capital at risk than someone without a farm or similar asset to fall back on.

If an investor has a hard asset such as gold, silver, or farmland, and he has no intention of selling, these are considered “core holdings.” Core holdings serve a different purpose than a stock, mutual fund, or exchange-traded fund (ETF) that deals in precious metals or agricultural land, namely short-term profit. In short, while a hard asset and a stock might be in the same sector, they do not fit into a portfolio in the same way.

In order to flesh out this idea, I went back to Abraham Maslow’s hierarchy of needs, something I had studied years ago. His pyramid became the basis for our investment pyramid, which is broken into three groups: Core Investments, Security, and Speculation. Core investments ensure survival; Security ensures survival for tomorrow (and the day after); and Speculation – the smallest and most high-risk section – funds the “something more” in life.

Core Holdings: Don’t Bet the Farm

Core investments are at the bottom of the pyramid. These are the most low-risk investments; they keep a roof over your head and food on the table. This section might include gold, silver, and/or interest in a family farm or some other valuable asset. These are assets we hope we never have to sell or use. Don’t confuse them with precious metals, or precious-metal stocks and ETFs, which are purchased for the purpose of selling at a future date at a profit. These would be allocated in other sections of your pyramid.

Security: Survival for Tomorrow

Security is the largest segment of the pyramid. These investments should provide income and growth, and are the primary catalyst for maintaining our portfolio over the long haul.

Because this section is quite large, it is color coded with green, yellow, and pink to indicate increasing levels of risk. Look for the color code assigned to each company in our portfolio.

For example, consider two different drug companies that have had excellent financial results for the last few years. One might have multiple new patents, while the other might have soon-to-expire patents on their top moneymakers. The first company would probably be a lower-risk investment and coded green accordingly. We might still recommend the higher-risk company, as it could have additional profit potential such as new drugs in the pipeline, but we would color code it differently.

Keep in mind that our risk code might not correspond exactly with your risk tolerance. Personal risk tolerance is largely subjective, so you can certainly adjust our categories to fit your situation. In our monthly newsletter, we decide on the risk level of each investment, and if our readers disagree, we encourage them to code it as they see fit. After all, it is their money. Part of enjoying retirement is sleeping well at night without breaking out in a sweat, worried over your portfolio. Be honest with yourself about your risk tolerance and invest accordingly.

Speculation: Enjoying Life’s Bonuses

Speculation provides the “something more” in life. It’s limited to a small number of high-risk, high-reward opportunities. The size of an investor’s speculation section depends a good deal on age and personal risk tolerance. Folks in their 30s have a lot more time to recover if a speculative pick goes sour than an investor who’s already contemplating retirement. Yet a couple of good experiences in this section can have a huge positive impact on an entire portfolio, so retirees should not neglect it. We recommend speculating with no more than 10% of one’s entire portfolio if you are close to retirement or already there.

We encourage our readers to tend to their core holdings first. After all, if you don’t have anything to eat, not much else matters. After that, do your own due diligence to flesh out the Security and Speculation sections of your portfolio. Our monthly publication, Miller's Money Forever, offers many recommendations for these sections.

Step One

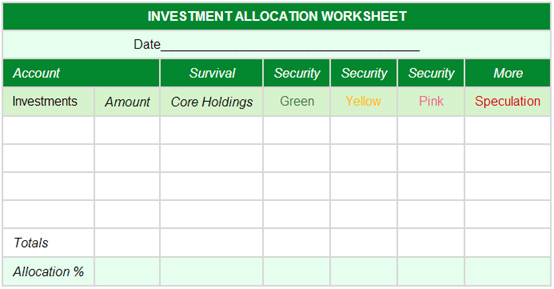

It’s easy to miss the forest for the trees. Individual stocks can be so exciting that we forget to step back and look at the big picture. Personally, I do this by taking a sheet of accounting paper and heading columns across the top: Core Holdings, Security, and Speculation.

Then I list all of my investments in the appropriate column. This tells me how well my portfolio is allocated.

The first time I did this, I was over-allocated in the Speculation section, so I needed to reallocate my investments. That’s not something you have to or should do all at once. Hasty investing is never a good idea, but you do need a clear picture of where you are before you can start making the right changes.

A balanced portfolio, however, needs more than the right allocation of risk. It also needs a balanced allocation across sectors. It is not unusual to be overly allocated in the technology sector or metals and mining stocks. If an entire sector heads south, you don’t want a huge portion of your portfolio to go with it.

After you have allocated your existing portfolio, then it’s time to think about adding new investments. Start by looking for holes, and then look for investments to fill them. There’s no need to jump at every exciting opportunity that comes along. An investment is only good if it’s right for your portfolio.

This is where newsletters – Miller's Money Forever included – come in. If you need a solid technology stock, check our portfolio. And if you have a large enough portfolio to add even more depth in technology or any other sector, find a trusted, sector-specific newsletter with additional recommendations.

First and foremost, the Money Forever team is here to teach our subscribers how to thrive during retirement. Our portfolio is filled with recommendations appropriate for baby boomers and retirees, and we are always open for questions from our subscribers, so consider trying out Miller's Money Forever with a 90-day risk-free trial today. You'll get access to all of our recommendations, as well as articles and materials to keep you on the right track for your retirement.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.