Silver Charts Offer Most Reliable Information

Commodities / Gold and Silver 2013 Dec 21, 2013 - 07:31 PM GMTBy: Michael_Noonan

The most reliable information is still found in the charts.

The most reliable information is still found in the charts.

Last week, we said to look at Bitcoin as an example of what to expect for silver, in terms of a market moving higher with impunity in a very short period of time, See Market Coming To An End, 18th paragraph. Ironically, reference to Bitcoin for its unfettered rise from just a few dollars to over $1,200, then just a few days later, the U S Treasury's Financial Crimes Enforcement Network decided to send notice to businesses that transact in Bitcoin that such activity may be considered in the arena of money laundering and that businesses "may have to comply with federal law and regulation as money transmitters, a Treasury spokesman said," and Bitcoin fell hard.

Nothing official, mind you, and no laws have been broken, but this central government operates on threat, imagined or otherwise, in order to have all underlings fall into line, and obey or else. Just like all the computer tech companies compliantly bent over for the NSA and provided any and all information, and more upon "request," businesses are doing the same government two-step and shutting down Bitcoin use.

Next day, China announces a ban on Bitcoin. The Peoples Republic of China makes no bones about squashing anything that may compete with its currency, and Bitcoin has dropped from the $1240 level to $455, recovering somewhat since.

Bitcoin still serves as an example of what can happen to silver once the central banker constraints lose their grip. The crypto-currency has no history as does silver and gold, yet it captured the world's willingness and hunger to use something other than existing fiat as a means of escaping from the elitist-controlled tentacles of Western central bankers.

The fact that the U S Treasury stepped in, unofficially but with equal effect, demonstrates what we have been saying about the elephant in the room few are addressing: central governments and their active suppression of precious metals. We maintain that their grip remains as tight as ever. It may be close to ending, at some unknown point, but it does not appear to be anytime soon.

Therein lies the problem for silver and gold. Look at how quickly businesses folded at the mere "suggestion" that they may have to comply with federal law and regulation as money transmitters. Did any of the businesses tell the Feds to get a court order, first? Hell no. Tyranny is alive and well in the Obama administration, as it was in the Bush administration, and as it will continue with the next administration, getting progressively worse each and every year. The revelation by Snowden was a shock to the entire world as everyone got a huge peek behind the elitist's federally controlled government.

Americans have no backbone when it comes to making a stand against its Orwellian government. None. This country was founded on a revolution against tyranny, but the forces of evil never stopped, and 200 years later, the same genesis of tyrannical control have won. They just took a different path, and no once noticed or stood in their way.

The point to be made is to demonstrate how powerful these hidden controlling forces are. It is these same forces that have put the silver market back in its place, as it were, by any and every means necessary. Sure, the manipulation game has been exposed, but who on Wall Street or in the federal government has suffered any consequences?

This past week, we have read more and more information about how the supply of silver on every level, from mining to almost-empty COMEX warehouses, at all time lows. Some of the articles are quite impressive. Most are still calling for much higher prices, eminently, anytime from a year ago to next week, month, or year. Despite the dismal record for timing and direction, article writers repeat the same message until eventually, they will get it right.

The elitists and their central controlling governments simply do not care what the numbers are, do not care what you or any articles say or think. What they care about is control and maintaining that control, and we know of no single force that will eliminate that control, except one: self-destruction.

We have said repeatedly, history is on the side an uninterrupted line of fiat failures and the ultimate reversion back to silver and gold. The problem is that all of the fiat failures took more time than most thought possible and did more damage than most feared before financial stability returned.

This is why we keep referencing the charts, and we know there are several smart people who have no use for a chart depicting paper manipulation. Unless and until we see someone present a better alternative, it is all that is available. So what if there is a premium of some physical gold transactions over paper? The premium still relates back to the paper price. Plus, the amounts of gold being traded are by the tonne and stamped with known and accepted purity, [and tungsten-free].

The Chicken Little "financial sky is falling" is wearing thin. Will it happen? Without a doubt. When will it happen? That is the question no one can answer. The shift has already changed over to 2014 as the inevitable end for central bank control. It may be possible, but momentum says manipulation could extend further in time.

One thing is certain: the end is near, and fiat currencies are likely to implode and cause enormous financial ruin for those unprepared. It is crucial, now more than ever to be buying physical silver. Precious metals are the last asset class standing, still languishing at the bottom of the pile. Housing took off. The art market is still soaring. The stock market is breaking into record high territory. Even the wine market is breaking records.

What of silver and gold? Both with the largest, legitimate record demand remain constrained by the unnatural forces of planned manipulation. Their time will come, and when it does, the unleashed built-up forces will meet, maybe even surpass all expectations. If Bitcoin can go from under a dollar to over $1,240 in a few short years, the demand for a more recognized and historically reliable pricing asset, like silver, will pay off hugely for holders of the physical.

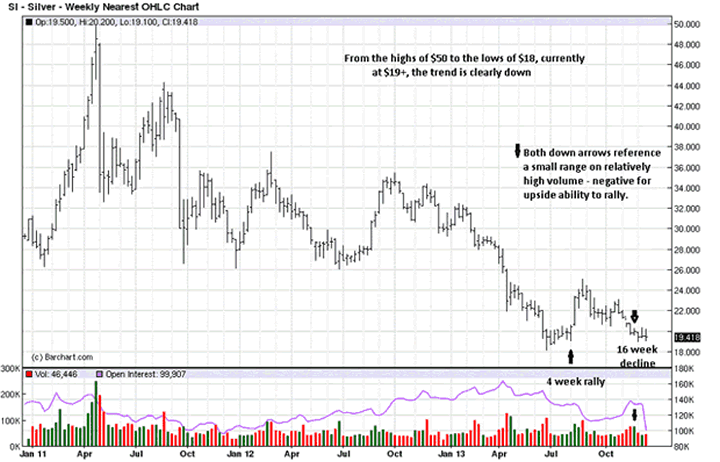

As to what the charts say, short of a surprise V-type bottom, where price advances rapidly, without building a base, we see no ending action to the current decline in silver. Once price reaches a bottom, and silver seems nearer to a bottom since the $50 highs, it can take several months, even a year or more, to build a base from which to launch a sustained rally.

These are abnormal times, and how price develops, moving forward, may be subject to some abnormal moves. We are talking about the paper market, to which the physical market is still tied, however loosely, and we hold no illusions that the paper market controls the physical. Rather, central banks have no counter parts to the influence they exert. China may be an enabling offset as it builds even greater eventual counter force, along with the BRICS nations and others gladly joining.

The most important factor for any market is the direction of the trend showing the prevailing momentum. For silver, the trend remains down. Before any market in a down trend can go higher, first, it has to stop going lower. This is basic logic, but it eludes a great number of people.

As to that small range bar, [see arrow], and high volume? The reason why it is so bearish is that the volume shows a larger than normal effort, yet the buyers were unable to extend price higher. We also know the other side is, sellers prevented buyers from pushing price higher and immediately regained control to push the market lower. Charts are replete with important information like this.

Based on the daily chart, solid resistance at $26 does not even show up. Now, buyers are confronted with having to rally over $20.50. Silver was poised to rally above $20.50 a few weeks ago, but sellers took over, once again. This happens frequently as a characteristic of a down trending market.

The first set of arrows, on the left, shows a strong rally and close on increased volume. At this level, it is more likely short-covering, maybe with some new buying, but it made a clear statement from buyers and completely overpowered sellers.

The second set of arrows, on the right, shows a strong decline and poor close, also on a sharp increase in volume. Watch this low closely. The market may be providing some important information. If the low holds and price moves in a more sideways fashion with overlapping bars, it indicates potential support. If price moves lower on small ranges and decreasing volume without going lower, or much lower, that, too, would be indicative of support. If price moves lower on wide ranges and increased volume, new lows are more than possible.

We just have to wait and see what develops. The best part of watching is that there is no need for guessing, or worse, predicting. Let the market do what it will and then simply read the message and follow the then known information with better results likely.

In all events, buy the physical, buy the physical, buy the physical, regardless of price. Owning silver is a form of insurance, if you will. You buy life insurance, health and home insurance, car insurance, etc. You buy it for the unexpected. For silver, there is no unexpected, only the inevitable, and it is among the best forms of insurance you can own for protection from imploding paper currency.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2013 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.