Western Gold and Silver ETF Inventory Changes 2013 Saw 942 Tonnes Gold Disappear

Commodities / Gold and Silver 2014 Jan 01, 2014 - 05:49 AM GMTBy: Jesse

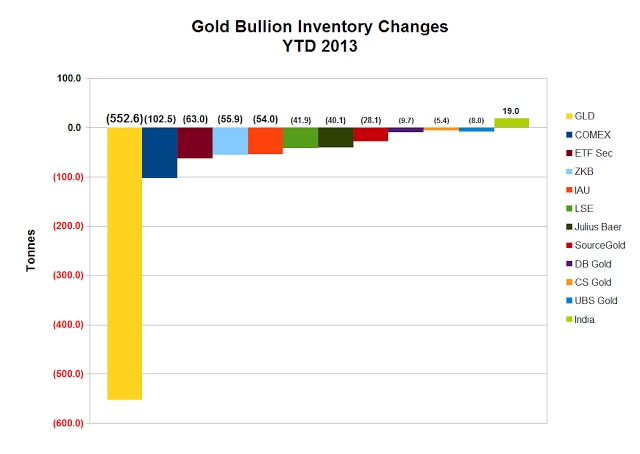

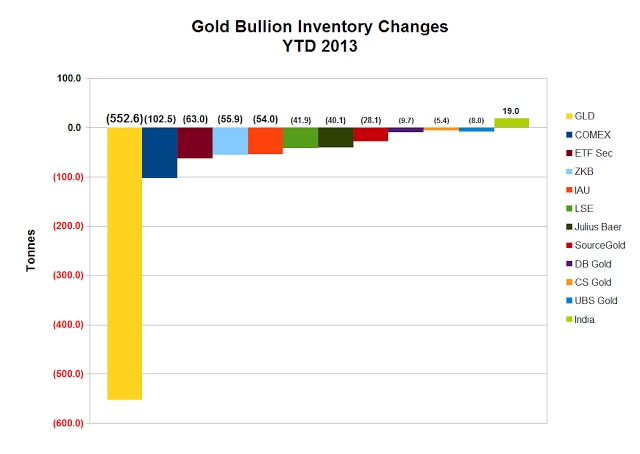

The drain of gold from the Western ETFs and Funds is apparent. About 942 net tonnes have been removed. This compares to the 856 tonnes that had been removed as of mid-December. That is quite a bit of bullion moving out in just a few weeks.

The drain of gold from the Western ETFs and Funds is apparent. About 942 net tonnes have been removed. This compares to the 856 tonnes that had been removed as of mid-December. That is quite a bit of bullion moving out in just a few weeks.

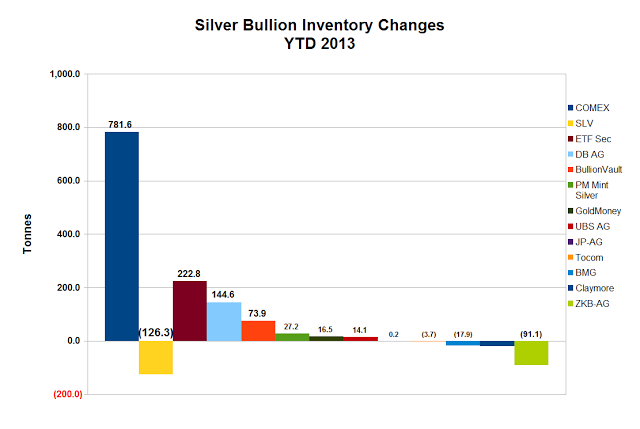

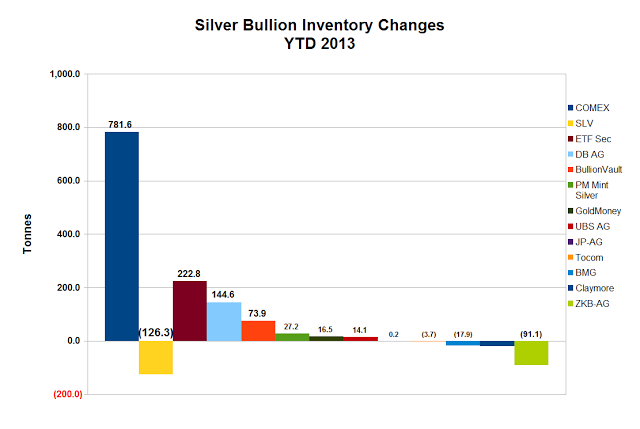

But even more notably, this is in sharp contrast to silver, which has had about 992 net tonnes added. On a percentage basis silver has had a worse price performance this year compared to gold, so ascribing this to investor preference seems a bit thin.

This is certainly an interesting phenomenon. It will be worth remembering I suspect.

There seems to be little question that the gold market is being manipulated by some big players. And there is certainly quite a bit of precedent for this manipulation. The bigger questions are the motives, and the course of the endgame, this time. All manipulations end, eventually.

As an aside, I would like to address a recurring pet peeve of mine. The financial spokesmodels will often look at the drawdowns in the GLD inventory and say, 'investors were dumping gold today.'

Where were they dumping it, into the ocean?

All this gold, that no one seemingly wants, and yet the New York Fed cannot find enough bullion to return Germany's gold, and for seven years. What about the gold they hold that no one has yet asked about?

No, the gold has been moving from the custody of GLD as Authorized Participants, aka the usual suspects, redeem bullion from the ETF, and send it elsewhere.

Where does this all lead? Follow the yellow brick road, or more appropriately, the river of gold. Judging from the overall import and export numbers, it is quite the golden river, flowing from west to east.

It is caught in the tide of history, as are we all.

These figures are from 12/31/2012 through 12/30/2013 and are courtesy of Nick Laird at Sharelynx.com.

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Note: This is certainly an interesting phenomenon. It will be worth remembering I suspect. As an aside, I would like to address a recurring pet peeve of mine. The financial spokesmodels will often look at the drawdowns in the GLD inventory and say, 'investors were dumping gold today.' All this gold, that no one seemingly wants, and yet the New York Fed cannot find enough bullion to return Germany's gold, and for seven years. What about the gold they hold that no one has yet asked about? Where does this all lead? Follow the yellow brick road, or more appropriately, the river of gold. Judging from the overall import and export numbers, it is quite the golden river, flowing from west to east. It is caught in the tide of history, as are we all. These figures are from 12/31/2012 through 12/30/2013 and are courtesy of Nick Laird at Sharelynx.com. http://jessescrossroadscafe.blogspot.com Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many. © 2013 Copyright Jesse's Café Américain - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

There seems to be little question that the gold market is being manipulated by some big players. And there is certainly quite a bit of precedent for this manipulation. The bigger questions are the motives, and the course of the endgame, this time. All manipulations end, eventually.

Where were they dumping it, into the ocean?

No, the gold has been moving from the custody of GLD as Authorized Participants, aka the usual suspects, redeem bullion from the ETF, and send it elsewhere.

By Jesse