Stock Market SPX Remains on an Aggressive Sell Signal

Stock-Markets / Stock Markets 2014 Jan 03, 2014 - 05:01 PM GMT I had mentioned earlier that the “traditional” relationship between stocks and bonds no longer applies. The Cycles Model will tell you that these so-called relationships come and go since no two cycles are identical.

I had mentioned earlier that the “traditional” relationship between stocks and bonds no longer applies. The Cycles Model will tell you that these so-called relationships come and go since no two cycles are identical.

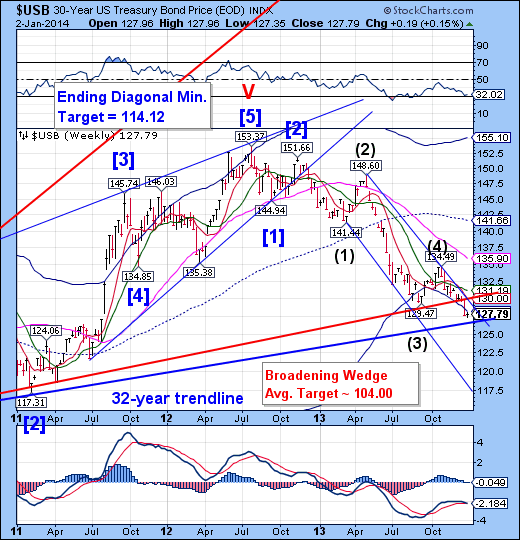

I have been stressing that USB is about to cross its 32-year trendline and for a while will actually decline alongside stocks.

As interest rates rise and the government budgets blow up, the risk of default will drive even more investors out of bonds and stocks will become the only haven for investors. That won’t happen right away, as both asset classes have to drop to the point where default is inevitable in bonds and stocks are low enough to again provide a bargain for investors.

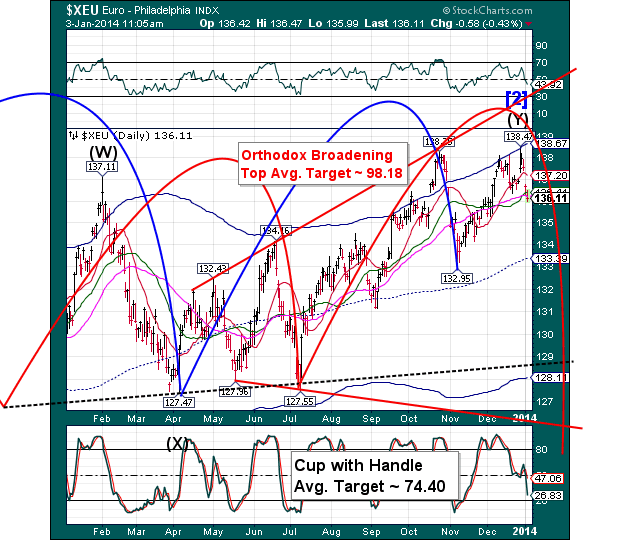

What may have been propelling stocks the final distance until today is the migration of money from Europe in search of a safe haven from the turmoil there. It is now completing an Ending Diagonal and may be one of the driving forces in the decline of the SPX.

As the Euro falls, money may have to be repatriated by European institutions to make up for losses in Euro-denominated assets.

Remember, the Fed has been propping up European banks to keep asset values from plummeting there. That effort has now reached its saturation, where further stimulus will no longer be effective.

You can see that European stocks have declined much faster than US stocks yesterday. However, as equities on both sides of the pond decline, there will only be one safe haven left standing.

You can see that the dollar declined as money shifted into European equities through the month of October. Europe was saved again, but at a terrible cost, which is yet to be revealed.

It shows up in the massive Orthodox Broadening Top in both the Euro and the EuroStoxx 50.

As the declines take hold in equities, the US Dollar is poised for its most powerful rally of the year.

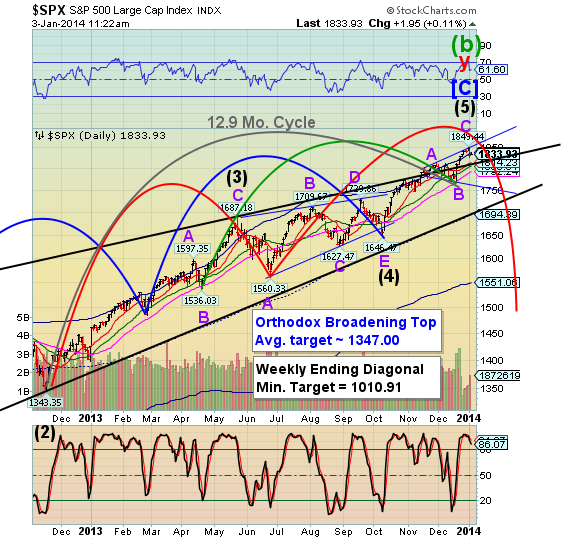

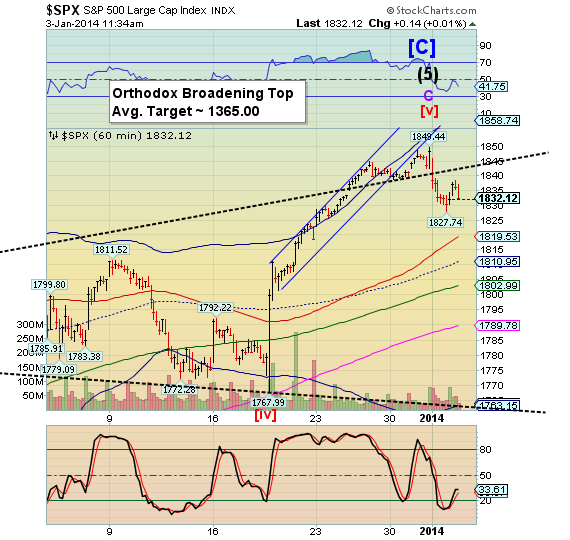

Meanwhile, SPX and US equities formed a weaker Triangle pattern through the month of October. Now all equities have reached the saturation point and a smaller Orthodox Broadening Top is now evident in SPX.

Equities no longer have the capability to absorb new liquidity. Thus we have seen the flight of $300 billion back to the Fed in the last two days of 2013.

SPX remains on an aggressive sell signal, but that may change later today as it decline to (and possibly through) its various support levels shown in the chart. Its initial target is to go beneath the lower trendline of its Orthodox Broadening top and Cycle bottom support, now at 1763.15.

The NYSE Hi-Lo index remained on its sell signal while the VIX remained on an aggressive sell signal. I’ll keep you updated on the changes as they occur.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.