Job Exclusion in America: What Caused Crash In the Labor Participation Rate?

Economics / Employment Jan 14, 2014 - 08:18 PM GMTBy: Washingtons_Blog

Workers May Simply Be Giving Up

Workers May Simply Be Giving Up

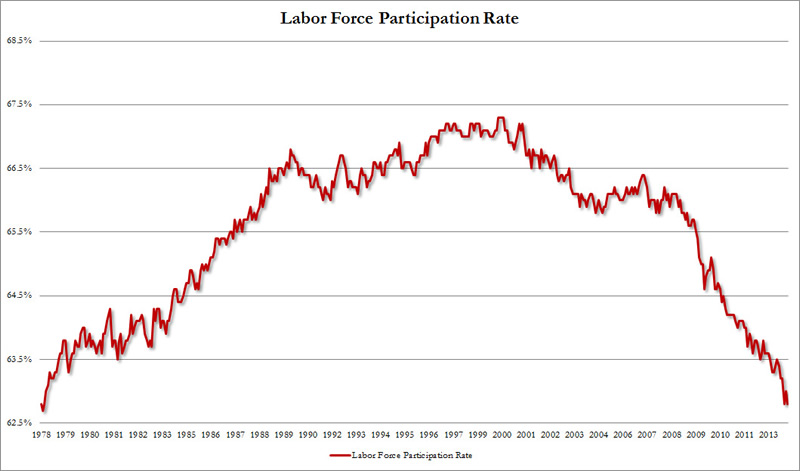

Zero Hedge notes that the number of Americans in the labor force has dropped to 1978 levels:

The civilian labor force … dropped from 155.3 million to 154.9 million, which means the labor participation rate just dropped to a fresh 35 year low, hitting levels not seen since 1978, at 62.8% down from 63.0%.

And the piece de resistance: Americans not in the labor force exploded higher by 535,000 to a new all time high 91.8 million.

What’s causing the crash in labor participation?

Initially, the number of women not in the labor force climbed to a new high. This is significant because the labor force skyrocketed in the 1960s when feminism encouraged women to work outside of the home:

As the Washington post notes in a fantastic roundup on unemployment:

The Urban Institute notes [that] what’s happening is that workers aren’t entering the labor force at the same rates they used to. That’s especially true for women, who are much less likely to enter the labor force today than they were in 2002 and 2003. Many of them, the paper notes, appear to be enrolling in school instead or deciding to start families.

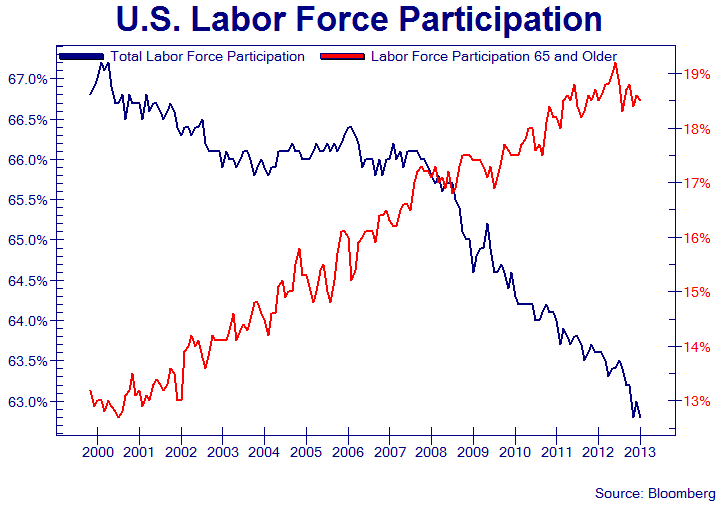

An aging U.S. demographic may also play some role in the decline. As the Washington Post notes:

Americans over the age of 65 are much less likely to work than prime-age Americans. And since that subset of Americans is expanding its ranks, that drives the labor-force participation rate down.

***

Economists disagree, however, on exactly how much demographics are responsible for the current fall in the participation rate. The Chicago Fed estimated in 2012 that retirements accounted for one-fourth of the drop in labor force participation since the recession began. Other analysts, including Barclays, have suggested that aging Boomers could account for a bigger slice of the drop.

Meanwhile, a recent paper by Shigeru Fujita of the Federal Reserve Bank of Philadelphia staked out a more nuanced view: Demographics, he argued, didn’t play a huge role in the labor-force drop between 2007 and 2011. But since then, retirements are responsible for basically the entire fall of the participation rate. One possible reason is that many older Americans postponed retirement immediately after the financial crisis to rebuild their battered 401(k)s. By 2012 or so, they began retiring en masse.

However, Zero Hedge and Bloomberg show that there are countervailing trends:

Most disturbingly, the Post notes that the main factor may be workers simply giving up:

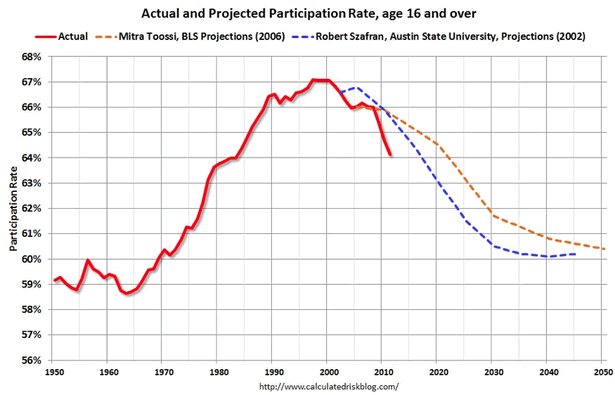

The number of Americans working or actively seeking work has actually fallen faster than demographers had predicted:

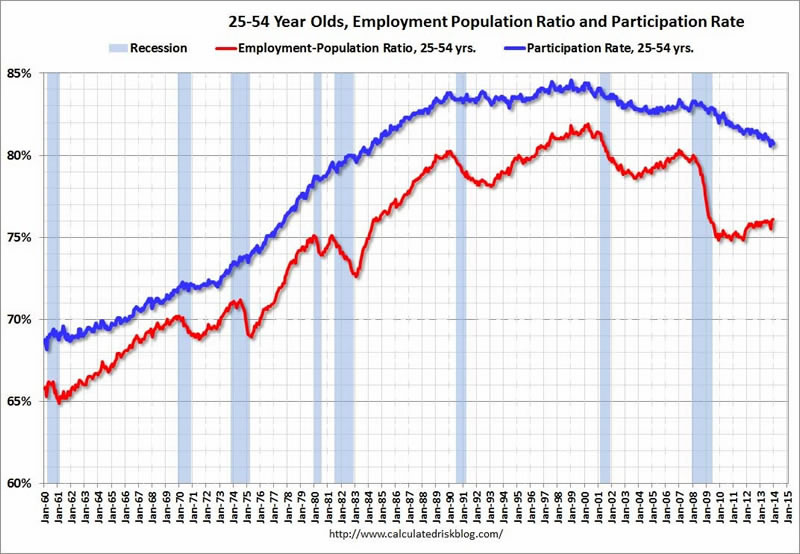

And here’s another clue that this isn’t just a demographic story: The participation rate for workers between ages 25 and 54 fell sharply during the recession and still hasn’t recovered. Obviously, retirements can’t explain this:

So, what’s going on? One theory is that the weak job market is causing people to simply give up looking for work — they’re crumpling up their résumés and going home. An recent study from the Boston Fed suggested that these “non-inevitable dropouts” might even account for most of the decrease. Among other things, the authors noted that the labor-force decline has been far sharper for all age groups than simple demographics would predict.

***So, why does the size of the labor force matter? If people are leaving the labor force for economic reasons (and they’re not going back to school), it would mean that the economy is in much worse shape than the official unemployment rate suggests. The jobless rate is officially 6.7 percent, but that only counts people who are actively seeking work — not labor-force dropouts. [Remember, you have to include labor-force dropouts in order to arrive at a useful unemployment number.]

The size of the labor force also goes a long way to determining America’s growth prospects. If, say, baby boomers are retiring faster than expected, then long-run U.S. economic growth will be lower than projected.

***

It could also mean the U.S. economy will be significantly weaker in future. One recent paper from the Federal Reserve estimated that America’s economic potential is now 7 percent lower than it was before the financial crisis — in part because workers who lost their jobs during the downturn have become less-attached to the labor force. That’s a bad sign.

In other words, the crash in labor force participation rate is a very significant indication that all is not well with the economy.

Unfortunately – instead of helping to reduce unemployment – bad government policy has made it much worse. And see here and here.

http://www.washingtonsblog.com/

Washington’s Blog strives to provide real-time, well-researched and actionable information.

We at Washington’s Blog have an insatiable curiosity for new discoveries, new information and new insights.

Despite our passion for what’s new, there are themes that we keep reporting on year after year, as they reflect a bigger picture which remains fairly constant, or the root causes of our problems which have still not been addressed, or potentially powerful solutions which have still never been tried.

© 2013 Copyright washingtonsblog - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.