Stocks Plunge, Horrific Jobs, Was The Fed Too Hasty With Its Taper Decision?

Stock-Markets / Stock Markets 2014 Jan 25, 2014 - 10:59 AM GMTBy: Sy_Harding

The Fed surprised markets with its December decision that the economy is strong enough to stand on its own with less stimulus. The majority of economists and analysts expected it to wait until March for more evidence to accumulate.

The Fed surprised markets with its December decision that the economy is strong enough to stand on its own with less stimulus. The majority of economists and analysts expected it to wait until March for more evidence to accumulate.

In the month since the decision, economic reports from key areas of the economy; jobs, housing, auto sales, and consumer confidence, have not been impressive.

There was that horrific shock of only 74,000 jobs created in December. New home starts plunged 9.8% in December. Permits for future starts fell 3.0%. Although up for the full year, existing home sales in the 4th quarter were down 27.9% from the same quarter of 2012. Mortgage applications continued their sharp decline, ending December at the lowest level in 13 years. Auto sales slowed significantly in December in spite of the return of rebates and zero percent financing to entice buyers. Consumer sentiment fell in December to 80.4 versus the consensus forecast of an improvement to 84.0.

Meanwhile, fourth quarter earnings reports have also not been encouraging.

Prior to the reports, corporations reached their most pessimistic outlook in years. According to Thomson/Reuters, warnings that earnings, or sales, or both, would not meet Wall Street’s forecasts were “the most negative on record.”

The U.S. stock market initially took the Fed’s decision that the economy was strong enough to stand on its own as a positive, rallying to a new record high at the end of the year.

However, so far this year, investors have peeked behind the curtain of QE stimulus that had been masking the realities of the market’s normal driving forces, especially in 2013, and are apparently not liking what they see.

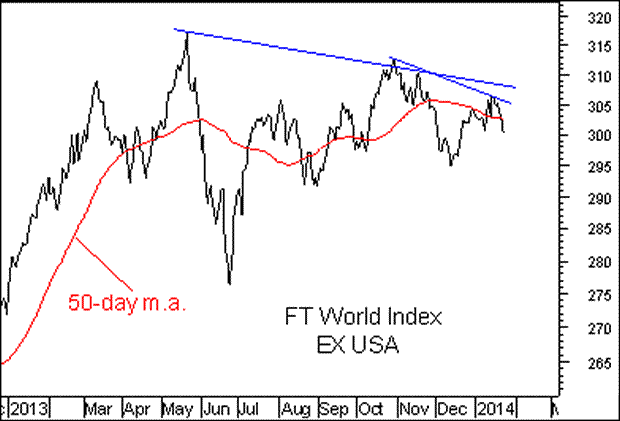

Markets outside the U.S. have been reading the tea leaves since last May when the Fed first hinted it was getting ready to taper back its stimulus, and did not like the prospects.

This week the U.S. market lost some of its confidence.

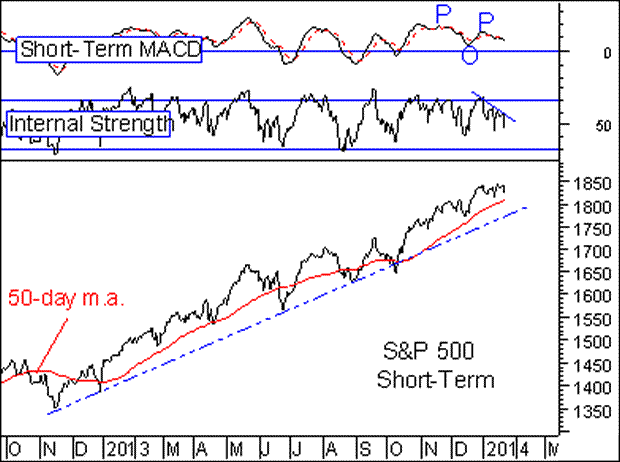

Like many, I’ve been calling for a short-term correction since November, a correction that would at least retest the short-term trendline support before resuming the bull market into April or May. But such a pullback was nowhere to be seen.

However, from this week’s plunge it appears to finally be underway.

The problem is that while our intermediate-term technical indicators remain on the buy signal, and we are still only expecting a short-term correction, even the intermediate-term indicators are deteriorating.

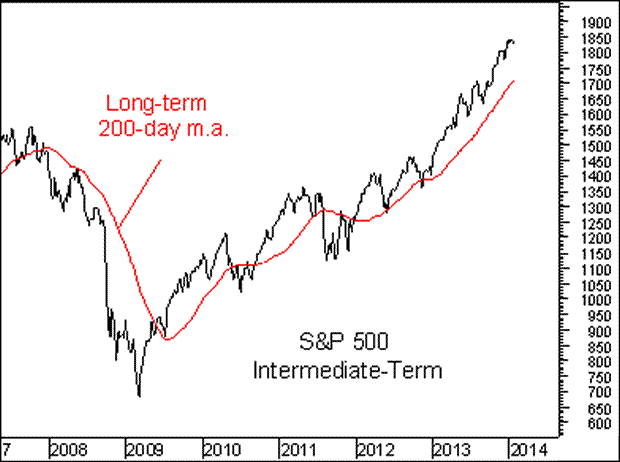

And the S&P 500 is overbought not only above short-term support levels, but above its long-term 200-day moving average. The market has a history of touching the 200-day m.a. from one direction or the other at least once each year. Last year was the first year in at least 15 that it did not, and therefore may be overdue to do so.

If in the correction that appears to have begun this week, the S&P 500 were to pull back to retest the support at the 200-day m.a., which is around 1,700, it would take the S&P 500 back down to its level of mid-October, wiping out the entire ‘favorable season’ gain since then. That could create a degree of panic and beget more selling.

In a year in which we expected a significant correction, probably of bear market proportions, and big potential gains from downside positioning in inverse etf’s, but not until the second and third quarter, anything can happen. Just when investors were at their most confident in 2000 the market topped out in March, and again under similar circumstances in October, 2007.

Investors would be wise to be alert over coming days and weeks. Failure to take timely steps to avoid losses this year could wind up with last year’s gains having been temporarily borrowed, and subject to being given back.

In the interest of full disclosure, my subscribers and I remain invested on the long-side, and do not have downside positioning at this time. That could change at any time as we watch developments closely.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.