How Japan May Cause the Failure of Current Federal Reserve Policy

Economics / Deflation Apr 24, 2008 - 05:19 AM GMTBy: Mick_Phoenix

Starve the Rich to Feed the Poor - Having written 2 in-depth articles about the rationale behind the Federal Reserve and US Govt plans to bail out the financial system some readers of the last couple of Occasional Letters may well have wondered if I was about to change my outlook. This article should put paid to any such thoughts.

Starve the Rich to Feed the Poor - Having written 2 in-depth articles about the rationale behind the Federal Reserve and US Govt plans to bail out the financial system some readers of the last couple of Occasional Letters may well have wondered if I was about to change my outlook. This article should put paid to any such thoughts.

Previously I looked at the evidence that supported the view that the Fed and US Govt (along with the Bank of England) are following a monetarist approach, adapted by GB Eggertsson , to attempt to re-inflate the economy through non traditional means. As we have seen, especially recently in the UK, all the mechanisms required for the plan are in place and are being instigated.

In this article I want to look at why the monetarist approach will fail and what the results of that failure will be. (Yes, this is the article you have been waiting for). In doing so, I may quote from others but I shall make it clear when I am doing so.

First and most importantly, I must stress that my long term outlook remains unchanged:

- A recap of the scenario: bubble, easy money, inflation in fiat money supply, inflation in commodities and hard assets, inflation, fear of inflation, rising rates, YC inverting, flattening, rising and inverting again, tightening, withdrawal of liquidity, corrections, crashes, talk of stagflation, FEAR, withdrawal of speculative funds, further corrections and crashes, demand collapse.......Deflation.

Now the next bit might sound a little patronising for which I apologise in advance, I know my readers are a clever bunch and this could be seen as pointing out the obvious.

Read the scenario again. Within it is a wisdom that could form a theory all of its own (I know, I'm getting carried away) and would explain many of the observations about the economy and stock/bond markets.

Here is the patronising bit. To circumvent the final outcome of the scenario, which is the biggest fear of the Fed et al, the central planners have a "cut out". Simply put, when they judge circumstances may lead to the dreaded conclusion; they stop the process by resetting it to the beginning. They rewind the tape. Is this my way of saying that the deflation will not happen? No, it will occur when the tape snags and breaks. What we are living through now is an attempt by the Central Banks, in cooperation with their Governments to reset conditions back to "easy money". In other words every attempt to avoid a deflationary period results in a series of actions that make the requirement for the same actions to reoccur, the only difference being that the size of each "action" has to be larger than the previous one.

It is the infinite Ponzi scheme. Whereas a normal Ponzi scheme requires investors to keep ploughing in new money, the infinite scheme is only regulated by the pace of newly created money introduced to the scheme as the fiat system guarantees supply.

Let us see this in action by examining other periods when the tape was rewound.

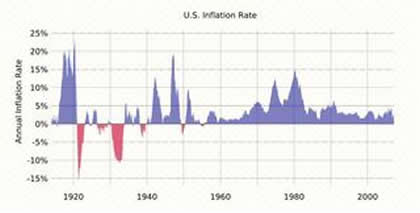

Firstly here is a chart of inflation/deflation swings from Jan 1914 - Mar 2007. Although a year behind, it shows well the current long term trend (Dept of Labor/BLS):

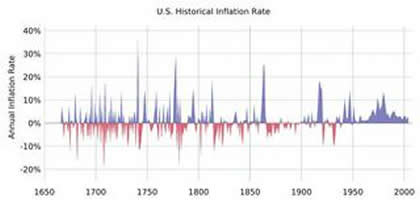

Most noticeable is the smoothing of inflation peaks and deflation lows, with the elimination of deflation by the mid-50's. This remarkable achievement is even more apparent in this chart (using McCusker to 1913 then as per previous chart):

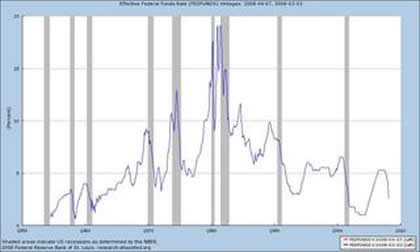

Never has the elimination of deflation or such a sustained period of inflation been seen in the past 350 years. We truly are in an age of innovation. Without doubt, it is the elimination of deflation that is the Fed mandate, accomplished by a continuing inflation which is controlled in its acceleration by the application of interest rate policies:

FFR 1954-2008

Now for most that read my Letters none of this is particularly earth shattering news, for the uneducated public though this would come as a shock. The recognition that the past 50 years are aberrant, not the norm, is like saying the deflationary outcome of the 30's crash was "unexpected". There is no doubt that the deflationary period in the Great Depression was not unusual . What is unusual is the persistence of inflationary conditions since the mid-50's.

Some will say that it was the loss of a gold or silver backed currency that caused this unusual inflation, others that the social and economic ills of the 30's made episodes of deflation unacceptable to the politicians and public.

Although both points could offer contributory causes to the current inflation, it would not explain the acceptance and appearance of both inflation and deflation prior to the mid-50's. What may explain the disappearance of deflation is the rapid and innovative use of debt.

Who initiates and allows the accumulation of debt?

To read the rest of this article, click here

By Mick Phoenix

www.caletters.com

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.