Alleged Bitcoin Creator Denies Any Involvement

Currencies / Bitcoin Mar 08, 2014 - 02:15 PM GMTBy: Mike_McAra

To the point: we don't support having any short-term positions in the Bitcoin market.

To the point: we don't support having any short-term positions in the Bitcoin market.

The media frenzy surrounding the supposed discovery of the Bitcoin creator continues. Dorian Satoshi Nakamoto, the man Newsweek claims to be the creator of the currency, denied having any involvement with Bitcoin and claimed he hadn't heard of Bitcoin until recently.

An L.A. Times' reporter tweeted she had spoken with Mr. Nakamoto in an elevator and he denied having anything to do with the currency system. Yesterday, Mr. Nakamoto agreed to speak to an Associated Press reporter, one of the crowd camped out in front of his house, if they invited him to lunch. Afterwards, they set off in Nakamoto's car and were chased by the remaining journalists to a sushi restaurant.

Today, the story was run by AP and they confirm that Mr. Nakamoto actually denied creating Bitcoin:

In an exclusive two-hour interview with The Associated Press, Nakamoto, 64, denied he had anything to do with it and said he had never heard of bitcoin until his son told him he had been contacted by a Newsweek reporter three weeks ago.

Nakamoto acknowledged that many of the details in Newsweek's report are correct, including that he once worked for a defense contractor, and that his given name at birth was Satoshi. But he strongly disputed the magazine's assertion that he is "the face behind bitcoin."

"I got nothing to do with it," he said, repeatedly.

(...)

"I'm saying I'm no longer in engineering. That's it," he said of the exchange. "And even if I was, when we get hired, you have to sign this document, contract saying you will not reveal anything we divulge during and after employment. So that's what I implied."

"It sounded like I was involved before with bitcoin and looked like I'm not involved now. That's not what I meant. I want to clarify that," he said.

Newsweek writer Leah McGrath Goodman, who spent two months researching the story, told the AP: "I stand completely by my exchange with Mr. Nakamoto. There was no confusion whatsoever about the context of our conversation -and his acknowledgment of his involvement in bitcoin."

Newsweek's Managing Editor also said the paper stood by the story.

So, where's the truth here? It may be hard if not impossible to discern that in the nearest future. On one hand, a lot of the facts brought up by Newsweek seem to suit the profile of the Bitcoin creator. On the other, why would someone supposedly so intent on preserving their privacy intact ever sign off a research paper outlining the Bitcoin system with their real name?

As usually, we will probably have to wait and see if any additional facts emerge.

For now, let's turn to the market itself.

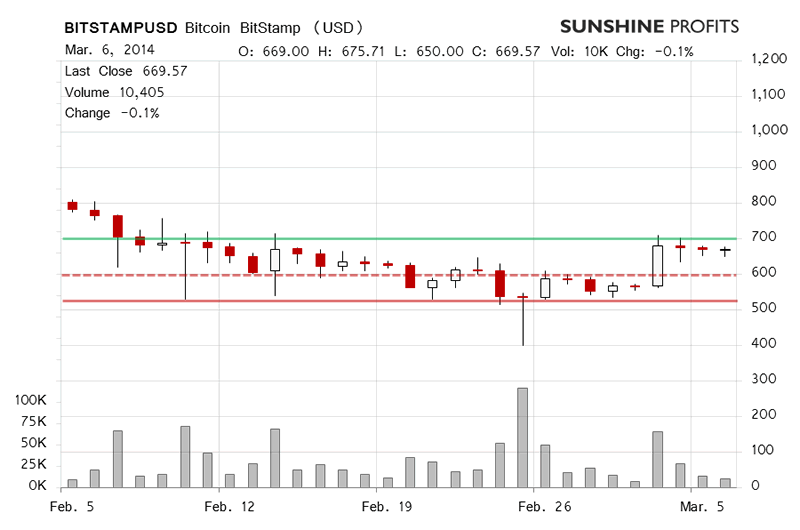

On BitStamp, the price was flat yesterday, Bitcoin edged 0.1% down, there was virtually no action and it was the third day of falling volume in a row. Not much happened at all. There were neither bearish nor bullish indications for the short term.

Today, the volume has already surpassed yesterday's level (this is written at 9:30 a.m. EST). The move has been 4.4% down, but Bitcoin is at around $640, above the first warning level (dashed red line on the chart). We don't see the move down as significant enough to change the short-term outlook to bearish at this time.

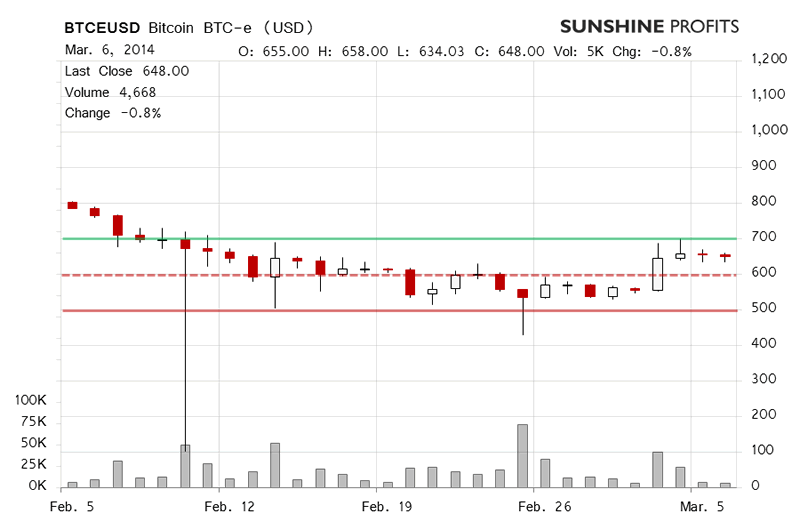

The price on BTC-e generally moved in line with the one on BitStamp. The currency lost 0.8% yesterday on falling and already tiny volume. There was not much action.

Today, BTC-e has seen declines and Bitcoin is 3.1% down but the volume is still lower than it was yesterday at the close. This means that despite the move down, there is no momentum present in the market at this time. The price is also above $600 (dashed red line on the chart) and we haven't seen any meaningful deterioration.

If anything, the move down on BTC-e seems to be even weaker than it is on BitStamp. Taking into account the action on both exchanges, we haven't seen any change in the short-term outlook. As such, at the moment the conclusions remain unchanged from yesterday.

We were asked to comment on the viability of Bitcoin by one of our readers. You'll find our answer included below as we feel it could benefit all our readers.

Q: I am wondering whether following bitcoin is viable at this point.

A: In my opinion, Bitcoin is a high-risk-high-reward type of investment. As such, it value can fluctuate wildly, even without much apparent reason. Because of that, I believe that one should only put a small part of their overall portfolio into Bitcoin investments, and only the money you can absolutely afford to lose.

So, putting 50% of your savings into Bitcoin might not be a great idea. But putting 5% of your spare money might be. I cannot really give any specific advice since I don't know your specific situation and every person has different objectives, tolerance for risk, amount of losses they can absorb, etc.

The general idea is that no money which you will need in the future (e.g. your retirement funds, cash for your kids college education, savings for holidays etc.) should be put in high-risk investments and Bitcoin is certainly one.

Now, as to whether Bitcoin is viable, the answer is that no one can really claim that with certainty. Saying that Bitcoin will certainly go through the roof is like saying one knows for a fact who will be elected president during the next run - sounds nice but has little substance to it. Having said that, I am of the opinion that Bitcoin holds long-term promise and this promise is really what we're buying at this time. If it is in fact fulfilled, the gains could be cosmic, but there's very little certainty about that.

Again, I think that there's an opportunity in Bitcoin. The recent events surrounding Mt. Gox show that the system is far from mature but are also, perhaps, a cleansing period for the currency. I would expect more experienced players to enter the markets and exchange security to increase as result of the Mt. Gox flip-up. This year we might also see first significant regulation being decided on in the U.S. While this could limit the freedom in the market, I would also expect it to stabilize the situation. And this is precisely what potential Bitcoin users, i.e. retailers would love to see. With clear rules it might become less risky for large businesses to get involved with Bitcoin. I think that regulation would probably be most painful to those who use bitcoins for legally ambiguous purposes and not for Bitcoin enthusiasts and investors.

The possible price for stability will be loss of anonymity but Bitcoin already is not anonymous. Registering with most exchanges will require some sort of ID and all the Bitcoin transactions are registered "forever" in the blockchain. If you remember the disussion surrounding Satoshi Nakamoto's (the creator of Bitcoin) coins - it is possible to determine which coins belong to him. So, establishing which coins come from whom within the Bitcoin framework is relatively easy.

All in all, it seems to me that Bitcoin still has a lot to promise in the long term. The three most important things to watch out for this year will be: regulation in the U.S., stability of the system, and new retailers accepting bitcoins.

If you remember to use only a small part of the money you can afford to lose for Bitcoin trades and investment, then Bitcoin might be a great vehicle to add to your portfolio. Again, none of this is investment advice, merely my opinion, since I don't know your specific details.

Summing up, in our opinion no short-term positions should be held in the Bitcoin market now.

Trading position (short-term, our opinion): no positions. There still hasn't been a meaningful change in the short-term outlook. If we see a move below $600 on strong volume, we might consider short positions. A similar move above $700 could, on the other hand, serve as bullish confirmation.

Best,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.