Bitcoin Trading Maybe Flat but Not Flatlined for Good

Currencies / Bitcoin Mar 14, 2014 - 07:24 PM GMTBy: Mike_McAra

To the point: we don’t support having any short-term positions in the market now.

To the point: we don’t support having any short-term positions in the market now.

We wrote yesterday that Bitcoin’s future holds promise and that the system has the potential to revolutionize payments. In an article from its print edition, the Economist also comes to the conclusion that the characteristics of Bitcoin may as well outweigh the recent disastrous shutdown of Mt. Gox over the long term. What is more, the applications of Bitcoin or its underlying general ledger (blockchain) system might not be restricted to money transfers:

Such “permissionless innovation”, in the jargon, should in time result in a cornucopia of applications. Bitcoin’s technology could be used to transfer ownership both in other currencies and of any kind of financial asset. This, in turn, would allow the creation of decentralised exchanges which let asset holders trade directly. And money could be “programmed” to come with conditions: for instance, it might be released only if a third person agrees.

Some want ownership of devices—a car, say—to be represented by a Bitcoin, or a tiny fraction of it. The car would work only when turned on with a key that includes the Bitcoin token. This would make managing ownership of and access to physical assets much easier: the token could be sold or rented out temporarily, enabling flexible peer-to-peer car-rental schemes. Such “smart property” would turn the blockchain into a global registry of ownership in physical assets.

We don’t anticipate seeing such solutions in the nearest future but these possible applications of the blockchain system show that there might be even more to Bitcoin than we expect.

Let’s turn to the charts.

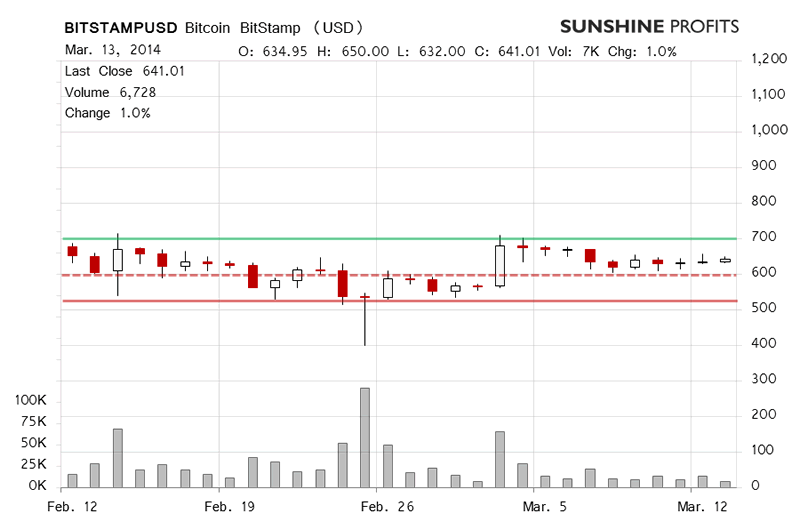

Yesterday, Bitcoin appreciated 1.0% on BitStamp on low volume. In spite of this move up, there was no change in outlook as the currency remained between $600 (dashed red line on the chart) and $700 (solid green line).

Today, there have been no important changes so far (this is written just before 11:30 a.m. EDT). Bitcoin is at $637, 0.6% down from yesterday’s close. The final volume today might be higher than yesterday but at this point it seems like yesterday’s move up is being cancelled out. No direct bullish or bearish short-term conclusions here.

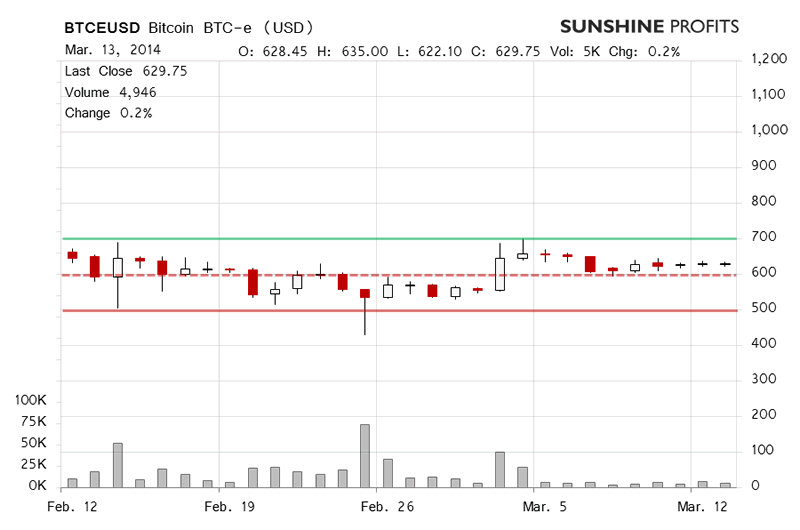

The same can be said about BTC-e. Bitcoin jittered 0.2% up yesterday but today it has lost 0.4% from its last close. If there was a divergence in prices yesterday, today we haven’t seen one. Instead both exchanges seem to confirm the stagnation.

If anything, the volume on BTC-e today might end up being even lower than yesterday. This would mean extremely weak. Even if it comes in as comparable with yesterday’s levels, it still will be weak. This means that the move today hasn’t gained any weight to change to the short-term trend (which is flat).

Currently, Bitcoin is closer to $600 than $700 on both exchanges. The action we’ve seen recently doesn’t add significant bullish or bearish cues to the picture. One potentially comforting fact is that the decline fueled by speculation about Mt. Gox seems to be over. We still think that Bitcoin has the potential to go back to $800 but we’re not betting on the move happening in the nearest future.

Summing up, in our opinion no short-term positions should be kept in the Bitcoin market at this time.

Trading position (short-term, our opinion): no positions. We’re waiting for volume to pick up.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.