Bitcoin Trading Clues from Price and Volume

Currencies / Bitcoin Apr 05, 2014 - 05:25 AM GMTBy: Mike_McAra

In short: we don’t support any positions in the Bitcoin market at the moment.

In short: we don’t support any positions in the Bitcoin market at the moment.

The Financial Post reported that Bill Downe, CEO of the Bank of Montreal, expressed the view his company would consider dealing in Bitcoin was the currency a stable means of exchange:

If it was reliable and if it was regulated, “then there’s no reason why we couldn’t be an intermediary in bitcoin-related transactions,” Bill Downe said in an interview after the company’s annual general meeting in Toronto.

“Because, if you wanted a Swiss franc transaction or a Japanese yen transaction or a U.S. dollar transaction, we can do that transaction for you,” he said. “If bitcoin [can be] a reliable medium of exchange, then at that point in the future, we would be able to [conduct business] with bitcoin.”

This is definitely one of the first such replies from senior management figures in the finance industry. Usually bank officials are far more cautious in their comments on Bitcoin, which is understandable given the young age of the currency and the pace at which its value has changed. The industry would probably have to see Bitcoin around for much longer than it has to come to the conclusion that it’s not just a new fad bound to pass.

There’s no reason to get overly optimistic, though. Downe’s comment just admits the possibility of handling Bitcoin transaction in the unspecified future when the currency becomes regulated and, perhaps, more stable. Which brings us to the dual nature of Bitcoin.

On one hand, the coin is loved by the Bitcoin community because in its design it embodies values such as personal freedom and the possibility to build things without governmental supervision. On the other hand, it is loved because it offers a possibly groundbreaking method to complete payments without a third party verifying the transaction – it is the community of Bitcoin user that confirms the validity of transactions.

Bitcoin has been able to gain some notable attention because of its unique characteristics. Its users are, however, still limited in numbers. For Bitcoin to reach the general public, the currency would have to mature and become stable and trusted, pretty much what Downe said. But this process is likely to see the currency regulated and treated just as other assets. While this might help make Bitcoin a widely accepted payment system, it might go against the grain with those who hope the currency will remain not influenced by regulations.

It remains to be seen whether regulations will actually help attract retailers and financial institutions to Bitcoin. We’ll be watching for the possible effects of the recent U.S. IRS ruling classifying Bitcoin as property.

Now, let’s have a look at the charts today.

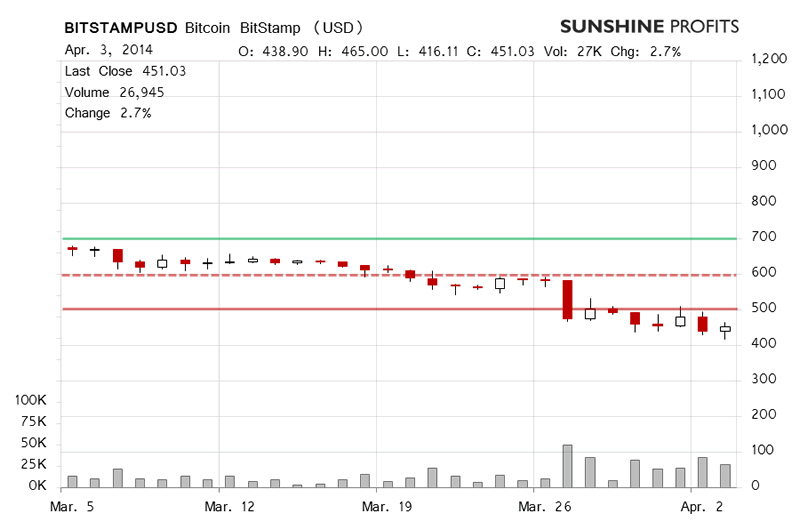

Bitcoin moved 2.7% up on BitStamp yesterday. The volume was relatively strong but lower than on Wednesday. This move up didn’t inspire much confidence since a weak move up on falling volume might be actually a sign of weakness to come. The short-term outlook was still bearish but not clearly enough to go short. Yesterday we wrote:

The moves on BitStamp and BTC-e were violent yesterday, less so today but the short-term outlook remains bearish. We expect more action now, possibly to the downside but the situation is not clear enough to suggest opening any sort of short-term positions now.

This remains up to date since we haven’t seen a strong move up today (this is written before 11:00 a.m. EDT). Bitcoin is actually 1.2% down for the day. The volume is weaker than yesterday and if this trend persists, this will be a second day of falling volume (the day isn’t over yet).

The price moves yesterday and today have been calmer than what we saw recently. If we don’t see a sizeable move soon, it might be possible that the price is back in the “sleep mode” which we experienced in mid-March. This is not a sure bet though.

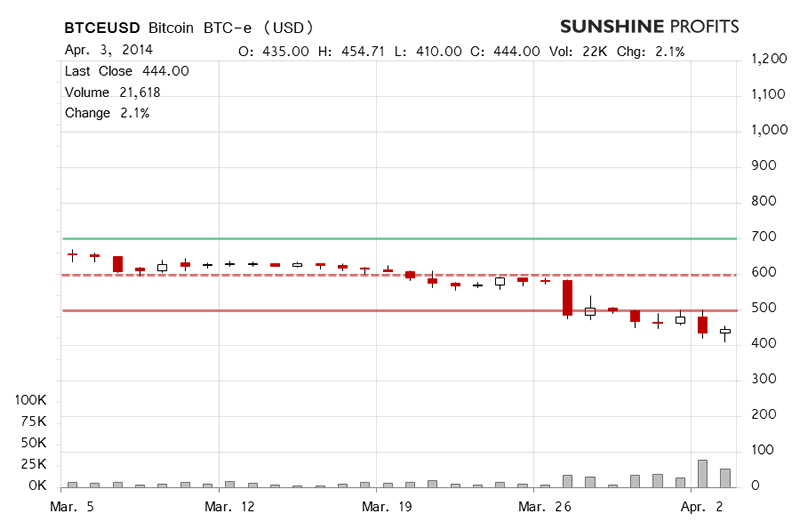

Bitcoin moved 2.1% higher yesterday on BTC-e. The volume was lower than on the day before and the move didn’t do much to change the bearish short-term outlook as the move was not particularly strong compared with the recent depreciation and Bitcoin remained below $500 (solid red line in the chart).

Today, the trading has been weaker than yesterday but Bitcoin has managed so far to stay above the level of the last close. This doesn’t change much since the move we’ve seen has been relatively tiny, 0.7% up and is not confirmed by an increase in volume. We’re still inclined to think that the next move will be to the downside but the current action doesn’t support going short yet. We would have to see another day or two of weakness or at least stillness to consider shorts.

Summing up, in our opinion no short-term positions should be kept in the market now.

Trading position (short-term, our opinion): no position. Another day or two without a move higher could make the short-term outlook even more bearish.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.