Euro-zone Bazooka - Whatever It Takes 2.0?

Economics / Euro-Zone Apr 08, 2014 - 06:29 PM GMTBy: Axel_Merk

If you are convincingly irrational the market may expect extreme measures and front run your bluff. It’s in this spirit that ECB President Draghi is threatening the market with another bazooka. We discuss implications for investors.

If you are convincingly irrational the market may expect extreme measures and front run your bluff. It’s in this spirit that ECB President Draghi is threatening the market with another bazooka. We discuss implications for investors.

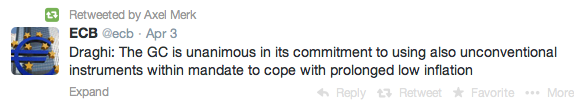

During the ECB press conference on April 3, 2014 the official ECB Twitter account tweeted (“GC” is the Governing Council, akin to the FOMC in the U.S.):

In fact, the entire press conference appeared focused on convincing the market that inflation in the Eurozone must move higher. Draghi argues that low inflation is a problem for a couple of reasons:

First and foremost, the longer the period of low inflation, the higher the risk in terms of medium-term inflation expectations. (Eluding to the risk of a deflationary spiral)

The second drawback of low inflation… is that it makes the adjustment of imbalances much more difficult. It is one thing to have to adjust relative prices with an inflation rate which is around 2%, another thing is to adjust relative prices with an inflation rate which is around 0.5%. That means that the change in certain prices, in order to readjust, will have to become negative. And you know that prices and wages have a certain nominal rigidity which makes these adjustments more complex.

The third drawback has to do with the presence of a debt level, which, both for the private and public sectors, is still elevated. And with low inflation, the real value of this debt does not go down as fast as it would if inflation were higher, so it makes the adjustment of the debtors, the deleveraging, more difficult.

A key culprit for the low inflation? The euro. He said the exchange rate “is an increasingly important factor in our medium-term assessment of price stability.” A month earlier, on March 6, 2014, Draghi quantified the euro’s drag on inflation:

As a rule of thumb, each 10% permanent effective exchange rate appreciation lowers inflation by around 40 to 50 basis points. So we can say that between 2012 and today about 0.4 or 0.5 percentage points of inflation was taken out of current inflation because of the exchange rate appreciation

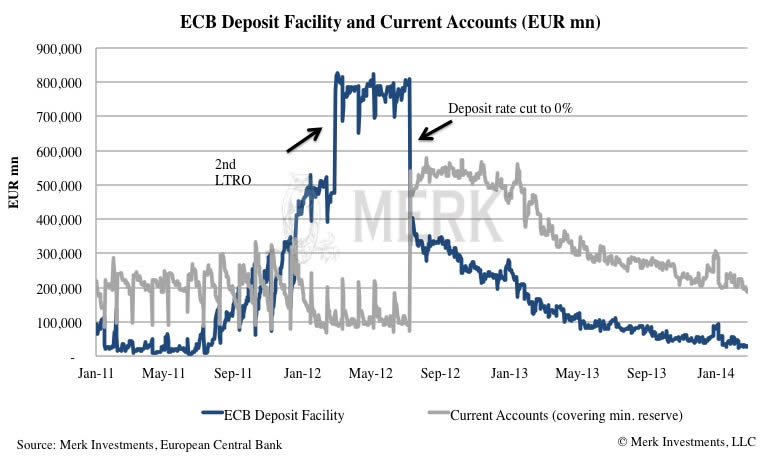

If there was one thing puzzling about the euro last week it was that Draghi’s salvos did not get the euro to plunge. As has happened many times over the past year, Draghi’s verbal assault on the euro didn’t convince the markets. That’s despite threatening to impose negative deposit rates or to engage in “QE.” Trouble is that these tools may not get the job done. Let’s look at the deposit facility at the ECB first:

What one sees is that the deposit facility is small for central bank standards. The facility under consideration is used by banks- we are not talking about negative rates on mom and pop savings accounts; at least not yet. In our assessment, the key implication of moving to negative rates is reputational risk: Northern European savers may lose the little confidence they have left in the ECB if their savings are explicitly robbed. A key role of a central bank is to foster confidence in a currency. Well, in this case, if the ECB wants to weaken the euro they may want to do quite the opposite but we caution policy makers that they are playing with fire. Policy makers, however, are concerned with the opposite risk: that low inflation is causing a revolt in weaker Eurozone countries where negotiating wages downward is incredibly painful.

Then there is QE (quantitative easing). Most are not aware that the ECB has operated very differently from the Fed. Rather than “printing” money to buy securities, the ECB has provided liquidity against collateral. The key difference is that ECB facilities expire and banks have returned liquidity they don’t want. Draghi phrases the difference this way:

When the Fed buys assets or buys government bonds, it does change prices all across the spectrum of all assets, and this has an immediate or direct effect on credit, because most of the credit goes to the real economy via the capital markets. In our case, all these effects go through the banks…

He realizes that US-style QE doesn’t work in the Eurozone (emphasis added)

The final effect on the real economy depends, of course, on the demand for loans, but also on the state of health of the banking system. The euro area cannot really go back to serious growth if the banking system is impaired. A healthy banking system is more essential to the euro area than to other financial systems that are more market-based.

With weak demand in the economy and an impaired banking system holding back growth, what could QE do? Draghi may not be able to boost real demand but he is certainly trying to address the impaired banking system. He has been asked in the past why he conducts the stress tests when such tests might discourage banks from borrowing money from the ECB (as this admits weakness); Draghi correctly points out that weak banks don’t lend whether stress tests are conducted or not. As such, it’s important to identify weaknesses; then have a plan to address them.

Note that Draghi is actually quite positive on aspects of credit growth in the Eurozone:

What is happening is that new credit is actually expanding... at relatively decent rates. But... there is still deleveraging that has to take place... Improvements in lending to new clients, but at the same time redemptions of old loans weighing on credit figures.

To us this suggests the biggest problem appears to be a lack of patience at the ECB. This is confirmed by Draghi’s own words that low inflation isn’t really a problem as it was due to lower food and energy prices – considered transitory and irrelevant by the Fed (at least when they go up!):

If you take the actual inflation of the first quarter of 2012, it was 2.7%, and now it is 0.5%. Of these 2.2 percentage points of difference, 70% of this is due to lower energy prices and lower food prices.

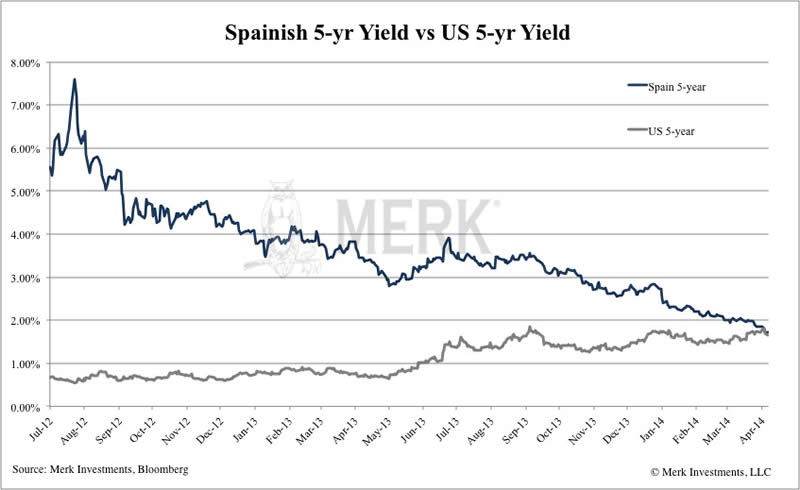

At the other end of the spectrum QE is supposed to increase bond prices to lower yields. In the Eurozone it’s the cost of borrowing of weaker countries (the “periphery”) that matters. I’m not sure how many are aware that the cost of borrowing for Spain for 5 year money is now just about the same as it is for the U.S.:

Draghi’s “whatever it takes” attitude has made peripheral debt securities in the Eurozone appear to be low risk. As such, the flight out of emerging market bonds didn’t make it back to the U.S. but instead to the European periphery.

So what exactly should QE achieve if the verbal intervention has already lowered the cost of borrowing; de facto providing a substantial stimulus to the Eurozone periphery, even as ECB short-term rates have only been lowered marginally.

Draghi, never short of ideas, wants to improve the “bank-lending channel.” What follows is our own interpretation of what he is planning as he has only provided hints. Last year he referred to an “Asset Backed Securities” (ABS) program to ignite lending in the Eurozone. You may recall ABS as playing a key role in the financial crisis, however, not all ABS are evil. The goal would be to make the Eurozone economy less dependent on banks and more dependent on the markets. If one can securitize debt, credit could flow. Here’s what Draghi said about ABS last week:

There are obviously different preferences about which QE would be more effective, and we will continue working on that in the coming weeks... It is not easy to design a programme of QE on private debt that is large in size and doesn’t have risk for financial stability. That is why the ECB is so squarely behind the need to develop an ABS market, because that is where the largest pool of private sector assets lies, basically banking loans – as I said before, we are a bank-based economy. So, if we are able to have these loans being correctly priced and rated, and traded, like it would happen, like it used to happen in the ABS market before the crisis, then we naturally have a very large pool of assets. As a matter of fact, the ECB will present a joint paper with the Bank of England on this point at the next IMF meetings.

We see two key challenges:

- Even if there were a perfect design, it takes a long time to build a large ABS market;

- A vibrant ABS market does not require a central bank to set it up. If it were such a great idea the smart kids at investment banks would have already developed this market.

However, Draghi may not see these as a problem. That’s because, just like the OMT (Outright Monetary Transaction) program that turned around the fortune in the Eurozone after being announced in August 2012, this may never be implemented. Draghi may hope that the very fact that it is on the drawing board, will convince the markets that credit spreads should tighten and financing conditions should improve for private sector borrowers.

What does it all mean? In a nutshell:

- President Draghi appears to be out to convince the market to lower both the euro exchange rate and private sector credit spreads in anticipation of ECB action, without actually firing the proverbial bazooka that he’s just hoisted onto his shoulder. Or, as we call it: Whatever It Takes 2.0

- The ECB may feel ever more pressure to act. At some point they will. Whatever action they take is likely to have unintended consequences that, in our assessment, are not worth the little impact they are likely to have (especially given that the signaling has done all the work for them).

- Expect more talk from the ECB. They want a weaker euro, but in our assessment are unlikely to get it. We continue to believe a euro of 1.50 this year is a possibiliy.

For more on how to not be a fooled in the markets, please register to be notified when we hold a webinar; our next Webinar is Thursday, April 17, 2014. Also don't miss another Merk Insight by signing up for our newsletter.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.