Understanding (and Ignoring) the Media Bandwagon Against Gold

Commodities / Gold and Silver 2014 Apr 15, 2014 - 10:49 AM GMTBy: James_West

For those of us who media often refers to as “gold bugs”, the fragility of popular sentiment toward not just gold and silver, but toward all investments generally, is the biggest barrier to a sane, free and fair market. The willingness of the majority to embrace opinions parroted by mainstream media and repeated dutifully by talking heads and other erstwhile shills for U.S. dollar interests simply because they are far more numerous than negative ones, and are delivered by talking heads who manage billions, is frustrating.

For those of us who media often refers to as “gold bugs”, the fragility of popular sentiment toward not just gold and silver, but toward all investments generally, is the biggest barrier to a sane, free and fair market. The willingness of the majority to embrace opinions parroted by mainstream media and repeated dutifully by talking heads and other erstwhile shills for U.S. dollar interests simply because they are far more numerous than negative ones, and are delivered by talking heads who manage billions, is frustrating.

It is no coincidence that the default definition “Gold Bug” for those who comment on and follow the performance of gold throughout history (and are often investors in precious metals) connotes insects and insanity. That suits the requirement for writers categorizing gold followers as such in lieu any cogent argument against having an interest in gold naturally. The mainstream financial media’s persistent inclination to seize upon the sensationally negative “Gold is a barbarous relic!” is highly indicative of the complete lack of perspective and research that goes into the majority of anti-gold diatribe. (This is a quote from John Maynard Keynes who could be considered the father of Monetarist policy in reference to the gold standard (not gold itself) that existed at the time.

The limited intellectual leadership of major media outlets is replicated throughout the industry by boards of directors who are sympathetic, if not downright duplicitous, with the banks who are both the source of negative sentiment broadcasts as well as broadcasters’ bead and butter.

The inability (or willful refusal) to understand gold and silver, their place in economic history, and the implications of a severely and daily manipulation of gold and silver price data across physical, futures, and derivative classes of gold and silver-denominated assets permeates the social strata from teenagers to central bankers. Their thinking about gold is informed by the mainstream financial press.

It doesn’t take much to understand why banks and media are unified in their opposition to gold and silver’s status as a global financial system bellwether when not severely manipulated.

Adding further to the frustration of clued in gold and silver commentators, is the fact that the instances and evidence pointing unquestionably to widespread manipulation by banks around the world and of all asset classes does nothing to change the average citizen’s impression of the integrity of banks and media. Especially now with the sterilization of the U.S. Commodities Futures Trading Commission (Commissioner Bart Chilton was the only one with the courage to speak up and publicly declare that something was definitely amiss in silver futures trading), we can expect the scrutiny of the markets mis-regulated by that commission to disappear and their ability to influence negative sentiment toward precious metals to increase.

Understanding Human Phenomena is Reached by Understanding Motive

The first step in throwing off the yoke of mainstream financial media-generated innate anti-gold sentiment is to catalogue the motives that exist for banks and media to do their utmost to win broad popular disdain for precious metals as the number one standard against which all other currencies can be measured. In fact, the main compelling reason for banks to undermine popular sentiment toward gold and silver is PRECISELY BECAUSE they are the ONLY reliable standard against which the debased character of strategically manipulated and inflated fiat currencies becomes apparent.

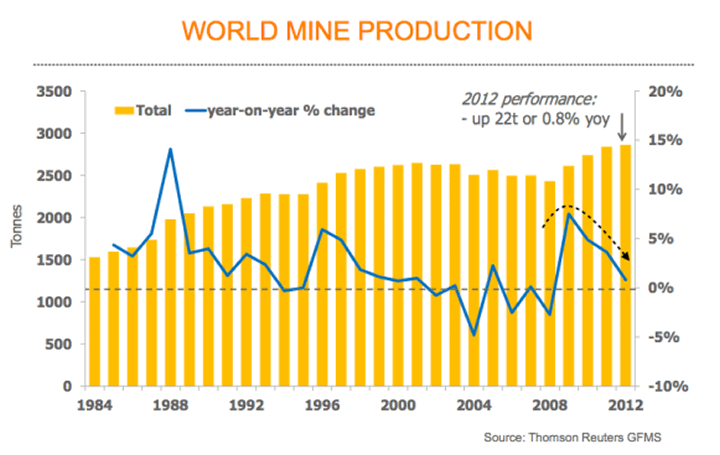

World gold production is dropping year-over-year.

At least, that is the case when the market is not subject to the intense daily price and data manipulation as it is right now. The interest groups who are typically the largest shareholders of key financial institutions such as the U.S. Federal Reserve and the top tier banks and bank holding companies around the world are unified in their opposition to gold and silver because:

1. They can’t make any money when investors cash in money-losing engineered financial assets that banks sell and put it into gold, which they typically hoard;

2. The more gold and silver reflects the debased nature of any fiat currency like USD by rising in price relative to those currencies, the more investor sentiment weakens toward the engineered assets that provide the bulk of their revenue;

3. If popular opinion were to behold that, as per the price of gold measured in U.S. dollars before the exponential amplification of manipulative practices was launched against gold in September 2011, that a high gold price indicated an excess of monetary supply, and a popular desire to curb such debasement was to manifest itself, the banks arguably be required to reduce the amount of synthetic U.S. dollar denominated asset fabrication that is the basis for their growing profits.

And as for what motivates mainstream financial media to be so obedient to the dictates of their financial sector clients, well..I just said it. They are clients. Mom and Pops don’t rent Bloomberg Terminals or buy full page ads and banner ads in the Wall Street Journal. Banks, and funds that buy and sell the synthetic asset classes, do. If you don’t understand the inherent conflict of interest in all financial media relationships with advertisers who are also the provisioners of media’s data and opinions, you are a certifiable part of the problem previously stated.

Evidence of Mainstream Financial Media Opposition to Gold and Silver

So now what instances of proof can we discover to support the idea that mainstream financial media is inherently biased against precious metals?

Demand for gold as a hedge against currency debasement in China is on the rise.

Well, lets examine the three largest shaper of public opinion in regard to all things financial, shall we?

1. Bloomberg is possibly the most influential publication in the world. Their presence on the desks of any serious professional trader is a given and undisputed in the financial services industry. Today (Monday April 14, 2014), Bloomberg has published two stories referencing the future performance of gold.

The first article pointing to Bloomberg’s allegiance to the banker’s meme that gold is a go-nowhere investment comes with an article published at 4:48 am ET Monday April 14, 2014 entitled, “Goldman Stands by $1,050 Gold Target on Outlook for Recovery”. In this article, Bloomberg gives free and ample coverage of Jeffrey Currie, Goldman Sachs principle market sentiment manipulator in gold, and provides multi-paragraph repetition of his forecast for a year-end gold price of $1,050, and the reasons why.

“Gold’s 12-year bull run ended in 2013 as the Fed prepared to reduce monthly bond-buying that fueled gains in asset prices while failing to stoke inflation. Prices rose 10 percent this year even as the Fed cut purchases, with Russia’s annexation of Crimea and mixed U.S. economic data boosting haven demand. Last year, Currie described gold as a “slam-dunk sell” for 2014.”

Where, one must ask, is the ‘fair and balanced standard of journalism’ in this article? Why is there no comment from any other analyst who suggests gold prices could rise on the record-breaking investment and acquisition of gold by China’s citizens? There is none. And that, to me at least, suggests duplicity on the editorial level to one of Bloomberg’s most important clients (for Bloomberg terminal subscriptions).

It goes on to categorize gold as the “least preferred commodity among metals”, according to an April 8th note to clients by Morgan Stanley.

But then there’s the second article, published a few hours later at 9:10 a.m. ET

Superficially, it appears to be an article that is pro-gold: “Gold Bears Wager Wrong Again as Fed Talk Favors Bulls“. However, as you read through the article, while it points out that commentators making negative bets on the gold price have been uniformly wrong in the first quarter of 2014, the article’s primary editorial thrust is to provide plausible explanations as to why they were wrong (attributed to extraordinary events) while pointedly reiterating why Goldman Sacks and Morgan Stanley are bearish on gold. So it comes off, overall, to be an apologist stance for the incorrectness of gold bears in the 1st quarter.

So questions should persist in inquiring minds about this. Why does Bloomberg not report on the positive influences on the future gold price? Why is there no reference to increasing demand for gold as an investment in Asia? Why is there not one mention of the deteriorating availability of gold and silver for physical delivery from COMEX warehouses? Why is there absolutely no discussion whatsoever of the premium one must pay over the quoted price of gold if one seeks to acquire physical gold at a bullion dealer? Why is there no mention of the fact that global production of gold is decreasing even as physical demand is rising? Why is there no discussion of the “double-counting” influence of paper gold in futures and other derivatives that distort buying and selling of derivative gold assets?

Why are you not asking these questions yourself?

While it is oh-so-fashionable to dismiss everything with a knowing wave of the hand as ‘conspiracy theory’, it is historically relevant that gold continues to be the internationally acknowledged standard against which all other currencies – indeed any asset value – can be measured. My vested interest in a higher gold price is limited, at this point, and so thus is my bias. My motivation in pursuing coverage of gold stems from a natural abhorrence of ignorance. What, you should be asking yourself, is Bloomberg’s vested interest in their preferential treatment of negative gold sentiment?

James West is the publisher of the highly influential and widely respected Midas Letter at midasletter.com. MidasLetter specializes in identifying emerging companies in gold and silver exploration at the beginning of their share price appreication curves, and regularly delivers 10 baggers (stocks that increase in value by at least a factor of 10) to his premium subscribers. Subscribe at http://www.midasletter.com/subscribe.php.

© 2014 Copyright Midas Letter - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Midas Letter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.