Apple, Facebook Beat Expectations - Stock Markets Long-term Recap

Stock-Markets / Stock Markets 2014 Apr 24, 2014 - 03:29 PM GMTBy: PhilStockWorld

Courtesy of Blain writes: Indexes took a little rest today, which as we said yesterday was probably needed. There was actually some bad economic news in housing and the market didn’t react much at all which is something bulls will like. After the close was a surprise stock split by Apple (AAPL) which will help the indexes tomorrow as the stock is up strongly in after hours. The S&p 500 fell 0.22% and the NASDAQ 0.83%. The Commerce Department reported new home sales fell 14.5 percent in March, the worst sales month since July. Again it is not the news that matters to markets, but the reaction to the news and the market didn’t really care.

Courtesy of Blain writes: Indexes took a little rest today, which as we said yesterday was probably needed. There was actually some bad economic news in housing and the market didn’t react much at all which is something bulls will like. After the close was a surprise stock split by Apple (AAPL) which will help the indexes tomorrow as the stock is up strongly in after hours. The S&p 500 fell 0.22% and the NASDAQ 0.83%. The Commerce Department reported new home sales fell 14.5 percent in March, the worst sales month since July. Again it is not the news that matters to markets, but the reaction to the news and the market didn’t really care.

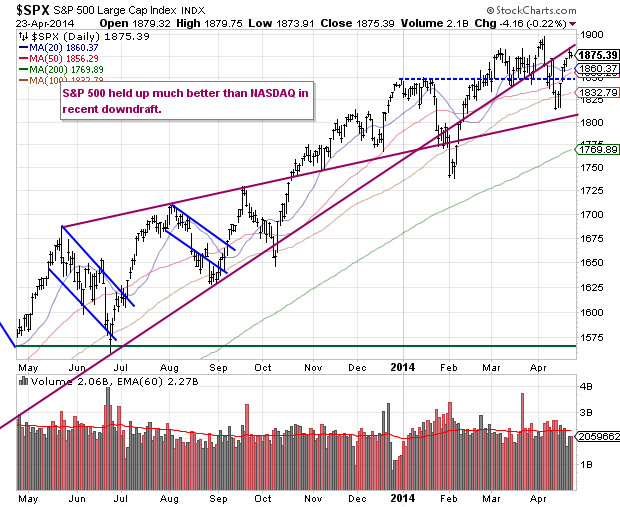

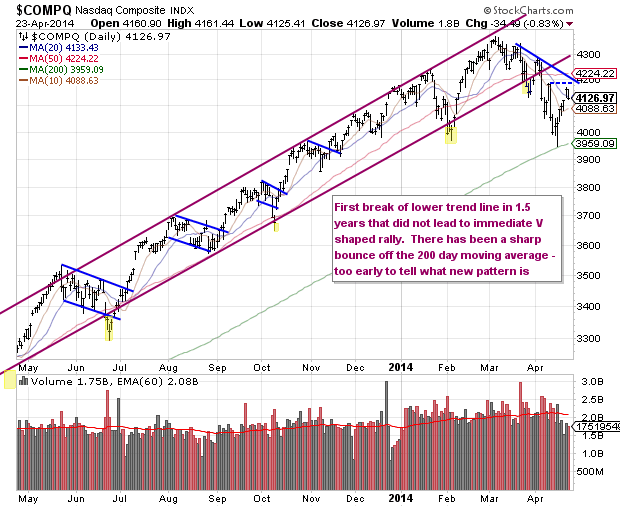

Here are longer term charts of the two indexes. The S&P 500 hit the top trendline which connected the lows of summer 2012 yesterday and fell back after a furious week long rally.

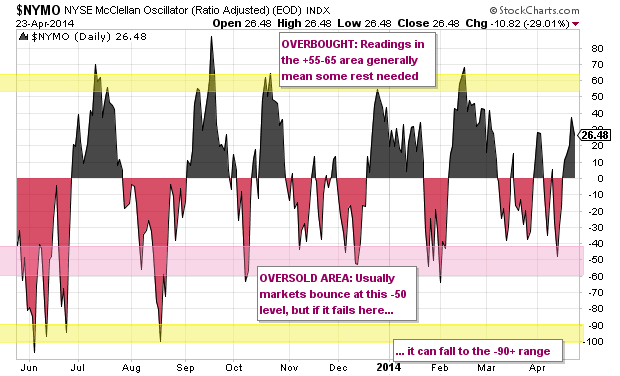

The NYSE McClellan Oscillator is back firmly in the positive; as always sustained readings between 0 and 40 would be good.

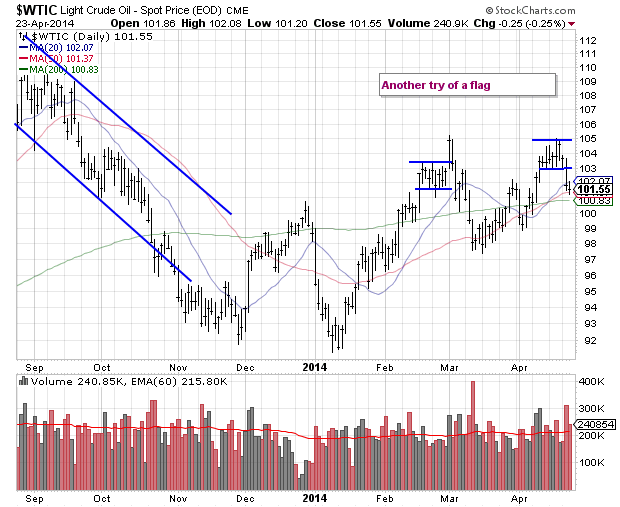

We mentioned oil Monday noting it was trying a new bull flag but this pattern has not been helpful in the commodity as it has been failing repeatedly. Well, the very next day it failed yet again so oil really is not respecting any technical analysis nowadays.

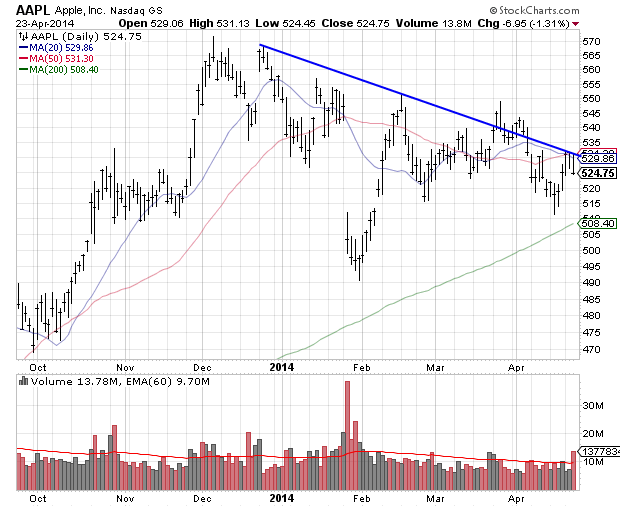

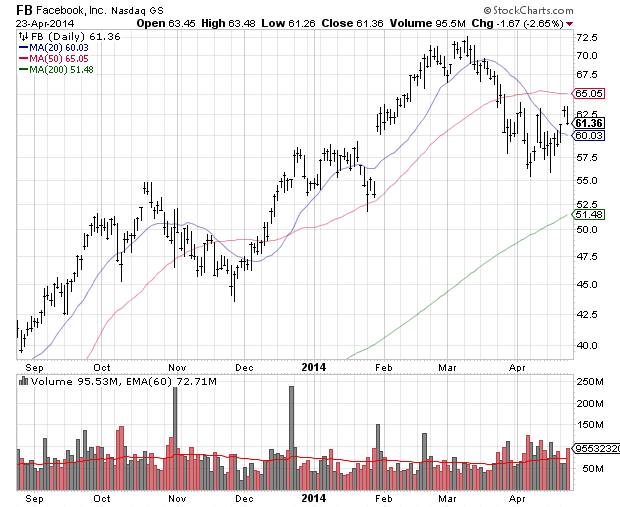

After the close the 2 widely followe dnamed to report were Apple (AAPL) and Facebook (FB). Both did well.

Apple exceeded expectations on iPhone while iPads didn’t do so well but news of a 7:1 stock split and larger repurchase plan helped lift the stock some 8% in after hours – this is a huge component of NASDAQ so you should see NASDAQ react well early tomorrow.

The company posted earnings of $11.62 a share, on revenue of $45.6 billion, blowing past estimates for $10.18 a share on $43.53 billion in revenue. Apple also authorized a 7-for-1 stock split, addressing calls to share more of its cash hoard. The board also approved a dividend increase of approximately 8 percent to $3.29 a share. The company additionally said it would boost the overall size of its capital return program to more than $130 billion by the end of 2015, up from its previous $100 billion plan. The tech giant said it sold 43.7 million iPhones and 4.1 million Macs, above expectations for 38.45 million and 4.08 million, respectively. But iPad sales missed estimates, with the company selling 16.35 million units, versus forecasts for 19.8 million.

Facebook continued to succeed in ramping up its mobile ad business which is what Wall Street is focused on. These results should help the momentum stocks tomorrow.

Facebook mobile advertising business accelerated in the first three months of the year, helping the Internet social networking company top Wall Street’s financial targets. Shares of Facebook were up nearly 3 percent at $63.05 in after-hours trading. Facebook said that mobile ads represented 59 percent of its ad revenue in the first quarter, up from 30 percent in the year-ago period. Facebook’s overall revenue grew 72 percent year-on-year to $2.5 billion in the first quarter, above the $2.36 billion expected by analysts polled. Facebook’s newsfeed ads, which inject paid marketing messages straight into a user’s stream of news and content, have ignited Facebook’s revenue growth and bolstered its stock price during the past year. The ads are ideally suited for the smaller-sized screens of smartphones and other mobile devices.

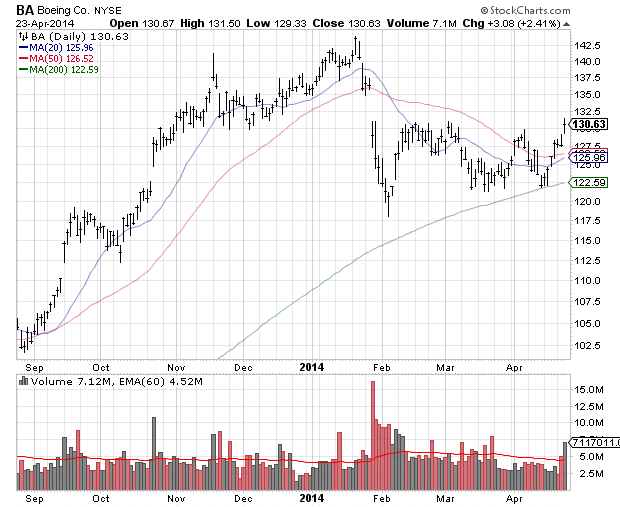

Boeing shares gained after the plane manufacturer tallied a 14 percent gain in adjusted net profit in the first quarter, topping expectations.

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2014 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.