The Great American Giveaway

Politics / US Debt Apr 25, 2014 - 04:15 AM GMTBy: Andy_Sutton

What do the national debt and a designer Hepatitis C drug have in common? This question actually spans two areas near and dear to my heart: economics and medicine. What I’m going to be covering this week is something that I feel is going to be part of a growing trend in America over the coming decades. You see, too many – myself included for quite a while – were asking the wrong questions. Many still are. We shouldn’t be asking what we can do, conventionally speaking, to pay off the national debt because it cannot be done. Consider the unfunded liability portion and that should be obvious to everyone. So what? We just default? That has been suggested. With devaluation we’ve already been doing it, albeit with sleight of hand. Don’t count on the fact that the debtors are ignorant though because they aren’t. This article is going to prove that.

What do the national debt and a designer Hepatitis C drug have in common? This question actually spans two areas near and dear to my heart: economics and medicine. What I’m going to be covering this week is something that I feel is going to be part of a growing trend in America over the coming decades. You see, too many – myself included for quite a while – were asking the wrong questions. Many still are. We shouldn’t be asking what we can do, conventionally speaking, to pay off the national debt because it cannot be done. Consider the unfunded liability portion and that should be obvious to everyone. So what? We just default? That has been suggested. With devaluation we’ve already been doing it, albeit with sleight of hand. Don’t count on the fact that the debtors are ignorant though because they aren’t. This article is going to prove that.

Sovaldi (Sofosbuvir) – the $1000/day Hepatitis Drug

I’m not here to tout this drug or make a commercial and I will disclose that as of this writing neither myself nor any of my firm’s clients hold any financial interest in Gilead Sciences, the maker of this drug. This article is an illustration, not an infomercial. While I have my own opinions based on scientific training and experience on the viability of this drug and the results that can be expected, they will remain private.

Indisputably, the results so far have been pretty good, and with the explosion of Sovaldi on the scene, it seemed that the sky was indeed the limit, and the price tag reflects that. The drug received FDA favored status (Breakthrough Therapy Designation) and the new drug application that was filed in April 2013 was essentially fast-tracked and approved in December 2013. The course of treatment is around 12 weeks for most types of Hepatitis C, with some types of the disease requiring a 24-week course. The cost is around a thousand bucks a day if you happen to live in America. Given the savings status of the average American and the fact that the cases are skewed towards lower SES folks mostly due to the way the disease is transmitted, one wouldn’t think such a price tag would fly in the USA.

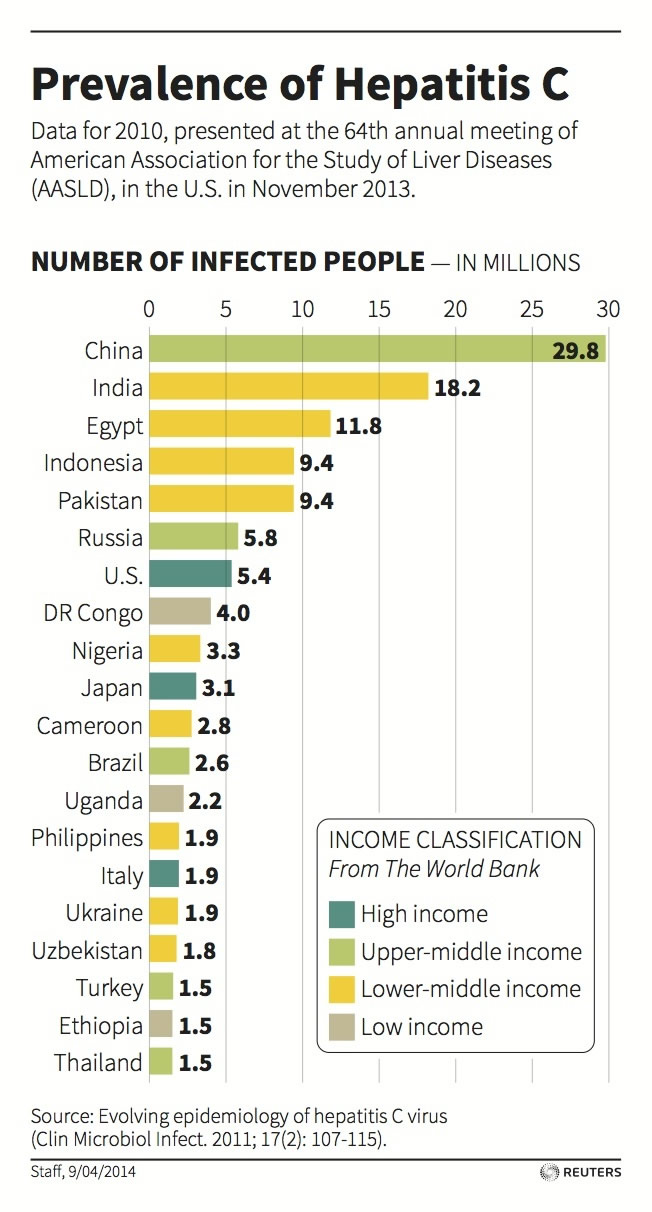

But with the tentacles of government reaching into virtually every household with the march towards single-payer healthcare, there is going to end up being a pretty healthy appetite for the drug here in the states after all. According to the journal Clinical Microbiology, there were around 5.4 million cases of Hepatitis C in the US in 2011. At $84,000 a pop minimum per case, we’re looking at a windfall of around half a trillion dollars. Yes, trillion with a T. Obviously this assumes that there are in fact 5.4 million cases still, that every one of them gets treated, and that the insurance or someone actually shells out the $84,000 for the regimens. Obviously, given that a certain percentage of patients are going to need a 24-week treatment, it is very possible that the windfall from Sofosbuvir could be a lot higher.

Keep in mind this is just for the US alone. According to the same journal, there are approximately 120 million cases among the top 20 countries for Hepatitis C cases. You do the math. Using the same assumptions as above, just a shade over a cool $10 trillion. Extraordinary, right?

It’s Payback Time…

Not so fast. You see, Gilead Sciences is an American company. The company, headquartered in California, has locations spread out mostly on the west coast. There is one big fly in the ointment of this whole $10T profit idea and that is a simple one. You go into the parts of the world where Hepatitis C is the most prevalent and the money to pay for the drug disappears. But these governments recognize the drag on GDP, etc. that the disease represents even if they deny that it is a huge albatross on public health. So they want their people treated. Let’s name some names here. We’re talking about places like Brazil, India, Egypt, and even Iran.

These countries have one thing in common. Forget ideological rhetoric. That is for the brain-dead. Let’s look at this practically. These countries all have an aversion to the USDollar. Take India and Brazil and you’re looking at an important spoke of the BRICS wheel. China has a huge Hepatitis C problem if only in absolute numbers at nearly 30 million cases. There’s another huge chunk of the BRICS. And we know how they feel about the US running up astronomical debts, etc. We know that chunks of the amber waves of grain that used to run from sea to shining sea have already been pledged or already turned over to various debtors. Now our innovation is being pledged as well. How, you ask?

The Emerging ‘Solution’

How does a 99% discount sound for the folks in Egypt, India, and Brazil for starters? That’s right – in America, we will pay $84,000 for a course of Sofosbuvir, but it’ll sell overseas for $840. Ten bucks a day versus a thousand. Ever hear of a subsidy? Well, you’re looking at one right in the face here. Ever hear of payback? Again, you’re looking at it. Of course, American insurers are properly incensed about this price differential; after all, they crafted this scam called single-payer insurance also known as O’Puppetcare. They’re in business to lose money now, all of a sudden, right? False. Not the insurers, but rather, the insured will be the ones that pay for this subsidy. That in and of itself should be no surprise. The end-user pays for virtually every subsidy. That’s why it is called a subsidy. One pays for another. A tenet of socialism.

This one should have a particularly foul stench about it though, especially in a world where intellectual cretins have daily confabs on television about how this is America and we’re immune from the judgments of our fiscal misdeeds. There are no consequences, right, Mike? Right, Larry? While the economic equivalent of the Three Stooges carry on about this and that, our best and brightest of everything is going out the door to pay for debts the American people never signed onto. Have I got your attention yet?

The point of this essay is not to make value judgments about who should or shouldn’t be getting this or any drug or anything else for that matter. We’ll leave that to the pundits. After all, they need material too. And they’re really good at making a perfectly good lemon merengue pie look like a bulldog that ate a jar of mayonnaise by the time they’re done.

Simply put, this issue can be wrapped up nicely by saying that the spread of anti-greenback sentiment is spreading. Sure, we already knew that. However, what is fairly novel about this situation is that countries that otherwise really don’t have much in the way of financial or economic leverage are suddenly reaping benefits at the expense of the American healthcare consumer. Said another way, many thought we only had to worry about China because she is our biggest creditor. But don’t forget that she has many friends and that list is growing by the day, especially when it comes to denouncing the Dollar as the standard bearer in global commerce.

To put a tie it up and put a little bow on it, China takes care of her friends. Reference Pakistan last year where the mere threat of a dollar dump sent US diplomats diving for cover. Still haven’t heard anymore about that one, have we? Reference the ongoing issues in the Ukraine. The US is impotent. The sanctions are a joke. We sanction and Vlady laughs. Of course a whole bunch of us told everyone that years ago, but nobody was listening. Funny thing is, they still aren’t.

In summary, it is payback time. It might be the sale of a national park near you, a new toll highway, the loss of cattle grazing lands, ‘economic zones’ for the benefit of others, or the sale of a national landmark. Don't be surprised when you see these things happen. We’ve made our bed and now it is time to lie in it.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.