Sterling British Pound Strength and 'Real' Differentials

Currencies / British Pound May 06, 2014 - 05:15 PM GMTBy: Ashraf_Laidi

The British pound is the best performing currency so far this quarter (+2.0% vs USD) as well as over the last 6 months (+5.7% vs USD) out of the top-traded 11 currencies.

The British pound is the best performing currency so far this quarter (+2.0% vs USD) as well as over the last 6 months (+5.7% vs USD) out of the top-traded 11 currencies.

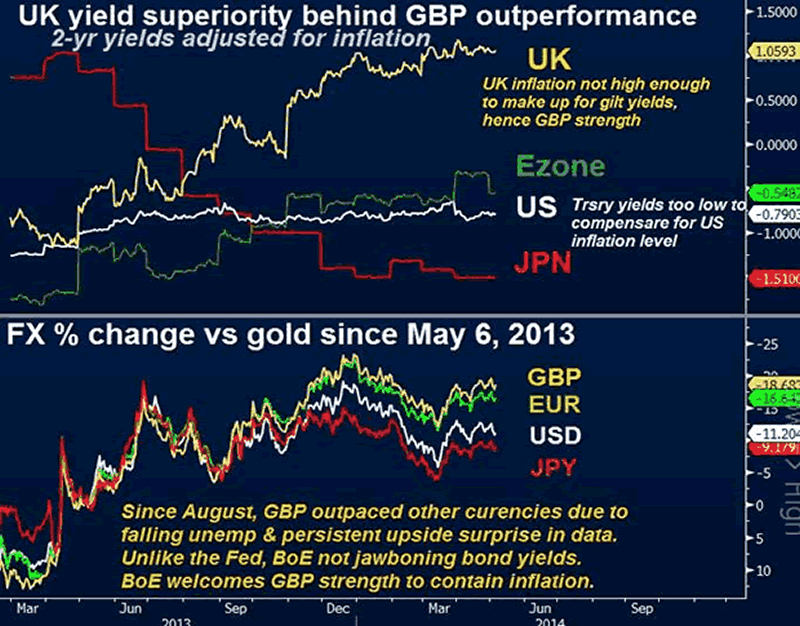

Real differentials in 2-year govt bond yields (yield minus inflation) have helped explain currency performance over the last 2 years, including sterling's strength since last autumn.

Such yield superiority is underscored by higher gilt yields and moderate inflation.

Currency performance is best measured against gold to highlight common denominator. Chart shows gold has fallen the most against GBP, -19% since May 6, 2013.

The simultaneous decline in UK inflation and unemployment rates, as well as the increase in real wages (earnings minus CPI) reflect the importance of GBP strength in maintaining inflation expectations anchored within the BoE's target at a time when further tightening in labour markets emerged alongside the slow but gradual expansion in UK growth.

Despite US 2-year yields exceeding their German counterparts by 0.27%, they're not sufficiently priced to account for the higher inflation differential with the Eurozone, considering Eurozone CPI at 0.7% y/y and US core PCE at 1.2%. This helps explains EUR outperformance of US.

The index of economic surprises in the UK continues to exceed that of the US, Japan, Germany, Canada and China. Wage growth is closing the gap with inflation and business surveys have remained robust after hitting multi-month highs earlier this year. Not only these figures (including positive real wage growth) will favour PM Cameron's re-election bid next year in showing the positive spillover from the City onto main street, but they will translate into an added boost to finally see a break above $1.69 in GBPUSD.

For these reasons, we continue to expect NO verbal intervention from the Bank of England regarding sterling strength. If anything, the market will likely keep on buying sterling on the dips based on the classic combination of improved growth-low inflation. $1.7130 is now our objective and any decline below $1.66 is behind us for now.

Best

For tradable ideas on FX, gold, silver, oil & equity indices get your free 1-week trial to our Premium Intermarket Insights here

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2014 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.