The Nickel Supply Squeeze Is Just Getting Started

Commodities / Nickel May 28, 2014 - 04:02 PM GMTBy: Investment_U

Back in January, I wrote a column explaining the supply-demand squeeze in nickel.

Back in January, I wrote a column explaining the supply-demand squeeze in nickel.

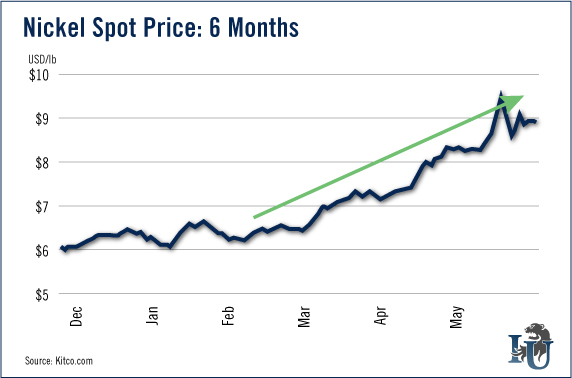

One way I suggested to play the nickel squeeze, the iPath Dow Jones-AIG Nickel Total Return Sub-Index ETN (NYSE: JJN), is up 38% from my recommendation.

Did you buy that fund? Well, if you didn't, there's no need to kick yourself.

The nickel run isn't over.

The biggest user of nickel is China. Nickel is used to make stainless steel, and China makes a lot of it. Stockpiles of nickel in China are falling. According to Deutsche Bank, China's nickel stockpile is now down to one month's supply, a drop of 26% in just a month.

A big supply crunch is coming for China.

What's more, the global nickel market will swing to a deficit of 132,200 tons next year from a surplus of 13,800 tons this year, according to Citigroup.

What will that do to prices? The price of nickel was recently $8.91 per pound, or $19,615 per metric ton. Citi forecasts nickel prices to rise to more than $30,000 per metric ton next year. That's a rise of more than 50%!

The Source of the Problem

Indonesia's ban on nickel ore exports has removed close to a third of the world's supply. Indonesia's raw nickel exports have gone to zero. Everybody thought there would be relief to this thanks to an election in April, but that didn't work out.

Now Indonesia says it is furiously building nickel smelters to fix the supply crunch. And that's a good idea, except for one thing: power.

The government is talking up the number of planned smelters. Two ferronickel and seven nickel-pig-iron smelters should be completed this year, according to the Energy and Mineral Resources Ministry.

What's more, the ministry says as many as 63 smelters may be built by 2017, including 40 nickel plants, 10 iron ore smelters and four copper-cathode smelters.

However, many of these mines are scattered over Indonesia's 17,000 islands. How are they going to get power to all those new smelters?

I'll tell you how: They won't. The whole thing is pie in the sky.

According to an analysis from Standard & Poor's, smelters at new mines are horribly expensive and a drag on profitability.

"For a greenfield nickel smelter to be economical, capacity must be at least 10,000 or 15,000 tons of contained nickel per year," the S&P report said. "Such a smelter would require several hundred megawatts of electricity capacity and more than $1 billion in investment."

So maybe the Chinese will pony up money for the smelters. Are they going to pay for a power grid that can connect to outlying islands, too?

The Government Doesn't Care

Do you think any of this worries the Indonesian government? Ha!

Sure, lack of supply will put upward pressure on nickel prices. And nickel miners are being thrown out of work. But the fact is, the Indonesian government really doesn't care.

That's because it taxes finished nickel exports, and as the price of nickel goes higher, the taxes it collects will more than make up for what it formerly collected on nickel ore.

So why would the Indonesian government solve a problem that puts more money in its pockets?

Meanwhile, the price of nickel is going up and up and up.

Good investing,

Sean

P.S. As recently as 2005, America's energy industry faced the same sort of supply-demand crunch. But then came an incredible invention. Not only did it revolutionize an industry... it's still spawning overnight millionaires. To get my full take (with several profit opportunities) on the technology, click here.

Source: http://www.investmentu.com/article/detail/37689/nyse-jjn-nickel-supply-squeeze-starting

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.