The Underpants Gnomes Business Plan

Companies / Investing 2014 May 29, 2014 - 10:02 AM GMTBy: John_Mauldin

By Grant Williams

By Grant Williams

This week’s TTMYGH will be a little shorter than usual (“Thank heavens!” I hear you cry) owing to my presence at the Strategic Investment Conference 2014 this past week and the travel time to and fro.

Due to the hectic schedule and the fact that there were so many interesting people in attendance, I had planned to spend my week dragging as much knowledge as I possibly could out of those who made the trip to San Diego rather than committing finger to keyboard; but a chance encounter with a delightful young lady initiated an engaging conversation which, in turn, led to my discovery of the Underpants Gnomes.

Those of you who have ever attended an event such as the SIC know full well how such conversations arise. Those of you who haven’t will likely think I’ve taken another step towards the light (and will wonder just what sort of a dialogue we engaged in), but allow me to elaborate.

I will spare the name of the young lady in question to protect her modesty, but if she happens to be reading this back home in Bath, my thanks for the inspiration — even though I find myself awake at 3 AM rather worriedly thinking about underpants.

On December 16th, 1998, Comedy Central broadcast the seventeenth episode of the second season of South Park. In the episode, written by Trey Parker and Matt Stone, Harbucks (a franchise coffee shop chain with no similarity to any real-life company) planned to enter the South Park coffee market, thus threatening the local business owners.

Through a rather convoluted series of developments, the boys (Stan, Kenny, Kyle, and Cartman), are tasked with writing a school report on the threat that corporatism poses to small businesses. The report mobilizes the South Park community to take action against the insurgent corporate behemoth.

In true South Park style, what starts off as an attack on the culture of greed surrounding corporate interests ends up taking a pot-shot at the work ethic and merchandise quality of the small business owner.

Somewhat surprisingly, the TV critic (and sometime Austrian economist) Paul Cantor referred to this particular episode as “the most fully developed defense of capitalism ever” — which simultaneously speaks volumes regarding both the South Park writers and all those who have at one point or another defended capitalism.

(If you’d like to watch the full episode, you can find it HERE. Ain’t the internet grand?)

So... those Underpants Gnomes.

In the middle of the episode, Stan, Kyle, Kenny, and Cartman finally manage to lay eyes upon a pack of mysterious gnomes and ask them if they know anything about business. The gnomes assure the boys that they do and lead them into the cave where the gnomes stash their contraband underpants.

Once there, the gnomes lay out their business plan... a thing of beauty and simplicity that has been emulated by many companies in the age of the Internet of Things (a phrase whose constant occurrence in recent years has never failed to get my hackles up, but one that has, amazingly, been in existence since the early 1990s).

Surprisingly enough, many investors seem to have bought into things that even Eric Cartman could see through. Ah well, there’s no helping some folks.

Behold, the Underpants Gnomes’ business plan in all its majesty:

Now, in the real world, during the first internet boom (which peaked the year after this episode of South Park aired), the business model of the Underpants Gnomes was commonplace, as scores of companies flooded the marketplace, sustained purely by the promise of future profits that would somehow magically appear.

It was the corporate embodiment of George Costanza’s “yada, yada, yada”: “First we build a company... yada, yada, yada... we make billions.”

Of course, most of these companies went the way of the dodo; but remarkably, a mere 14 years after the bursting of the original internet bubble, there are signs of what Yogi Berra so beautifully referred to as “déjà vu all over again” — signs which some real heavyweight financial minds have recently highlighted:

(Seattle Times): Venture capital rising to levels not seen since 2001. Companies with no profits going public. Billions of dollars being paid for startups.

These and other signs that the tech boom may be taking an irrational turn are leading some notable investors to utter the dreaded word “bubble,” waking up the ghosts of an era many in Silicon Valley would prefer to keep buried.

Has Silicon Valley once again lost its collective mind?

Hedge-fund manager David Einhorn thinks so.

“There is a clear consensus that we are witnessing our second tech bubble in 15 years,” he warned in a note to his clients in late April. “What is uncertain is how much further the bubble can expand, and what might pop it.”

Of course, as we saw in 1998/9, there are plenty of people who believe in fairy tales, and they are happy to explain why THIS time is different:

Venture capitalists and entrepreneurs insist the Silicon Valley tech economy is not in bubble territory. Yes, they misjudged just how fast the Internet would change the world a decade ago and let things get a little bit out of hand.

But this time, they say, the revolution of mobile and cloud services justifies big, bold bets. And most of the companies going public are profitable, with real businesses that are transforming the way we live.

To some tech insiders, the region’s economy is in a “Goldilocks” moment. Not too hot. Not too cold. Enough of a boom to be just right.

Seriously?... Goldilocks? Again with that?

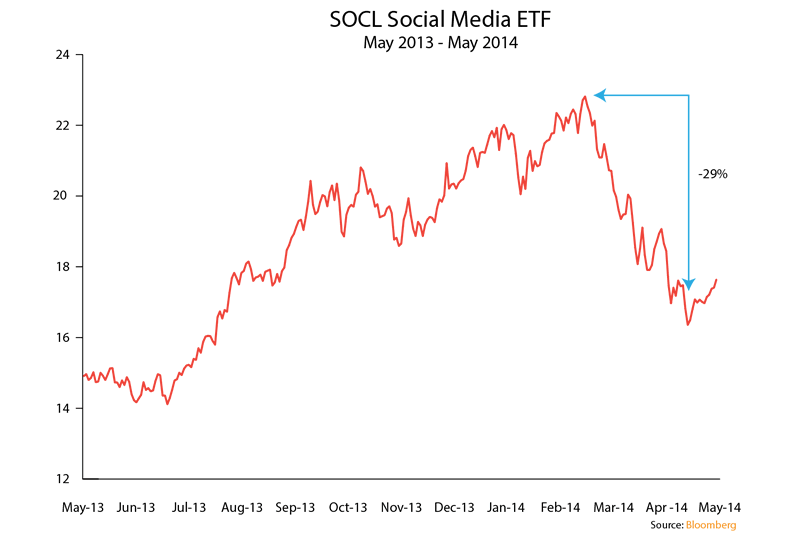

As you can see from the chart above, the Social Media ETF (SOCL) has fallen in almost a straight line since it peaked on Feb 19, 2014. Quite coincidentally, that was the day when $19 billion was paid for Whatsapp’s 450 million users.

The day that rationality returns to investing in technology stocks will be the day that we see some high-flyers (which had previously been given a pass on their poor performance because the promise of a bright tomorrow was just SO compelling) fall to earth in a hurry.

However, so as not to call out any specific companies, I am going to take the South Park approach and lay out a hypothetical fable about one such giant, high-flying corporate darling which has been embraced for its willingness to follow the Underpants Gnomes’ ingenious business plan.

The company has designs on becoming absolutely essential to all of mankind; and at that point, it has promised, it will figure out how to make a profit from the massive turnover that comes with ubiquity.

Let’s call this company... Spamazon.

(I should point out that Spamazon is an entirely fictional company. I offer no recommendation whatsoever, implied or otherwise, to either buy or sell the imaginary shares of this completely made-up entity.)

Spamazon was founded in 1994 in the mythical town of Beattle by an ex-investment banker and Harvard graduate named Jim Beeswax, a man with a passion and talent for engineering who had seen the internet wave swelling and wanted to ride it to the shore, where riches and fame awaited.

Click here to continue reading this article from Things That Make You Go Hmmm… – a free weekly newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.