Gujarat, India Like Investing in China… In 1980

Stock-Markets / India Jun 02, 2014 - 02:10 PM GMTBy: Money_Morning

Peter Krauth writes: Hardly anyone would argue that China isn't an economic miracle.

Peter Krauth writes: Hardly anyone would argue that China isn't an economic miracle.

Over the last 20 years, its 1.3 billion people have propelled the Chinese economy into the world's No. 2 spot.

But two decades of blistering 10% annual growth have moderated to 7%.

However, a potential sea change is underway in its southern neighbor, India.

With a new, impressive prime minister, and a burgeoning consumer population, they're setting up as the next economic miracle...

The Barriers to Growth Are Tumbling Down

India's 1.2 billion people have just held the world's biggest democratic election in history.

With 814 million eligible voters, it took over a month to complete.

And with a 66.38% turnout, the highest ever in Indian general elections, people wanted to be heard.

That's because after decades of crippling bureaucracy and deep-rooted corruption, Indians have had enough.

In a country where government boondoggles are rampant, it's estimated some $240 billion of public works projects are red-taped and unable to move forward.

In one instance, the federal government investigated illegal and unreported iron ore mining over the four years spanning from 2006 to 2010. As a result, numerous high-ranking officials were jailed after more than 110 billion short tons of iron ore may have been mined without permits or paying royalties.

Since then, the Supreme Court of India has banned mining in some of the involved areas, with the Federation of Indian Mineral Industries indicating that iron ore exports have fallen 70% since the ban in Karnataka and Goa states.

Sadly, most of India's infrastructure is appalling: power, transportation, information networks, and water, where they exist, are often subpar and overloaded.

But that's not the case everywhere.

Take Gujarat state, for example...

The Economist said Gujarat is India's Guangdong - an industrial powerhouse province in China - and that "so many things work properly in Gujarat that it hardly feels like India."

Gujarat is so industrious that it's responsible for 25% of national exports, while home to just 5% of India's population.

Most impressive, however, is the man who was instrumental to the state's success.

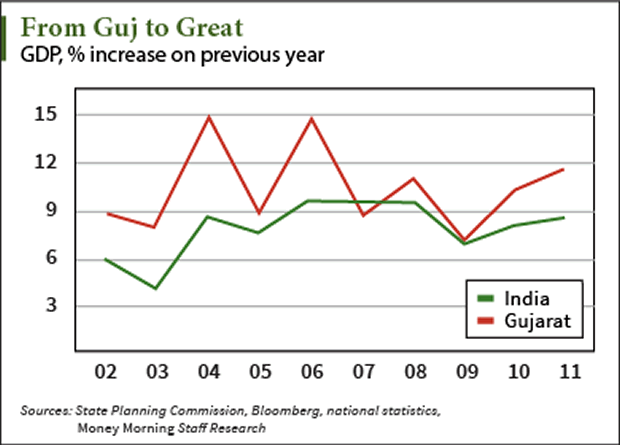

Narendra Modi was Chief Minister of Gujarat from 2001 to 2014. During his tenure, the last decade saw Gujarat's economy grow at over 10% annually, while India's grew at just under 8%. Modi brought electricity to all 60 million of its residents, the first Indian state to achieve this milestone.

And Modi also happens to be India's newly elected prime minister.

Modi's reputation, it's fair to say, is why his party won the election. They even locked up seats to spare with India's most decisive vote in three decades.

According to the BBC's Andrew North, "The scale of victory is truly gigantic in India's fractured polity where no party has managed to get a simple majority since Congress in 1984 won 415 seats riding on a sympathy wave after the assassination of Indira Gandhi."

On his first day in office, Modi clearly stated that his office would "call the shots" on all important policy issues, reversing the structure that developed over the last decade, leading to massive inaction.

The Best Direct Play on India

Modi may be a person of ambition, but, more importantly, his track record demonstrates he's one of action.

His goal is to bring electricity to all of India by 2019 which, to this day, still counts 400 million citizens without.

Infrastructure build-out and improvements, deregulation, and foreign investment are all top priorities for the new administration. Modi has ambitious plans for his country.

That's going to require massive amounts of resources like base metals and energy. And with China's growth moderating, India could go a long way to compensate for demand.

And it appears investors have taken notice of India's new way forward.

Year to date, along with a shot in the arm since the start of the election, India's stock market has gained 17%.

But I believe there's much more to come.

A straightforward way to play India's secular bull is through the iShares India 50 ETF (Nasdaq: INDY). The fund tracks the performance of India's 50 largest public companies. It's up by 26% year to date, but still trades at a very reasonable P/E of 15 while yielding 0.7%. And there should be a lot more upside to come.

Modi's campaign slogan was "Good Times Ahead."

Considering his pro-business stance, propensity for lean government, and most of all his track record, it will also be "Great Profits Ahead."

Source : http://moneymorning.com/2014/06/02/this-is-like-investing-in-china-in-1980/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.