Gold and Silver Bottoming Out?

Commodities / Gold and Silver 2014 Jun 13, 2014 - 02:30 PM GMTBy: Alasdair_Macleod

The signs are good. With record short positions in gold and silver, hedge funds and algorithmic traders should be worried at the lack of price confirmation: gold is holding well above its bear-market lows and silver is refusing to weaken into new low ground.

The signs are good. With record short positions in gold and silver, hedge funds and algorithmic traders should be worried at the lack of price confirmation: gold is holding well above its bear-market lows and silver is refusing to weaken into new low ground.

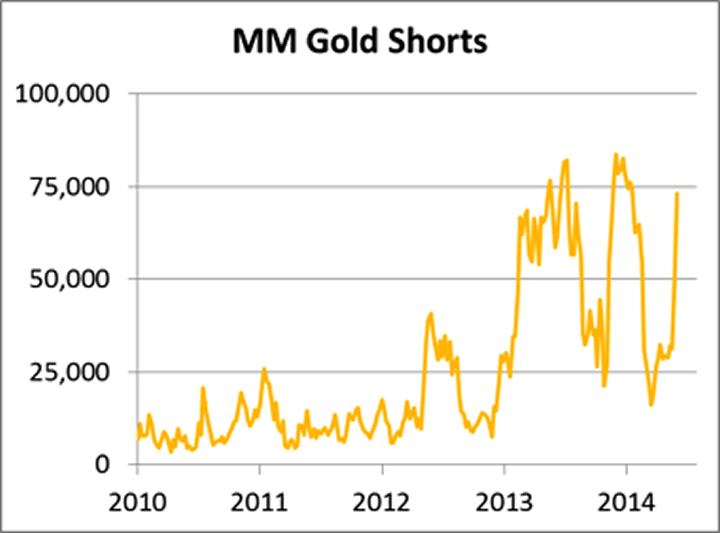

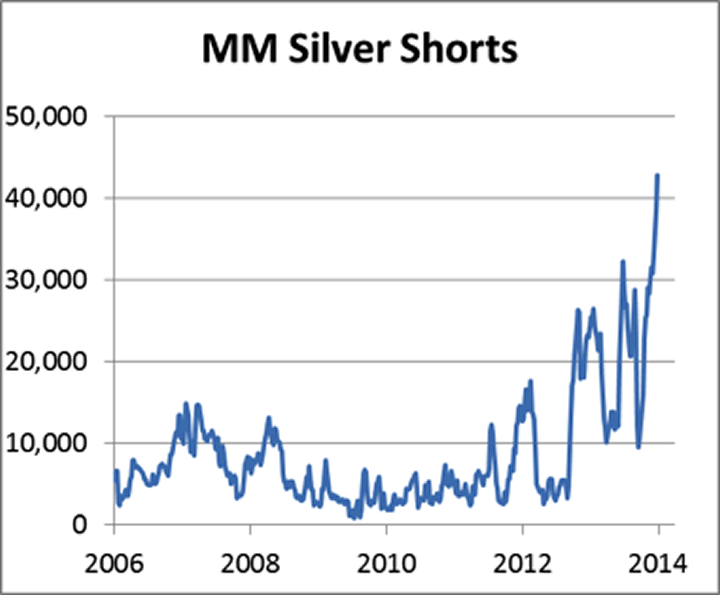

The first chart is of the Managed Money short positions in gold futures on Comex, and the second is of silver futures.

The sudden increase in shorts in both metals amounted to a dramatic bear raid. With gold rising every day this week the squeeze is now on, suggesting in the absence of any new and material factor the current rally should have enough legs to take gold to the $1300 level. The situation in silver is likely to have a more dramatic outcome, with the caveat that the active July contract is running off the board.

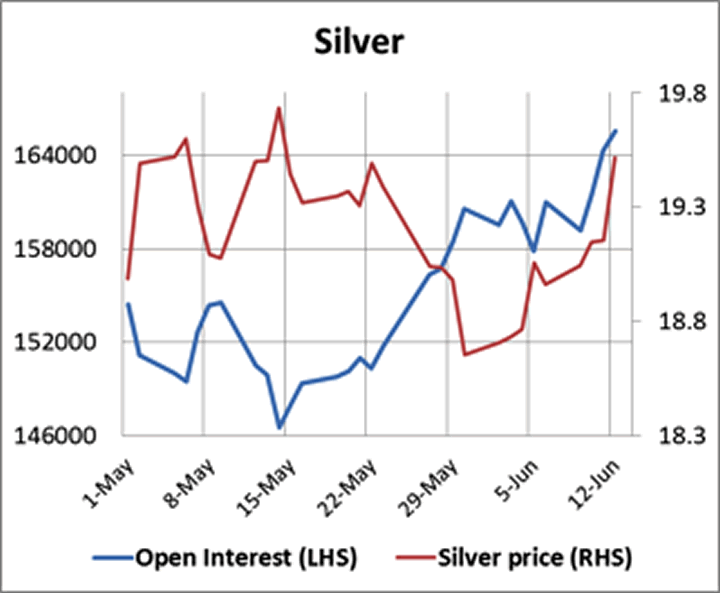

It is notable however that open interest in silver has been steadily growing to near-record levels for the last eighteen months, which tells us that buyers are absorbing everything the bears are throwing at the market. This is shown in the next chart.

The big news this week came on Wednesday, when Al-Qaeda affiliated rebels in North-Western Iraq took the cities of Mosul and Kirkuk. In the process they captured a large amount of military hardware and are now well equipped. This morning Iraq’s problems appear to be spreading into a wider Sunni insurrection, with Kurdish tribesmen also rebelling against Bagdad rule. Importantly, the Kirkuk-Ceyhan pipeline, which takes oil to the Mediterranean, as well as the Kirkuk Oilfields themselves were first to be affected, and oil prices rose sharply on the news. Indeed, all Iraq’s oil production could be threatened. Higher energy price assumptions are likely to influence economists’ forecasts of economic growth in US and other markets.

Economists had been downgrading growth prospects already. In the US first quarter GDP expectations have been revised to a contraction of as much as 1.6%, and the Fed’s forecast of 2.8% growth for the whole year is now looking too optimistic. The US is not alone: Japan and the Eurozone are fighting deflation and China is trying to rein in credit growth. In short, the conditions that have led to low bond yields and highly-valued stock markets may be changing for the worse.

Where this leaves precious metals is yet to be seen, but it is worth bearing in mind that hedge and other funds exposed to losses in bonds and equities will likely reduce their short positions in gold and silver. And if the current weakness in bonds and equities persists, it should be positive for precious metal prices as the bears run for cover.

Next week

Monday. Eurozone: HICP. US: Empire State Survey, Net Long-Term TICS Flows, Capacity Utilisation, Industrial Production, NAHB Builders’ Survey.

Tuesday. UK: CPI, Input Prices, Output Prices, ONS House Prices. Eurozone: Labour Cost Index, ZEW Economic Sentiment. US: Building Permits, CPI, Housing Starts. Japan: Customs Cleared Trade.

Wednesday. US Current Account, OMC Fed Funds Rate. Japan: BoJ release minutes.

Thursday. Japan: All Industry Activity Index, Leading Indicator. UK: Retail Sales, CBI Industrial Trends. US: Initial Claims, Leading Indicator.

Friday. Eurozone: Current Account, Flash Consumer Sentiment. UK: Public Borrowing

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2014 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.