Five High-Yield Dividend Stocks That Will Make You Love the Tech Sector

Companies / Tech Stocks Jun 19, 2014 - 12:09 PM GMTBy: Money_Morning

Tara Clarke writes: Investors looking for high-yield dividend stocks have previously eschewed the tech sector, as that's traditionally been a place to invest for growth.

Tara Clarke writes: Investors looking for high-yield dividend stocks have previously eschewed the tech sector, as that's traditionally been a place to invest for growth.

Instead of paying out extra cash to investors, tech high-fliers typically reinvest cash in research and development, mergers and acquisitions, and other classic "growth" strategies. That's why their earnings - and share prices - grow faster than average.

3D Systems Corp. (NYSE: DDD) is the perfect example. Money Morning Defense & Tech Specialist Michael A. Robinson recently called it "the ultimate growth stock."

3D Systems started an aggressive acquisitions program in 2007 to gain engineers, software, and other material needs. DDD has acquired more than 40 companies since 2011. It has also more than tripled its R&D spending per quarter since 2012 - compare $4.933 million spent in Q1 2012 to $17.24 million spent in Q1 2014.

The company's earnings reflect the payoff - on February 28, DDD announced full-year revenue growth of 45% for 2013 to a record-high $513.4 million. And 3D Systems stock has skyrocketed - DDD gained more than 850% in two years, jumping from around $10 per share at the start of 2012 to $96 per share at the end of 2013.

But, like a classic searing-hot tech stock, DDD has never paid a dividend.

That's why investors looking for high-yield dividend stocks go to sectors like utilities and consumer staples.

These companies have matured. Their growth phases are over, so they use their strong cash flows to pay dividends. This attracts investors even if the stock has low share-price growth.

Procter & Gamble (NYSE: PG), for example, has increased its dividend for 57 straight years and offers a yield of 3.23%.

But a few years ago, things started to change. Now companies like this also exist in the tech sector.

In fact, some of the biggest names in tech have become high-yield dividend stocks that rival traditional dividend payers in yield and market performance.

And investors who take advantage of this trend will tap into some of the biggest dividend payouts in history...

Tech Becomes the Home of High Yield

As tech companies mature and transition from their growth phase into a more stable period, they usually find themselves with more cash than they know what to do with. That's why a couple of years ago, tech dividend payouts picked up the pace. They jumped about 14% in 2012 - compared to the previous years' increases of about 10%.

According to the online investing resource Investopedia, over the past 10 years tech has increased its average dividend payments by 25%. That's about 10% higher than the second-biggest dividend payer, consumer services.

Now Apple Inc. (Nasdaq: AAPL) is the largest dividend payer in the Standard & Poor's 500 Index. It paid out more than $10 billion in dividends in 2013.

Another reason to turn to tech for yield is, not only do these dividend payers provide income, but they also have outperformed market downturns. Many have shown sustained growth even in volatile markets.

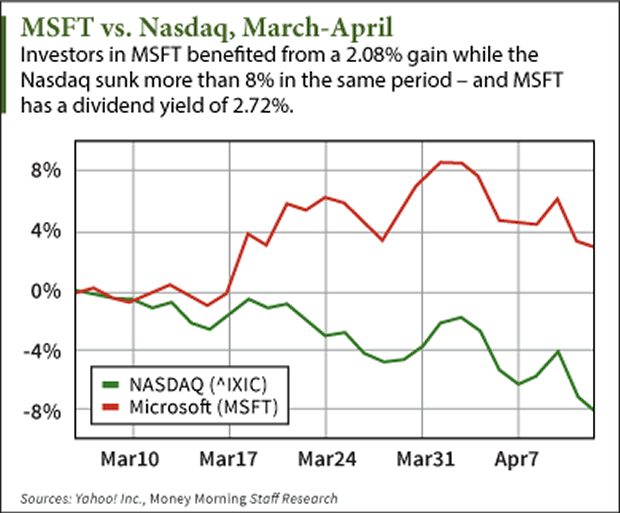

For instance, the Nasdaq Composite plummeted 8.22% between March 5 and April 11 this year. In the same time period, tech giant Microsoft Corp. (Nasdaq: MSFT) - which pays a quarterly dividend of $0.28 per share - gained 2.08%.

high yield dividend stocks

Now, here's a look at five high-yield dividend stocks in the tech sector.

Five High-Yield Dividend Stocks in the Technology Sector

Intel Corp. (Nasdaq: INTC)

U.S. chip manufacturer Intel doubled its dividend from 2007 to 2012, now paying $0.225 on a quarterly basis, or $0.90 annually. That's good for a yield of 3%. And, with a price that's only 11 times next year's earnings, it could still see significant growth in the next year. Plus, those who are assembling an income portfolio will be pleased to know that Intel has increased its dividend every year for the past decade.

INTC is up 15.45% year to date, and 20.24% over the last 12 months. Shares traded at $29.97 on Monday.

Apple Inc. (Nasdaq: AAPL)

The world's second-largest IT company by revenue, Apple started offering a dividend in 2012 after a 17-year hiatus. But, according to FactSet dividend information, it has quickly climbed to become the second-largest payer of dividends in the S&P 500, second only to Exxon Mobil Corp. (NYSE: XOM). Apple investors were rewarded with a $3.29 dividend on May 8, good for a yield of 2.04%.

Last Monday, an Apple stock split sent shares from more than $600 per share to a little over $90 per share. Apple stock traded at $92.26 on Monday and is up 15.08% year to date.

Cisco Systems Inc. (Nasdaq: CSCO)

high yield dividend stocks

In mid-December, networking equipment master Cisco Systems increased its dividend after a phone call from consumer advocate Ralph Nader. Nader urged the company, which had $45 billion in liquid assets, to share the wealth with their investors. Cisco obliged, boosting its dividend from $0.17 per quarter to $0.19 per quarter for an annual dividend of $0.76. That's good for a 3.1% yield.

CSCO stock is up 18.57% over the last six months, and 9.32% year to date. Shares traded at $24.52 on Monday.

Microsoft Corp. (Nasdaq: MSFT)

The world's largest software maker by revenue, Microsoft is stable and cash-rich, with over $77 billion on its books. However, that has not stopped the company from increasing its dividend every year for more than 12 years. TCW Dividend-Focused Fund portfolio manager Diane Jaffee told CNBC in March that she believes "there's still lots of room for dividend growth" for MSFT.

Microsoft currently pays a quarterly dividend of $0.28, for a yield of 2.71%. MSFT stock is up 11.15% year to date and traded at $41.55 per share on Monday.

Microchip Technology Inc. (Nasdaq: MCHP)

Arizona-based semiconductor manufacturer Microchip Technology's stock is another that has shown sustained increase in dividends over a long stretch of time. According to a January announcement from the company, since introducing a dividend in 2003, MCHP has increased its dividend 40 times.

January's announcement pushed this high-yield dividend stock to a record-breaking $0.3555 quarterly dividend, good for a yield of 2.91%. Microchip President, Chief Executive Officer, and Chairman Steve Sanghi credited the increase to the company's sustained cash generation. MCHP traded at $48.83 per share on Monday and is up 9.12% in 2014.

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.