GDP - They’re Lying To Us

Politics / Economic Statistics Jun 26, 2014 - 10:30 AM GMTBy: John_Rubino

Today the US took its next-to-last stab at calculating First Quarter GDP, and the downward revision was impressive even by recent standards. It now appears that the economy, well, here’s how Bloomberg puts it:

U.S. Economy Shrank in First Quarter by Most in Five Years

The U.S. economy contracted in the first quarter by the most since the depths of the last recession as consumer spending cooled.Gross domestic product fell at a 2.9 percent annualized rate, more than forecast and the worst reading since the same three months in 2009, after a previously reported 1 percent drop, the Commerce Department said today in Washington. It marked the biggest downward revision from the agency’s second GDP estimate since records began in 1976. The revision reflected a slowdown in health care spending.

And this, believe it or not, is still an unrealistically positive spin on the actual numbers. The Consumer Metrics Institute (CMI) specializes in finding the truth in the Bureau of Economic Analysis’ statistical fog, and here’s a telling paragraph in CMI’s longer, must-read report:

And lastly, for this report the BEA assumed annualized net aggregate inflation of 1.27%. During the first quarter (i.e., from January through March) the growth rate of the seasonally adjusted CPI-U index published by the Bureau of Labor Statistics (BLS) was over a half percent higher at a 1.80% (annualized) rate, and the price index reported by the Billion Prices Project (BPP — which arguably reflected the real experiences of American households while recording sharply increasing consumer prices during the first quarter) was over two and a half percent higher at 3.91%. Under reported inflation will result in overly optimistic growth data, and if the BEA’s numbers were corrected for inflation using the BLS CPI-U the economy would be reported to be contracting at a -3.51% annualized rate. If we were to use the BPP data to adjust for inflation, the first quarter’s contraction rate would have been an horrific -5.62%.

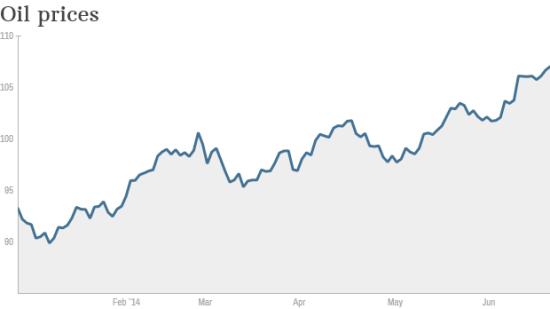

That’s right, the government is assuming that inflation is running at a rate of 1.27%. To anyone who eats (beef, eggs, and citrus prices are up 9%, 5%, and 22%, respectively, in the past year) or drives (gasoline is at record highs in many states) this seems just a tad on the optimistic side. As CMI noted, MIT’s Billion Prices Project, which monitors real-time pricing across the Internet, is rising at a nearly 4% rate, which for most people probably feels more accurate.

So why is Washington using such deceptive inflation numbers when calculating GDP? Because 1) it makes the economy look bigger, which makes US economic policy look more effective and its architects more competent, and 2) they can get away with it. Most media accounts of this and other economic statistics simply repeat the headline number without considering how it was calculated, so what the government says is exactly what most people hear. Only in the sound money community is this debated, and that’s far too small a forum to affect general perception.

But an effective lie is still a lie, and this one is a whopper.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.