The Bond Rally is Not a Good Omen for the Stock Market

Interest-Rates / US Bonds Jul 12, 2014 - 03:47 PM GMTBy: Sy_Harding

The Fed says the economy remains healthy enough that it will continue to taper back its QE stimulus at a rate of $10 billion a month, with plans to have it at zero by October.

The Fed says the economy remains healthy enough that it will continue to taper back its QE stimulus at a rate of $10 billion a month, with plans to have it at zero by October.

Speculation now is on when it will begin the next step toward returning its monetary policy to normal, by beginning to raise interest rates from their current level near zero.

A year ago, the Fed provided assurances it would not begin that process until the unemployment rate was down to around 6.7%. As employment improved much quicker than the Fed expected, it scrambled to lower that target point. A couple of months ago, as the unemployment rate continued to decline, the Fed dropped it completely as part of its targeting process. The Fed now says it will use a range of economic data to decide when to begin raising rates, with its emphasis on inflation. It indicated the first rate hike will probably not be until late next year.

However, with some signs that inflation is beginning to rise faster than the Fed expected, pressure is building for the Fed to consider raising interest rates sooner. Even some Fed officials are in that camp. Charles Plosser, president of the Philadelphia Fed, said this week that, “We should not keep rates at zero until we meet all our economic objectives.” He warned waiting too long could be disruptive, that rates would have to rise faster and higher if the Fed gets behind the curve. Kansas City Fed President Esther George said this week that some of the indicators the Fed looks at are pointing to a possible rate hike as early as this year. That is not the consensus of Fed officials, but raises the possibility of more dialog in that direction.

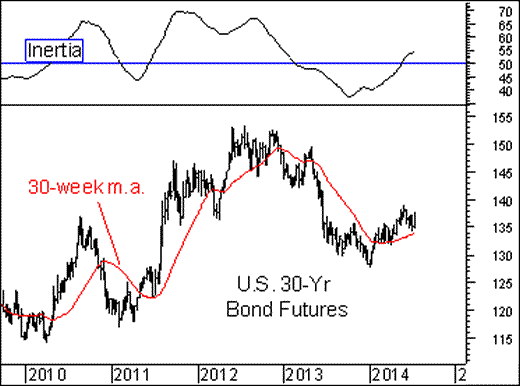

Meanwhile, regarding bonds, it was expected that the Fed’s tapering back of QE bond purchases would be a big negative for bonds once it began. Yet instead, bonds have been in a rally since the end of December when the Fed began that tapering process.

Bonds also tend to move opposite to stocks. Bonds followed that pattern when they declined to a new low at year-end, precisely as the stock market closed at a new record high. Bonds then rallied strongly when the stock market sold off in January.

However, after pausing in February and March bonds resumed their rally even as the stock market rallied back to new record highs.

What’s up with that?

It looks like the bond market, which loves a weakening economy and low interest rates, does not believe the Fed’s assessment that the economy is recovering nicely from the winter slowdown.

Bonds are also typically a safe haven in stock market declines. Their persistent rally so far this year is not a good omen for the stock market as it approaches August. As the Stock Trader’s Almanac points out, on average August, September, and October tend to be the most negative three-month period for stocks.

On the technical charts, after pulling back short-term and appearing to successfully retest the support at their 30-week m.a. again, bonds resumed their rally this week, even as the minutes of the Fed’s FOMC meeting, and those comments from a few Fed officials, raised the possibility of rate hikes coming sooner than previously expected.

In the interest of full disclosure, our technical indicators are on a buy signal for bonds, and my subscribers and I have a 20% position in the iShares 20-year bond etf, symbol TLT.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.