Tap in to Your Inner Feminist-Real Estate Mogul Without Holding Real Property

Housing-Market / US Housing Jul 25, 2014 - 03:34 PM GMTBy: Don_Miller

The new book titled #GIRLBOSS by Sophia Amoruso—reformed petty thief and CEO of a $100 million online clothing store—is the latest “live and work as I do if you want to succeed” book from a string of brand-building female executives. Facebook COO Sheryl Sandberg has women “leaning in,” while Arianna Huffington’s sleep crusade marches on in her latest book, Thrive. Now, I should confess that I haven’t actually read any of these books; one of my colleagues gave me the recap. However, I have had another female executive on my mind: Ms. C.

The new book titled #GIRLBOSS by Sophia Amoruso—reformed petty thief and CEO of a $100 million online clothing store—is the latest “live and work as I do if you want to succeed” book from a string of brand-building female executives. Facebook COO Sheryl Sandberg has women “leaning in,” while Arianna Huffington’s sleep crusade marches on in her latest book, Thrive. Now, I should confess that I haven’t actually read any of these books; one of my colleagues gave me the recap. However, I have had another female executive on my mind: Ms. C.

Ms. C heads up a certain real estate investment trust (REIT)—I’ll call it “Company V”—which Miller’s Money Forever chief analyst Andrey Dashkov and I featured in the latest edition of our monthly newsletter. So while she might not have a cult following or million-dollar book deal, she’s our gal—and for good reason:

- As Company V’s CEO for the last 15 years, Ms. C has boosted its market capitalization from $200 million to $19 billion.

- Under her leadership, Company V’s compound annual total shareholder return topped 28% for 14 years running, and it was named one of the top performing, publicly traded financial companies during the first decade of this century.

- As Andrey puts it, Ms. C has molded Company V into a “rock-solid business with an investment-grade credit rating, robust balance sheet, and reliable dividend history.”

On top of that, Ms. C has received countless accolades from the Wall Street Journal, the Financial Times, and a parade of other institutions. Plus, she practiced real estate, corporate and finance law, and sits on the Board of Trustees for the University of Chicago.

When asked about her professional achievements in an interview with the Chicago Tribune, Ms. C attributed her drive to her working-class Pittsburg upbringing. As the daughter of immigrant parents—a mailman and housewife—Ms. C said, “[T]here was always so much more for me to aspire to: in terms of education, in terms of seeing the world, in terms of working hard and achieving things. And so that drive comes from the kind of upbringing that I had.”

After announcing she wanted to be a lawyer, Ms. C’s father took her to watch a trial headed by one of the few lawyers he knew, a criminal defense lawyer whose son later became her husband. Ms. C praised her Italian father in the Chicago Tribune article, saying, “It was very unusual in that time, in that socioeconomic environment, very working-class and ethnic, that he would be what I would call a feminist. He would never call it that, but he was so supportive of my sister and me, and that was really rare.”

Sounds like my kind of dad.

OK, you get the point: this is an up-by-her-bootstraps, highly qualified CEO who puts shareholders first—a woman I imagine my wife and daughters would be happy to know.

Profiting from an Aging Population

People age 65 and over are expected to make up 19% of the US population by 2030—up from 12.4% in 2000. And it’s no secret that this demographic will demand more and more access to health care. Company V is tapping into this expanding need: It operates healthcare-related facilities, including hospitals, skilled nursing facilities, senior housing, and medical office buildings at over 1,500 properties in the US, Canada, and the United Kingdom.

Let me back up, though, and review REITs in general. Publicly traded REITs, which are traded just like any other stock, allow people like you and me to invest in large-scale, income-producing real estate without the headache of actually holding illiquid physical property. To be considered a REIT, 75% of a corporation’s income must come from real estate in some form or another.

Company V’s portfolio, for example, includes medical office building operations, senior living operations, and triple-net lease operations, whereby tenants cover taxes, insurance payments, maintenance, and repairs in addition to the rent. Ms. C has a proven track record of managing these holdings profitably over the last 15 years.

A word of caution is also in order here: not all REITs are investment worthy. Their profits depend on selecting and managing their properties well and keeping costs under control. Andrey and I culled a long list before landing on Company V. If you are considering buying in to a REIT, you should research it thoroughly as well.

The Rule of 90

One happy quirk of REITs is that they are required to distribute at least 90% of the taxable income to shareholders each year via dividends. On the flip side, they can also deduct these payouts from their corporate-level taxes.

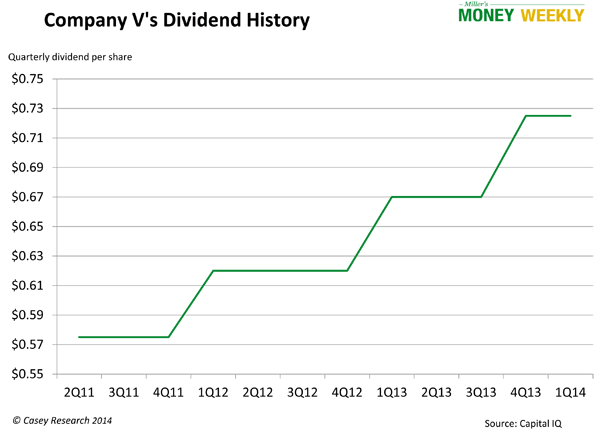

We’re happy to report that Company V has a stellar dividend history: 9% compound annual dividend growth over the past 14 years. Andrey put together the chart below to show its dividend growth since 2Q11.

Now, you’re probably wondering why I don’t just come out with it. Who is Ms. C and what is Company V? And of course I’m chomping at the bit to tell you, but we value our relationship with the thousands of Money Forever subscribers too much to do that. So we have a seamless way for you to count yourself among them: Sign up for a 3-month, no-risk trial subscription and read Andrey’s in-depth write-up on Company V. You’ll gain immediate access to our complete portfolio curated for seniors and conservative investors alike, our full library of special reports, and all of our back issues.

Read through the material, and if our breed of high-yield-meets-low-risk investing isn’t for you, just call or write within 90 days, and we’ll return every penny you paid. Click here to subscribe to Money Forever now.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.